Agile Finance: Moving from Cruise Liner to Speed Boats

As both philosophy and methodology, Agile has helped transform segments of our rigid financial institutions. But beware the fakes in our midst.

As both philosophy and methodology, Agile has helped transform segments of our rigid financial institutions. But beware the fakes in our midst.

By Dr Amanda Salter

‘Agility’ refers to the capability of an organisation to respond quickly to change and deliver value in conditions of high uncertainty, and is increasingly seen as a strategic priority for future-ready organisations. KPMG’s 2019 Global Agile Survey found that 88% of organisations have already implemented Agile practices, and 70% intend to have Agile integrated in the wider business in the next three years. All show a clear trajectory of progress along the Agile maturity curve.

Banks that have taken the bold leap have realised significant commercial benefits. Accenture’s Enterprise Agility in Financial Services: The New Strategic Imperative report found that truly Agile firms are more than twice as likely than the average to achieve top-quartile financial performance (55% versus 25%). They also show better long-term performance, with a 16% growth in earnings before interest, taxes, depreciation, and amortisation between 2007 and 2017, compared to 6% on average.

Agile has also enabled banks to de-risk their digital strategies, simplify working practices, and increase customer centricity. When done right, this in turn leads to increased employee motivation and higher retention of talent.

In April 2020, despite ANZ’s 51% decline in statutory net profit for the first half of 2020, Shaun Elliott, CEO, credited their early move into Agile as a key factor that enabled them to navigate the pandemic better than others.

“Covid-19 has clearly impacted our performance, however the work done over many years to simplify our business, strengthen our balance sheet, as well as developing a more Agile and resilient workforce meant we were well-prepared to support customers through the crisis and I’m confident we will emerge even stronger.”

Over 95% of ANZ staff have been working remotely since mid-March, 500 staff are now working on Covid-19 measures, another 300 staff have been redeployed to support customers via digital channels, and the bank is digging deeper with the newly created role of group executive data and automation to spearhead its digital transformation.

Other Asia-Pacific banks who have started their Agile journey include Standard Chartered, HSBC, RHB, and Westpac. The shift is underway, but the journey is fraught with dangers as few understand Agile’s roots and commitment to simplicity, flexibility, and customer-centricity.

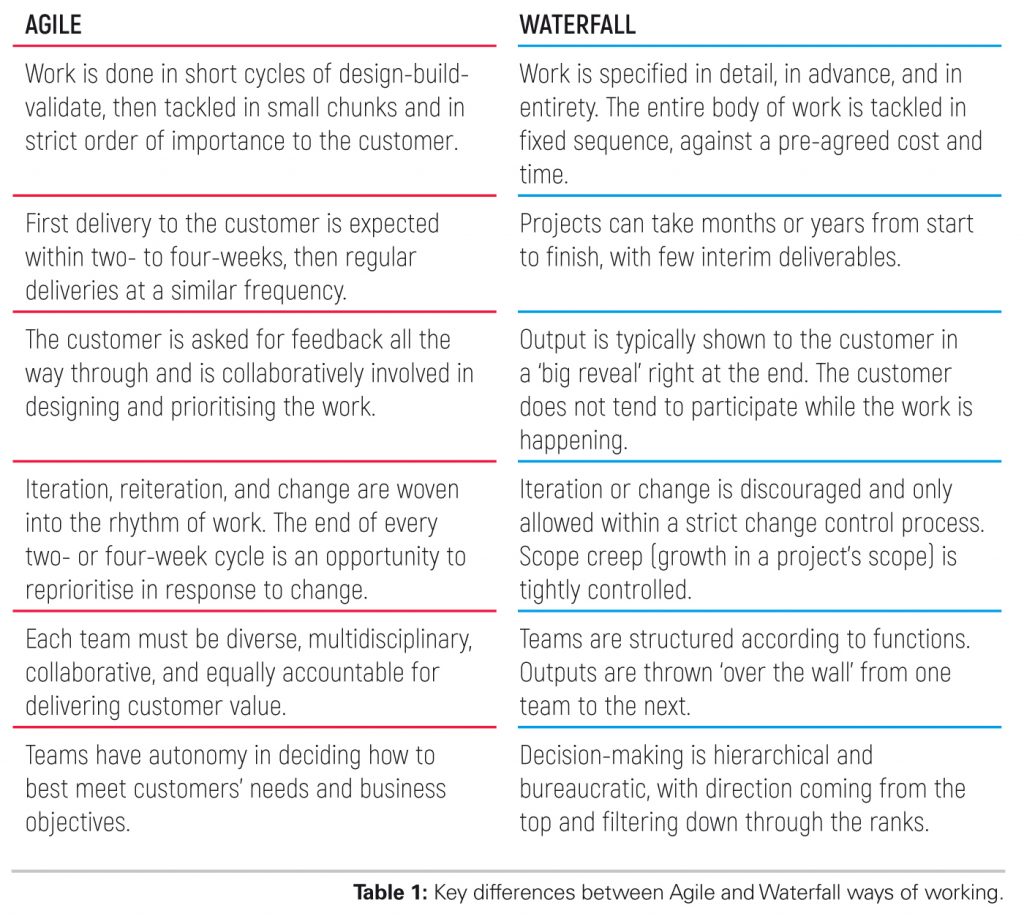

Agile ways of working originated in the Agile software development methodology that emerged to address the shortcomings of ‘Waterfall’ methodology in the 1990s.

Waterfall is a linear project management approach, in which tasks are planned sequentially (i.e. Task A must be completed before Task B begins) and the lifecycle of the project is mapped out in phases using tools such as a Gantt chart. Each phase must be completed before moving on to the next; Waterfall management doesn’t allow you to return to a previous phase once it is complete. The entire project plan – deliverables, milestones, checkpoints, documentation, sign-offs – can sometimes take weeks to plan and get buy-in, especially for complex programmes such as new product development or transformation.

In contrast, Agile is not just about methods, practices, or tools; it is a philosophy, a way of life that works for organisations and individuals. Critically, one must have a shared mindset and culture that embraces change and delivers value quickly to customers.

+ True Agile practitioners adhere to the Agile Manifesto, a statement of four core values, where the parts that are in bold are valued more than those that are unbold:

The Agile Alliance, whose founding members consist of 17 software architects, programmers and independent thinkers, drafted and signed the Manifesto and its 12 Principles at a Utah ski lodge in February 2011. The diverse talents of the Alliance are part of Agile’s uniqueness as it sought to break away from the confines of traditional project delivery and establish a simpler, trust-driven, customer-centric way of working.

There was Mike Beedle, an American theoretical-physicist-turned-software-engineer who authored the earliest papers about Scrum (now used extensively in research, sales, and marketing); Jeff Sutherland, Chief Technology Officer of PatientKeeper, an MIT based start-up; and author-cum-programmer Dave Thomas.

Another founder, award-winning programmer Jim Highsmith, describes the cornerstone of Agile and its resonance with people across all industries: “We all felt privileged to work with a group of people who held a set of compatible values, a set of values based on trust and respect for each other and promoting organisational models based on people, collaboration, and building the types of organisational communities in which we would want to work.”

“At the core, I believe Agile Methodologists are really about ‘mushy’ stuff — about delivering good products to customers by operating in an environment that does more than talk about ‘people as our most important asset’ but actually ‘acts’ as if people were the most important, and lose the word ‘asset’. So in the final analysis, the meteoric rise of interest in — and sometimes tremendous criticism of — Agile Methodologies is about the mushy stuff of values and culture.”

Since then, millions have signed up to the Manifesto, and as Agile gained traction, its ideals have become co-opted. Founders such as Thomas have in recent years come out publicly to steer people back onto the true path of Agile.

In a 2014 article, Agile is Dead (Long Live Agility), he writes: “The word ‘Agile’ has been subverted to the point where it is effectively meaningless, and what passes for an Agile community seems to be largely an arena for consultants and vendors to hawk services and products.”

He points to the four simple values in the Manifesto and asks: “Now look at the consultants and vendors who say they’ll get you started with ‘Agile’. Ask yourself where they are positioned on the left-right axis. My guess is that you’ll find them process- and tool-heavy, with many suggested work products (consultant-speak for documents to keep managers happy) and considerably more planning than the contents of a whiteboard and some sticky notes.”

“If you see this too, then it’s more evidence of the corruption and devaluation of the word ‘Agile’.”

There are distinct differences between Agile and traditional ways of working a.k.a. Waterfall.

Many perceive Waterfall as being lower risk, because scope, time and cost are specified and agreed upfront. However, there is a higher possibility that the final deliverable will not meet the customer’s needs as the landscape can change within months or, as experienced during Covid-19, in a matter of days.

An Agile project can be perceived as higher risk, because the scope evolves every two to four weeks as the work goes on. However, the customer’s return-on-investment trickles in sooner and they continue to receive incremental value all the way through.

Note that Agile is not a panacea – the British Association for Project Management cites a 9% failure rate for Agile projects. Nevertheless, this pales in comparison to the documented 29% failure rate for Waterfall projects.

Many have therefore jumped on the Agile bandwagon. But due to the sheer difficulty of effecting the required culture change, it takes time for Agile to take root. Successful organisations will transition to Agile maturity whilst others get stuck. Without the right support to catch and correct behaviours early, the workplace can become a ‘twilight zone’ where Agile is practiced in name only – no actual Agile thinking is applied and none of the expected benefits materialise. This is referred to as fake Agile, Agile theatre, Wagile (Waterfall-Agile), or dark Agile.

Becoming Agile is not an easy or quick process. Failure can be expensive, with long-term consequences. Here are some ways organisations sabotage their own Agile transformations:

The consequences of practicing fake Agile are damaging and far reaching. Productivity suffers as frustrated employees struggle to reconcile the gulf between ‘say‘ and ‘do’. Fake Agile results in loss of talent and reputation at the very least, or at its worst, can cost millions of dollars and jeopardise your entire digital transformation programme.

Is your organisation truly Agile? Telltale signs can indicate otherwise.

You’re not truly Agile if you:

Banks in particular face many challenges when implementing Agile. C-suites can often be dyed-in-the-wool traditionalists, convinced there is no need to do things any differently than before. Core banking systems sitting on legacy technology can also act as the millstone that drags down change initiatives.

There are many financial and organisational advantages to be gained if you choose to become Agile, but also many challenges along the way. If you are not ready to tackle organisation-wide culture change, or if you don’t have the right support, mandate, investment, or resources, it is best to wait until you do. But bear in mind, in a hyperconnected world, organisations built like cruise liners – big, impressive, weighty – risk being outmanoeuvred by the competition travelling in Agile speed boats.

Dr Amanda Salter is Associate Director at Akasaa Agile CX. She has delivered award-winning global CX strategies and is currently working with the UK Office for National Statistics on its digital transformation. Her recent guest lecture at Cambridge University shared insights from architecting impactful digital customer experiences. Dr Salter holds a PhD in Human Centred Web Design, BSc (Hons) Computing Science, First Class, and is a certified member of the UK’s Market Research Society and Association for Qualitative Research.