Sustainable Finance Must Be the Basis of Malaysia’s Post-Covid Future

Failure to do so will undermine long-term profitability and economic prosperity

Failure to do so will undermine long-term profitability and economic prosperity

By World Wide Fund for Nature

As we write this article, the Covid-19 crisis is in full swing and affecting every country. Malaysia is no exception. With four phases of lockdown, the economy essentially has been put on hold. The response by the Malaysian government, Bank Negara Malaysia (BNM), Securities Commission, and Bursa Malaysia have been swift and commensurate to the scale of the crisis. Multiple stimulus packages and interventions have provided much-needed relief for affected households, businesses, and economic sectors.

With the Malaysian government seeking to gradually reopen the country, the economy will hopefully start its recovery. Now is an opportune time to talk about the need to ensure a long-term sustainable recovery, the importance of the banking sector, and sustainable finance to achieve this.

While the response has provided immediate relief, the consensus among global institutions and thought leaders is that the recovery must provide long-term economic stability and prosperity by paving the way for the transformation to a low-carbon and climate-resilient economy, protection and restoration of the natural environment, and addressing of social issues.

Climate change and environmental degradation create systemic risks with significant implications for the financial sector. In September 2019, Governor Datuk Nor Shamsiah Mohd Yunus addressed BNM’s Regional Conference on Climate Change, commenting that climate change “threatens our socio-economic prosperity here in Southeast Asia. It presents a major economic issue with direct implications on financial stability”.

While governments have a key role to play, the economic recovery and addressing the unfolding climate and environmental crises can only be achieved with the full participation of the private sector. The banking sector, given its central role in the economy, will be paramount to such efforts and financial flows should be directed towards activities that support these objectives.

Failure to do so will create risks for financial institutions and undermine their long-term profitability as well as the economy’s ability to prosper over the long term. Sustainable finance will enable banks to prepare for future political and economic realities.

Globally, the evolution to sustainable finance is well under way. Three major factors are driving this and understanding them is vital for banks to maintain their relevance and competitiveness.

First, concerned citizens expect businesses to help address environmental and social problems articulated through major international processes such as the United Nations Sustainable Development Goals and the Paris Climate Agreement. As the climate and environmental crises escalate, so too do expectations.

Second, investors are increasingly concerned about the environmental and social risks to investment portfolios and are engaging portfolio companies, including banks and public policymakers, to accelerate the transition to a low-carbon world. As part of The Investor Agenda – a collaborative initiative to accelerate and scale up investor actions which are critical to tackling climate change and achieving the goals of the Paris Climate Agreement – 1,200 investors with over US$35 trillion (RM151 trillion) of assets under management have been engaging the world’s largest greenhouse gas emitters via the Climate Action 100+ initiative and called on G20 governments to scale up their ambition under the Paris Climate Agreement. Further, the distinction between shareholders and stakeholders is becoming blurred, as stakeholders are increasingly able to mobilise shareholders in light of social and environmental issues. For instance, recent climate-focused shareholder resolutions at Barclays Bank and Mizuho Bank were filed by civil society organisations with the support of mainstream asset managers.

Third, financial regulators are increasingly interested in and supervising the non-financial performance of banks, supported by recommendations of the Task Force on Climate-related Financial Disclosures and the Network of Central Banks and Supervisors for Greening the Financial System, of which BNM is a member. In Southeast Asia, seven countries have already issued regulations or guidelines expecting banks to make sustainability an integral part of their business strategy.

These factors can be seen in various degrees in Malaysia, indicating that the evolution from traditional to sustainable finance has already begun.

BNM, Bursa Malaysia, and Securities Commission have formed a Joint Committee on Climate Change to systematically improve the financial sector’s management of climate-related risks.

In November 2019, BNM issued the Value-based Intermediation Financing and Investment Impact Assessment Framework (VBIAF), for Islamic financial institutions to “generate positive and sustainable impact to the economy, community and environment”. It was noted that traditional institutions could use it to incorporate environmental, social, and governance (ESG) risks in their risk management systems. In December 2019, BNM also issued the Climate Change and Principle-based Taxonomy discussion paper for consultation with fundamental implications for the classification of financing and investments.

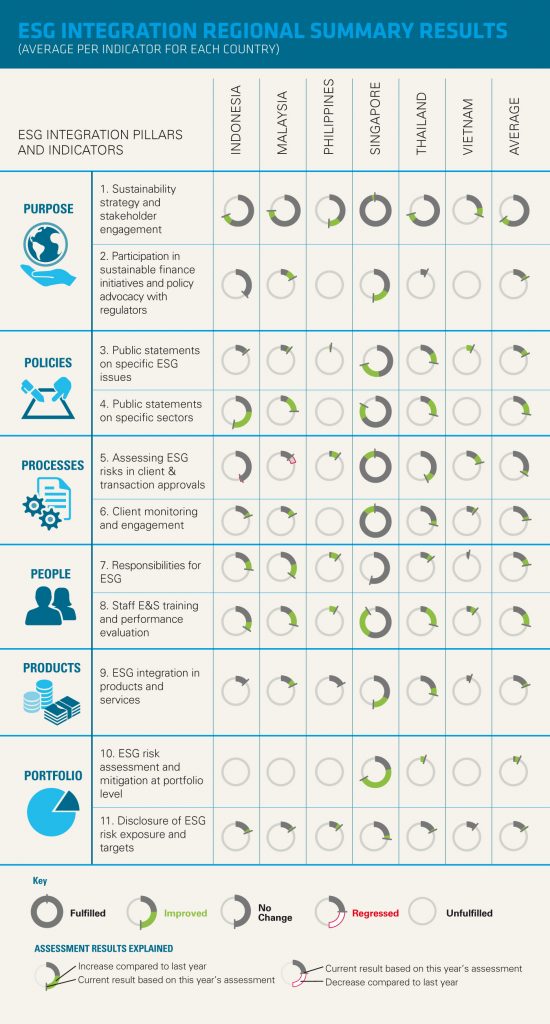

World Wide Fund for Nature’s (WWF’s) annual Sustainable Banking Assessment (SUSBA), which covers six Malaysian banks, show that environmental and social considerations are being integrated in both Islamic and traditional commercial banking activities. However, progress is uneven and all banks must progress further to comply with expectations set by the VBIAF . Comparatively, Malaysian banks lag far behind their Singaporean counterparts, particularly regarding restrictions to coal financing and investment, and requiring their agriculture and forestry clients to adopt best environmental management practices.

CIMB and Maybank currently have the most advanced ESG integration practices of the six Malaysian banks covered by SUSBA. CIMB is a founding member of the United Nations Environment Programme Finance Initiative’s (UNEP FI’s) Principles for Responsible Banking (PRB) and also signed the Collective Commitment to Climate Action in September 2019. Among these commitments are time-bound requirements to set sector-specific, scenario-based targets for portfolio alignment and publicly report on progress; demonstrating focused effort on the most carbon-intensive sectors within its portfolios; and taking “concrete action” to align portfolios to “the low-carbon, climate-resilient economy required to limit global warming to well below 2°C”.

Malaysia has the potential to be a leading regional sustainable finance hub. However, what does sustainable finance mean for a bank?

Sustainable finance requires a comprehensive integration of ESG considerations in the overall strategy and decision-making process. WWF’s team of experienced sustainable finance specialists have developed the freely available SUSBA tool to support banks in their sustainability journeys. It contains forward-looking, science-based, and portfolio-level criteria across six pillars (purpose, policies, processes, people, products, and portfolio), 11 indicators, and 70 sub-indicators, which can be used as a roadmap for action and benchmark against industry peers.

The development and implementation of more granular sector-specific or thematic policies is central to proper ESG integration. These outline a bank’s expectations towards its clients, conditioning the provision of financial products and services to meet minimum environmental and social standards, ideally in line with national and international best practice. Within the context of Malaysia and Southeast Asia, these policies should cover environmentally and socially sensitive sectors such as fisheries, agriculture (including palm oil), forestry, buildings, and infrastructure (including transport, energy, and waste) and cover key issues such as human and labour rights, biodiversity loss, water- and climate-related risks.

These policies can also foster a constructive dialogue with clients on how to improve their ESG practices. This can lead to the development of specialised financial products, such as sustainability-linked loans which reward clients who meet ESG performance targets. To deliver positive outcomes, such targets should be measurable and science based. Green or sustainability bonds and sukuk have also great potential for Malaysia, bolstered by the Green SRI Sukuk Grant Scheme issued in 2018 and the SRI Sukuk Framework established in November 2019. The issuance of green bonds and sukuk in Malaysia was US$1.3 billion as of 2020.

These efforts should be part of a bank-wide sustainable finance strategy or roadmap, driven by top management and aligned with state, national, and international sustainable development objectives. Strong internal governance structures and processes, with ongoing capacity building, are crucial to support holistic approaches to sustainability.

Banks can benefit from several sustainable finance platforms and resources. The most prominent is the UNEP FI’s PRB initiative, launched during the UN General Assembly in September 2019. The initial group of 130 founding banks from 49 countries represent more than US$47 trillion in assets (one third of the global banking sector) and has since grown to more than 170 banks, ranging from regional banks just starting their sustainability journey to the most advanced international banks. The initiative outlines six areas to guide banks on integrating sustainability, most importantly impact analysis, target setting and implementation, and accountability.

The Science Based Targets initiative is a platform through which corporates can adopt a greenhouse gas emission reduction target that is in line with what the latest science says is necessary to meet climate goals. Currently, 873 companies, including 53 banks, have joined the initiative.

The Asia Sustainable Finance Initiative provides technical support to banks. This initiative brings together academic, industry, and science-based knowledge partners to support financial institutions in understanding and sharing ESG best practices; and to identify solutions which link sustainable finance activities with measurable and positive impact on the ground.

WWF is keen to support banks wanting to undertake the sustainable finance evolution and its dedicated team of experienced sustainable finance specialists is currently working with several banks in Malaysia and Southeast Asia. Central to this is WWF’s ability to establish and develop long-term relationships through a constructive and confidential approach to engagement that is in tune with the social, economic, and political context.

Halting global warming to well below 2°C – the global target in the Paris Climate Agreement – will require almost complete decarbonisation of energy generation (phasing out fossil fuels like coal, gas, oil) by 2050 and immediately and rapidly investing in renewable energy (geothermal, wind, solar).

Undoubtedly, fossil fuels have been pivotal to the Malaysian economy. But technology and society are moving beyond fossil fuels.

Indeed, phasing out fossil fuel investments makes business sense as these are increasingly risky and volatile. Carbon Lock-in Curves and Southeast Asia: Implications for the Paris Agreement, a 2018 briefing paper by University of Oxford, estimated that 89% of existing and planned fossil-fuel-based power plants in Malaysia are incompatible with the aim of preventing dangerous levels of climate change. Consequently, they may become stranded assets and investments, suffering unanticipated or premature write-downs and liabilities. More than 100 globally significant banks and insurers have already announced restrictions to financing and investment in coal, according to Institute for Energy Economics and Financial Analysis. This includes the three largest banks from Singapore (DBS, UOB, OCBC) and Japan (MUFG, Mizuho, SMBC). Commonly cited reasons for enacting these restrictions are international science and policy, investor and regulator concerns, and financial risks; all of which are relevant considerations for Malaysian banks.

The evolution into renewable energy is underway and inevitable, not only due to the need to tackle climate change. According to the International Renewable Energy Agency’s Renewable Power Generation Costs in 2018 report, unsubsidised renewable energy is often the cheapest energy generation source. This relative cost-competitiveness is projected to only increase; current volatile and historically low oil prices may only exacerbate the inevitable by frustrating project investments.

To paraphrase a famous quote ‘the stone age did not end because the world ran out of stones’, the fossil fuel age will end and not because of a lack of fossil fuels. Situations and societies change as better and more sustainable technologies are discovered. The abovementioned reports indicate that banks which retain investments in high-carbon sectors will financially suffer and banks which address exposure to these sectors will be well positioned to prosper in the low-carbon economy.

Sustainable finance must become the basis of the economic recovery. The economic problems of today coexist with existential environmental and social problems. They have to be addressed collectively or the solutions to one crisis will cause another.

Sustainable finance is needed to safeguard the progress Malaysia has made since its independence and to achieve this we need more collaboration between stakeholders. Governments, citizens, corporates, banks, and civil society organisations need to come together to deliver the future we need.

Our response to the current economic recovery will affect an entire generation with lasting implications for the children of today and future generations. We owe them to do everything that’s in our power to change course.

Thiaga Nadeson is Head of Market and Education, WWF-Malaysia. He leads the sustainable finance programme and is the engagement focal point for financial institutions and regulators. If readers want support in implementing sustainable finance in their own institutions, they can contact him at [email protected].

Sylvain Augoyard is Vice President, Asia Sustainable Finance, WWF-Singapore. He leads the office’s regional work on sustainable banking regulations and previously spent nine years with BNP Paribas CIB to develop and implement its sustainability strategy.

Dr Adrian Fenton is Vice President, Asia Sustainable Finance, WWF-Singapore. He holds a PhD in climate change economics and policy, specifically focusing on physical climate change risks to banks and clients.

For more information, please visit www.susba.org and www.wwf.sg/sustainable_finance