Future-Proofing Your Risk Management Function

Key requirements for a comprehensive and sustainable competency development journey.

By Dr Eric H.Y. Koh

Banks are confronted with a limited risk management talent pool. One way of future-proofing your risk management function comprehensively and sustainably is by implementing a proposed integrated approach to competency development.

The 2008 global financial crisis (GFC) had severely dented both the financials and also the image of many global banks. Who could blame US taxpayers for being infuriated with the US$475 billion bailout? Ten years post-GFC, the pain continues as regulators worldwide penalised banks some US$375 billion for misconducts such as money laundering, securities fraud and London Inter-bank Offered Rate rigging. The crisis and these embarrassing penalties point to a fundamental problem: risk management weaknesses.

In order to address this problem, banks may resort to poaching risk management professionals, engaging consultants, or building better systems. Such actions may be necessary but they are not the panacea to the ongoing fundamental problem. Such actions, especially when taken in isolation, may neither be comprehensive nor sustainable. For instance, if you poach from your competitors, they may one day poach your professionals too and the musical chair continues with ever-increasing salaries but not necessarily better talents. Besides, it is pointless to hire professionals from another bank if they are not able or willing to integrate into your bank.

Some may suggest revisiting staff qualifications at various seniority levels. Others may suggest looking at staff retention. While these are important, publications on such matters abound. What seems lacking, however, is discussions on the key requirements for a comprehensive and sustainable competency development journey. This article aims to propose an integrated framework that provides an overarching yet granular view of these key competency development requirements.

Let’s consider the Japanese badminton team’s inspiring success. In a game dominated by China and Indonesia, Japan hardly featured until their stunning 2014 maiden Thomas Cup victory. They continue to surge ahead as Japan has now won the Uber Cup, World Cup and Olympics too. Although their players had traditionally been skilful, their prior achievements seem inhibited; they were not producing world-beaters.

Some other teams may have produced world junior champions but their momentum did not continue to the senior league. Some teams, on the other hand, seem to plateau or even deteriorate. In other words, these teams had a good head start or had already peaked but could not sustain their success. Japan, however, had none of these. Among the ingredients for Japan’s success story is the stretching of their players’ abilities through infusion of new external techniques by a great Korean coach, Park Joo Bong. Besides, there is a conducive learning environment where the authorities give Park sufficient latitude and both players and coaches share the same aspiration. This inspiring success story provides hope and lessons, even for banks. These key broad ingredients – stretching the players’ abilities, the ability to adjust to dynamic externalities, and a conducive learning environment – correspond to three popular competency concepts, namely core competencies, dynamic competencies, and the learning organisation.

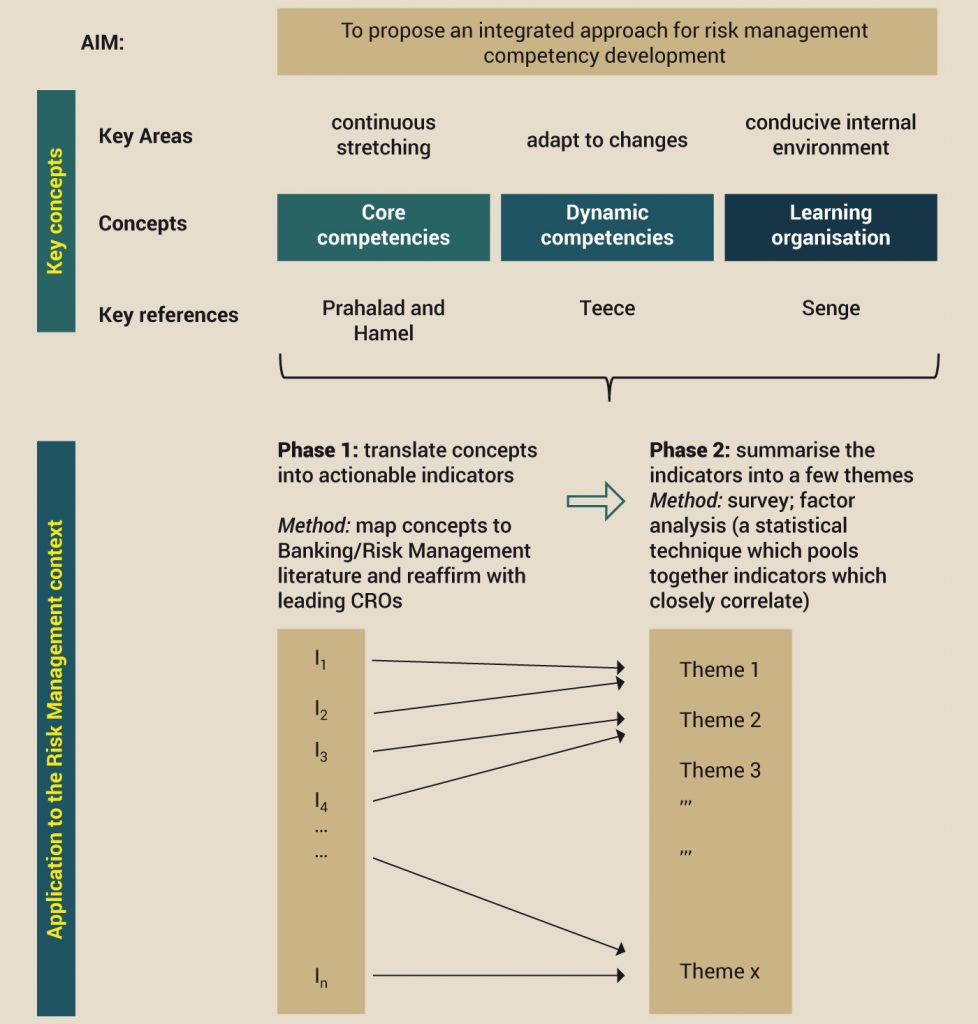

Most prior studies examine each concept in isolation. This article, however, pools together these three concepts because they complement one another. Pooling together the concepts provides a more potent tool for formulating a more comprehensive competency development journey. Besides, most prior studies remain conceptual; they do not translate the concepts into actionable or operationalised indicators, especially to an intangible service sector such as banking.

Figure 1 illustrates the work done and intended output through a two-phased approach. In Phase 1, we translate the concepts into actionable indicators through literature reviews and interviews with leading Chief Risk Officers (CROs). In Phase 2, we study the feasibility of summarising the indicators into a few themes according to the indicators’ statistical correlation. Towards this end, we obtained inputs from 135 risk management professionals in a survey. The survey sought to obtain their views as to the extent to which their banks implemented these indicators. We applied factor analysis to identify the indicators which closely correlate and hence, form the respective unique themes.

Table 1 summarises the output in terms of the five themes and also their respective constituent actionable indicators.

+ Theme 1: Active learning

This calls for a right mindset of wanting to learn meaningfully, intentionally, and willingly rather than blindly or grudgingly following routines or orders. It comprises eight indicators of which we will discuss three. First, having a right risk culture which upholds risk principles is important to foster competency development. Conversely, a bank which sees risk merely as a necessary evil would not have a conducive environment for risk management competency development. Second, people learn more effectively through hands-on experience from their previous experience. For instance, people who have prior experience in loan recovery, trading, or sales may be able to better sense and understand the potential pitfalls. Likewise, it may be good for risk management staff to be seconded to other functions to gain valuable insights. Third, we also need to actively relook at whether portions of the current competency profiles are relevant and up-to-date. In fact, we should also take drastic steps of removing irrelevant competencies so as to avoid being caught in a competency trap.

+ Theme 2: In the bank’s interest

This calls for a right heart. Any competency development initiative will fail if the staff members pursue their dysfunctional or selfish motives. First, staff members should engage in constructive debates to ponder upon future scenarios and prepare for the risk management ramifications. Second, the goals of the risk management function and its business partners must be aligned to the bigger picture of the bank’s interests. If their goals are not aligned, competency development efforts would be ineffective Finally, having objective discussions among staff members from different functions help to continuously widen their perspectives and sharpen their competencies.

+ Theme 3: Proactive

This calls for being prepared ahead of time and comprises three indicators. First, staff members need to be proactively aware of new emerging techniques rather than being told of such developments. Second, they should also keep abreast with risk-related regulatory developments. Finally, they should be self-driven to develop themselves rather than waiting to be sent to training programmes. A risk management function should encourage its staff to be proactive so as to continuously develop their competencies.

+ Theme 4: Stretch

One should also stretch beyond the current competency levels. For instance, instead of looking only at the conventional disciplines of banking and finance, a bank could recruit some staff members with strong quantitative backgrounds such as mathematics or engineering. Given the right orientation, such members would help enhance the risk management competencies in complex multidisciplinary areas such as derivatives and structured products. Likewise, besides discussing internally, the risk management function can also work with relevant external parties so as to be more sensitive to the rapid changes and to continuously develop competencies. These parties may include customers, suppliers, or even regulators.

+ Theme 5: Broader perspective

This calls for going beyond a narrow silo view. Instead, one should look beyond the surface and consider how events and developments interact or even have lurking risk implications. It also calls for viewing risk from an enterprise-wide or integrated perspective rather than being in separate buckets of risk categories such as credit, market, or operational risks. Indeed, risk management professionals should look beyond their respective domains and consider the potential interrelationships with other risk categories.

This article discussed the problem of risk management weaknesses in banks and proposed an integrated approach to competency development. It pooled together three concepts and identified the actionable indicators which may be summarised into five themes. The proposed framework provides a more comprehensive and sustainable approach towards competency development. This is because it looks at three aspects that facilitate competency development, namely stretching competencies, adapting to dynamic externalities, and a conducive environment for continuous bank-wide learning. It is overarching because it proposes a broad five-theme approach. This provides a practical tool to facilitate regular updating and brainstorming sessions. Concomitantly, it is also granular because it is easily expandable into the 18 constituent actionable indicators.

Just as seen in the case of Japan’s badminton team’s inspiring success, the proposed approach may facilitate a bank’s risk management competency development journey to greater heights in a more comprehensive and sustainable manner.

Dr Eric HY Koh brings together a unique blend of practical experience and academic credentials. His passion for education led him to join University of Malaya’s Faculty of Business and Accountancy. Prior to that, he held senior management positions at banks. Dr Koh facilitates various academic and professional courses. This article is an abridged version of his book, Risk Management Competency Development in Banks.