Central Bank Backs Gig Economy Boost

The gig economy – independent operators or contract workers hired for gigs or project-based jobs – represents approximately 26% of Malaysia’s workforce, according to the World Bank, and is an important component to a sustainable economic recovery.

To improve the financial health of gig economy workers, the Financial Innovation Gig Economy Challenge was launched in March 2020 by Bank Negara Malaysia, in partnership with APEC Malaysia 2020, Malaysia Digital Economy Corporation, and the United Nations Capital Development Fund.

Malaysia served as a testbed to refine these emerging ideas and to improve the financial health of gig workers in the Asia-Pacific region.

The challenge, which leveraged digitalisation to enhance the business viability of gig workers, courted over 100 global submissions with 10 teams making the shortlist for an intensive eight-week bootcamp and innovation programme. The top three finalists – PAY:WATCH, Versa and GetHyred – showcased their promising solutions at the APEC Virtual Finance Ministers’ Meeting on 25 September.

New Ways to Invest in People & Planet

The Organisation for Economic Co-operation and Development (OECD) launched its latest report, Global Outlook on Financing for Sustainable Development 2021: A New Way to Invest for People and Planet, on 9 November 2020 with estimates of the looming shortfall in financing for Sustainable Development Goals due to the economic impact of the Covid-19 crisis. The analysis also includes shortcomings in international and domestic financial and taxation systems that hold back investment in sustainable development.

The Organisation for Economic Co-operation and Development (OECD) launched its latest report, Global Outlook on Financing for Sustainable Development 2021: A New Way to Invest for People and Planet, on 9 November 2020 with estimates of the looming shortfall in financing for Sustainable Development Goals due to the economic impact of the Covid-19 crisis. The analysis also includes shortcomings in international and domestic financial and taxation systems that hold back investment in sustainable development.

Speaking from Paris, OECD Secretary-General José Angel Gurría’s keynote was streamed live with an ensuing discussion regarding public finances, foreign direct investment, portfolio investments and remittances, as well as ongoing tax evasion and illicit financial flows. The report highlights ways in which the financial system continues to fuel inequalities and unsustainable investments.

“Even before Covid-19, SDG financing was falling short with an estimated annual gap of US$2.5 trillion and developing countries face an estimated gap of US$1 trillion in Covid-19 emergency and response spending,” states Gurría.

“We need urgent action to shift the balance in favour of sustainable and inclusive development.”

Swapping Out of LIBOR

Reports that rigging of the London Interbank Offered Rate (LIBOR) may have existed as far back as 2003, yet the continued reliance of global financial markets on the benchmark interest rate poses clear risks to global financial stability.

The July 2020 report by the Basel Committee on Banking Supervision and Financial Stability Board (FSB), Supervisory Issues Associated with Benchmark Transition, reiterates that the “transition away from LIBOR by end-2021 requires significant commitment and sustained effort from both financial and non-financial institutions across many jurisdictions.”

The survey also notes that although non-FSB jurisdictions are less likely to foresee significant risks in LIBOR transition, mainly due to perceptions of less frequent use of LIBOR in their financial systems, low overall exposures to LIBOR do not necessarily indicate low levels of risk. Disorderly transition by some key market participants with substantial exposures could have spillover effects. Jurisdictions identified a range of risks which could arise from disorderly transition, some of which (e.g. operational risk) would apply regardless of the size of exposures.

Contextually, Sukh Deve Singh Riar in the September issue of Accountants Today, puts Malaysia’s exposure to LIBOR risk at approximately US$200 billion and warns that “the ramifications of LIBOR discontinuance can be chaotic and extremely challenging if not managed diligently”.

Banker of the Future

The Asian Institute of Chartered Bankers’ Empowering Bankers Webinar Series continues with one of its most recent sessions, a collaboration with the Financial Services Institute of Australasia which focused on the profile of a future banker.

Jim Christodouleas, Banking and Capital Markets Solutions and Capability Leader at PwC Australia, set the tone for the 200-strong attendees: “[We’re] not here to talk about succeeding as a banker in the world of Covid or in the world of virtual work … What we want to talk instead is a much broader perspective of what you need to do as you think about building your skills in the decade ahead.”

“Maybe you’re just starting your career or if you’re a leader in the industry looking to hop, hire, recruit, or nurture talent and retain talent; what are the things you’re going to need to think about and how might those things be different from what you might [generally] consider.”

The live chat and Q&A with panelists from PwC, National Australian Bank, Judo Bank, and FINSIA covered diverse subjects and includes practical knowledge on cultivating the knack for data crunching and the craft of risk management.

Access to the recording is available for members at https://member-portal.aicb.org.my/login. For updates on the AICB’s upcoming webinars, please visit https://www.aicb.org.my/thought-leadership/events/upcoming/.

e-RMB Giveaway

The People’s Bank of China has given legal tender status to the concept of a digital renminbi on par with its physical currency. The republic’s draft Banking Law paves the way for widespread adoption of the state-issued digital currency, including a ban on the issuance of substitute digital tokens. Tests have been underway in at least four cities, including a public trial of 50,000 residents in Shenzhen who were gifted ang pows or ‘red packets’ of the digital currency to spend in selected stores. An estimated 4 million transactions valued at US$299 million have been made since.

Latest Bag of Tricks for Cyber Resilience

In light of increased risks to cybersecurity, the Financial Stability Board issued two new G20 reports – Effective Practices for Cyber Incident Response and Recovery: Final Report and Cyber Resilience Lexicon – to assist standard-setting bodies, financial institutions, and international standards organisations in effectively addressing threats to the stability of the global financial system.

The lexicon supports cross-sector common understanding of relevant cybersecurity and cyber resilience terminology, whilst the toolkit contains a checklist and 49 best practices for effective cyber incident response and recovery across seven components:

- Governance;

- Planning and preparation;

- Analysis;

- Mitigation;

- Restoration and recovery;

- Coordination and communication; and

- Improvement.

Whilst many of these effective practices are already in use by larger organisations, they could also be valuable for smaller and less complex organisations to help strengthen their cyber resilience.

Crime-as-a-service Economy

Europol’s Internet Organised Crime Threat Assessment 2020 sounds the alert on the rise of Cybercrime-as-a-Service (CaaS) on the Dark Web. CaaS enables even technically inexperienced criminals to execute campaigns by providing exploit kits, access to compromised systems, and vulnerable remote desktop protocols. Since Covid-19, criminals piggyback on the increasing use of encrypted email, messaging apps, privacy oriented policies, and virtual private networks in order to hide their activities and obfuscate law enforcement. Dark Web alliances allow for more evolved threats in banking, including smishing, social engineering, and advanced malware which target broader banking functions.

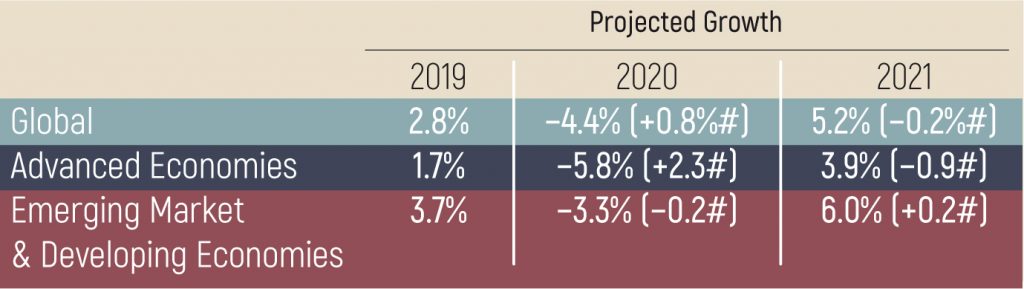

IMF Barometer

IMF Barometer

Uncertainty in baseline projection is unusually large. Forecasts are dependent on:

- Public health response and associated domestic activity disruptions.

- Extent of global spillovers from soft demand, weaker tourism, and lower remittances.

- Vaccines, treatments, and changes in the workplace to reduce transmission could allow activity to return more rapidly to pre-pandemic levels.

- Extension of fiscal countermeasures into 2021.

Note: #Difference from June 2020 World Economic Outlook forecast. Source: International Monetary Fund, World Economic Outlook: A Long and Difficult Ascent, October 2020. Q