The Post-Covid Opportunity for Banks

Leaders must take a proactive stance to ensure proven technologies and approaches that work during the crisis are made permanent.

Leaders must take a proactive stance to ensure proven technologies and approaches that work during the crisis are made permanent.

By Oliver Wyman

With more than 50% of the world in lockdown of various forms, a nosedive in global trade, and a forecast 3.8% decline in GDP, the Covid-19 pandemic has brought an unprecedented halt to normal life. This has led to fundamental changes in behaviour both externally in terms of customer activity, and internally in how firms are able to engage and operate. These changes are here to stay across three dimensions of activity, and firms need to thoughtfully adapt in order to thrive.

While the trend is not new, the pandemic has acted as an accelerator for digital adoption.

A large spike in digital channel utilisation during the Covid-19 pandemic has been observed across banks and markets and many expect increased usage to persist. Following lockdown announcements, one of the leading Southeast Asian (SEA) banks saw 10,000 new customer account applications through the mobile banking app in a period of three days. Another saw more than 100 million more digital banking transactions as compared to the same period in 2019, and a third saw a more than a 200% growth in online investment accounts. There has also been a sharp growth in digital payments. In mature Asian markets, over 100% growth in digital payment usage has been observed, with e-commerce transaction value rising 40%. In emerging Asia, there was 260% growth across two real-time electronic payment systems in the Philippines. Conversely cash usage has declined, with ATM transactions falling as much as 60% in some markets.

Engagement between banks and their customers has also changed fundamentally. Previously suggestions of video-conference relationship manager meetings would have been met with strong resistance on both sides. However, forced to move to digital modes of communication by lockdowns in many markets, outcomes have been largely positive. Many banks have found that engagement between relationship managers, sales teams and clients have increased as compared to pre-Covid with coverage teams’ client servicing load also increasing for some banks. Without lengthy commutes, particularly in some Asian markets, relationship manager efficiency has increased by up to 30%–40%. There have also been a couple of instances of investor events hosted virtually with more than 5,000 attendees, almost double the attendance of a standard in-person event, with even more positive feedback received when compared to prior events. Of course, the challenge is whether the higher levels of engagement would work in a ‘virtual for longer’ environment, with fewer ‘organic’ conversations, and how relationships can be built with new customers through virtual modes.

Pre-crisis, the banking world had a general perception that remote working would lead to lower productivity, be unable to hold workers to account using the traditional ‘clocking in/out’ mechanisms. With 40%–80% of bank employees working from home during lockdowns, these strongly held notions have been put to the test. What has emerged is a demonstration that remote working is just as productive, if not more productive, given other savings (time spent commuting, for example) than working from an office. However, a high asymmetry of productivity has been observed. Many are reporting skews where up to 70% of the output is coming from as few as 20% or 30% of the employees. This may be partially a result of the shift to remote, however it is more likely that the current environment is just exposing the large productivity skews that already existed in the system. Whilst highly dependent on the country and therefore the typical size of homes, many are also valuing the flexibility. A leading Australian bank found, in surveying its employees that had been working from home, that 80% of them wanted to maintain the greater flexibility it affords. Many of the leading banks in Southeast Asia are also now in the process of surveying their employees.

Another important efficiency gain has come from the decentralisation and often short-circuiting of decision-making. Many banks have found that the new ways of organising and managing teams have enabled them to better manage spans of control and layers to improve efficiencies during Covid-19. Others have reported a huge increase in speed of transformations, “tasks that would take six months to do are now getting done in two weeks.” This is a result of several factors, but one key component is the short-circuiting of decision-making. For example, a large global bank had 72 different approval gates and committees to sign off on a new product pre-Covid and this has now been reduced to seven.

Many institutions are seeing these shifts as an opportunity for lasting and profound change.

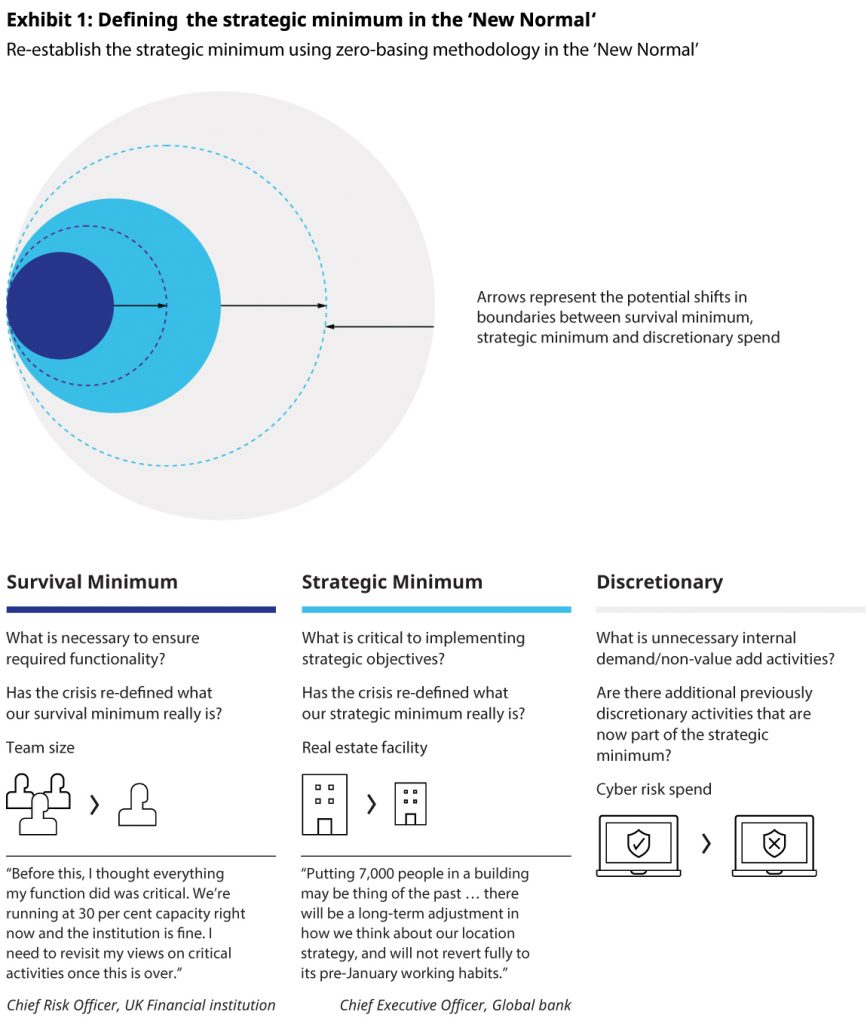

A significant change in the balance of activities necessary to survive and differentiate is expected to ensue, providing opportunity to re-establish the survival and strategic minimum. In some sense the real ‘survival minimum’ has been practically tested during lockdowns with initiation of business continuity measures, for example, shutting offices and branches, trimming service hours, reducing products and features, and technology constraints such as virtual private network outages. In other words, a real-life zero-basing exercise has been carried out. A new ‘strategic minimum’ is also emerging, challenging many aspects of the organisation that were previously considered essential, such as large real estate facilities. (See Exhibit 1)

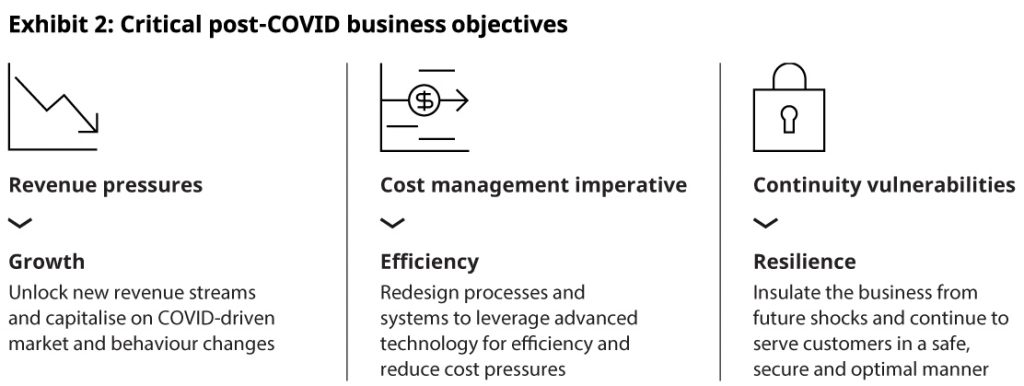

Whilst there are opportunities emerging, the crisis is also making change mandatory. Contracting economic activity, growing loan provisions, and expense increases for additional customer support and resilience requirements are already taking a toll on bottom lines. These headwinds exacerbate the impact of existing commercial challenges for financial institutions, given low interest rates and stiffer competition from market disruptors. The huge pressure placed on profitability is driving both objectives around growth and efficiency. Banks are looking to unlock new revenue streams and capitalise on the Covid-19 driven market and behavioural changes.

Profitability pressures are also bringing about inevitable cost management imperative. Whilst banks in Europe and North America have been undertaking large cost management programs since the global financial crisis (GFC), the banks in Southeast Asia have been still enjoying double-digit returns on equity (ROEs). However, they too were starting to face net interest margin and RoE contraction and beginning major cost management and branch reduction exercises. Whilst banks are currently facing substantial pressure to preserve jobs, given the observations around productivity and profitability pressures, a wave of cost-cutting programmes is inevitable. The crisis has also revealed several vulnerabilities in the operating model, ranging from increased cyberattacks, stability of technical architecture and increased transactions volumes, to operational constraints from off-shore centres ill-equipped to shift to remote working. Taking all these factors into consideration, objectives around growth, efficiency and resilience will be at the heart of rethinking a ‘new normal.’ (See Exhibit 2)

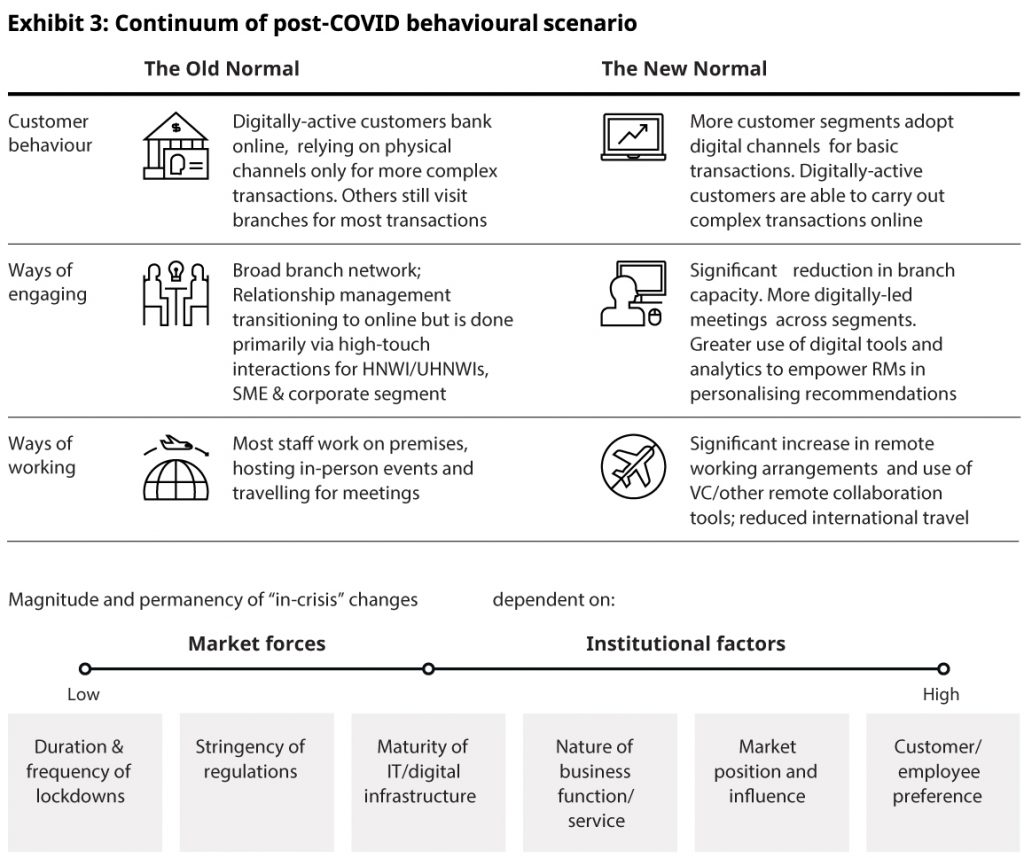

It is unclear how permanent all the changes will be. However, most believe that returning to the ‘old normal’ is no longer an option. Furthermore, for many of the changes there will be a window of opportunity that will close upon return to offices, unless leaders take a proactive stance to ensure permanency. Examples include many of the productivity gains, improved speed of delivery and decentralised decision-making. We urge organisations to first start thinking through a set of plausible scenarios to feed into their strategic planning, and then proactively start to examine the changes required to thrive in an environment of persistently lower rates, growth and margins. (See Exhibit 3)

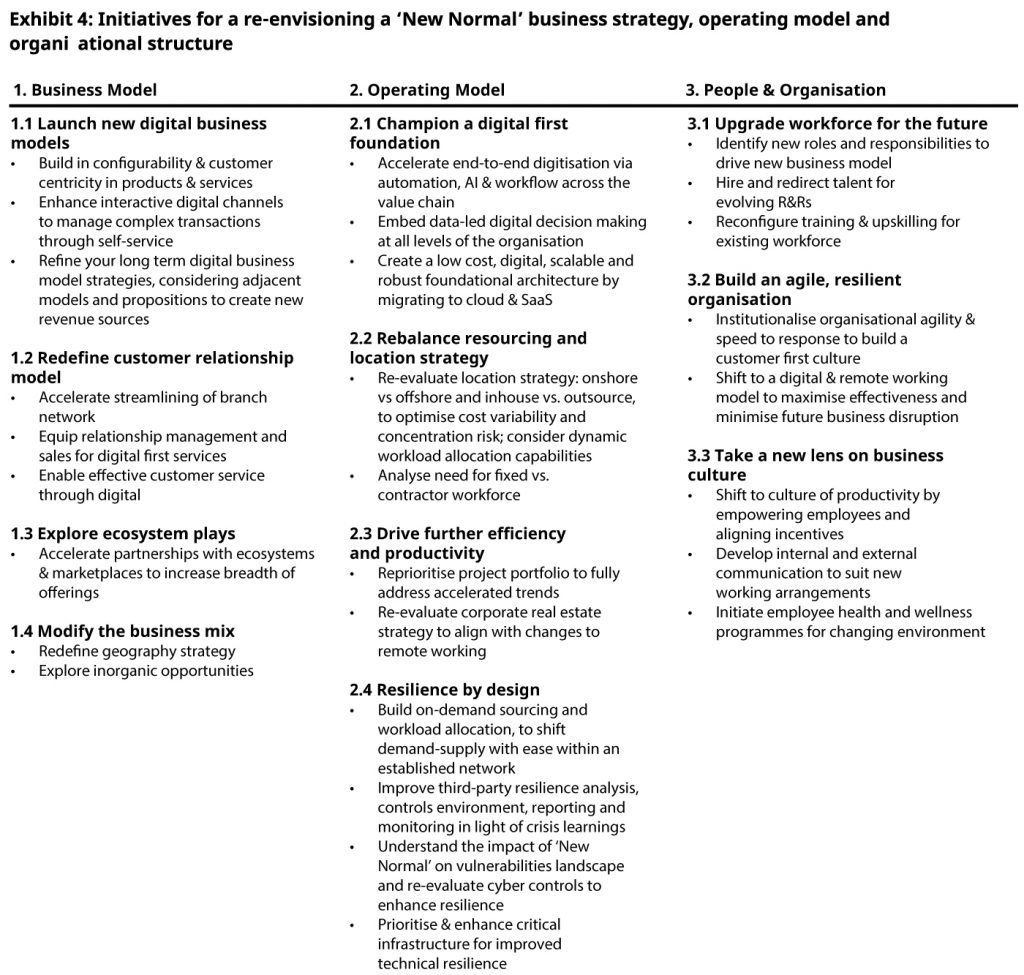

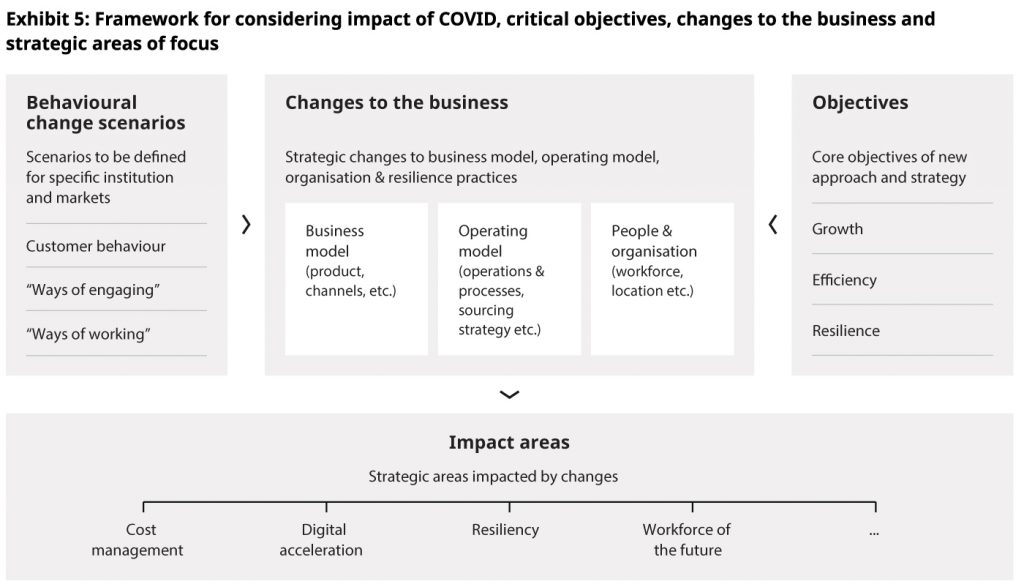

Defining a ‘new normal’ for business operations has implications across strategy, operating model and organisational design. Whilst many responses are not new (see Exhibit 4 for the full list of initiatives), for example in technology around process digitisation, or adoption of more scalable, front-to-back architecture, the level of management attention and pace at which institutions are looking to achieve the transformations has changed significantly. For example, banks are looking to convert three-year digital roadmaps to 12-month roadmaps, and similarly for branch optimisation programmes. However, while we are seeing organisations focusing on specific initiatives, we have not observed many taking a holistic front-to-back review. There is a high degree of synergy and linkage between initiatives. For example, branch strategy must be paired with the advancements in digital servicing and creation of interactive digital channels; HR cannot review talent requirements in isolation from understanding proposed new business models; technical architecture must be designed around considerations of remote working and associated access, security and redundancy. Large strategic programmes also cut across these initiatives (see Exhibit 5), including cost management programmes, digital acceleration, resiliency programmes, etc. Cost programs will be a derivative of many of the initiatives around digital acceleration, change of business model, productivity and so forth; digital acceleration work will run front to back and resilience will be at the heart of many infrastructure and operating model considerations.

Covid-19 has accelerated many trends that were already underway and it has proven technologies and approaches which were underutilised. Ways of working will not return to the status quo ante; underlying profit and its drivers cannot. Businesses have to remodel and those who take time to review the myriad design options and their ramifications as a single, strategic review of the connected whole, will be those who emerge strongest from the crisis.

Oliver Wyman is a global leader in management consulting that combines deep industry knowledge with specialised expertise in strategy, operations, risk management, and organisation transformation.