All Aboard

Building the Right Board to Respond to the Climate Challenge, a webinar jointly hosted by the Asian Institute of Chartered Bankers and UK-based Chartered Institute for Securities & Investment, addressed the discourse surrounding board commitments in the transition to net-zero.

During the 71-minute webinar this January, panellists including Richard Burrett, Fellow at the University of Cambridge Institute for Sustainability Leadership, and Beate Van Loo-Born, Executive Director – Head of Strategic Projects at UBS Zurich, outlined the impact of current board trends at government and corporate levels, existing knowledge on board characteristics and their degree of impact to positively influence climate response. The closing Q&A also addressed global expectations as climate-related issues gain further traction.

In response to an audience question on voluntary or mandatory disclosures by boards, Burrett elaborated: “We are seeing an increasing regulatory burden on institutions in general and financial institutions in particular around climate change. The TCFD (Task Force on Climate-related Financial Disclosures) has had a major impact on the way that many institutions now think about climate change, and the regulators are doing this because they see climate change as a material systemic risk and I think that’s an important addition to the shareholder versus stakeholder debate.”

“Even if you don’t care about your stakeholders, even as a shareholder, the materiality of climate change as an issue is evolving and people are recognising that it does have a material impact.”

A University of Cambridge research, What Board Characteristics Are Driving the Climate Change Response of Firms in the Financial Sector? revealed:

- The importance of the chair in driving the firm’s climate response. When the chair possesses a sustainability mindset, this has an impact on whether climate is included on the board agenda and ultimately in the firm’s climate response.

- Even a climate-literate chair with a sustainability mindset needs to bring other directors along on the journey.

- Separation of CEO and chair roles are found to positively influence climate response.

- Board diversity, including gender, age, and expertise, positively contributes to a firm’s climate response, as does a sustainability mindset.

Watch the recording at https://member-portal.aicb.org.my/login.

Visit https://www.aicb.org.my/events/upcoming for information on upcoming webinars.

IMF: Asia’s Recovery Lifts Global Growth Estimate

Stronger performance in advanced and emerging economies in Asia – China, India, Malaysia, Thailand – led to an upgrade in the International Monetary Fund’s (IMF) global growth estimate for 2020 by 0.7 percentage points to a contraction of 1.5%.

Its January 2021 World Economic Outlook Update reports that the pandemic-led collapse last year has had acute adverse impacts on women, youth, the poor, the informally employed, and those who work in contact-intensive sectors.

The international financial institution also predicts the world economy is set to grow 5.5% in 2021 and 4.2% in 2022 on the back of a vaccine-powered strengthening of activity and additional policy support in several major economies. Expect a divergent recovery in 2021 as emerging markets and developing economies outpace advanced economies by 6.3% vs 4.3%.

New Cost Paradigm to Unlock Savings

With nonbank insurgents carving inroads in the sector, retail banks must rethink and realign cost structures.

In Global Retail Banking 2021, Boston Consulting Group states: “The bank of the future cannot operate with the cost structure of the present and remain competitive. Our analysis shows that the operating costs of the best banks are already about 40% lower than those of the typical bank, and they have roughly 50% fewer employees. These banks make larger and more sales, and they do so with branches that are less transaction focused.”

To unlock cost savings, the consulting house recommends that retail banks take the following steps or will likely struggle to monetise their current investments:

• Restructure operations around value streams. The typical bank has fewer than ten value streams, including joining the bank, borrowing, saving, and making transactions. In our experience, front-to-back value stream redesign can typically deliver a reduction in costs of 15% to 25% and an increase in the consumer advocacy or net promoter score of 20 to 40 percentage points.

• Shift digitisation from front-end to front-to-back. While most banks have prioritised select digitisation measures (often focusing on front-end functions that will have the most customer impact), they have not put an equivalent effort into cost and risk control (the back-end or internal processes). As a result, customers’ digital experience has improved, and they are enjoying new options and features, but banks’ fixed costs, which are largely tied to terrestrial assets, remain in place.

Rathi: Diversity & Inclusion are Regulatory Issues

The UK Financial Conduct Authority (FCA) together with the Prudential Regulation Authority are developing a cohesive approach to diversity and inclusion (D&I) – which includes gender, ethnicity, sexuality, disability, social background – for all financial services firms under its jurisdiction.

Nikhil Rathi (photo), CEO of the FCA, said in a speech in London this March: “We care because diversity reduces conduct risk and those firms that fail to reflect society run the risk of poorly serving diverse communities. And, at that point, diversity and inclusion become regulatory issues.”

Nikhil Rathi (photo), CEO of the FCA, said in a speech in London this March: “We care because diversity reduces conduct risk and those firms that fail to reflect society run the risk of poorly serving diverse communities. And, at that point, diversity and inclusion become regulatory issues.”

“In our recent guidance on vulnerability, we said that firms – all firms – needed to understand the needs of their customers and be able to respond to them through product design, flexible consumer service and communications.”

“I would question if any firm can adequately respond to the needs of these consumers if they do not have the diversity of background and experience required to overcome biases and blind spots.”

If improvements are not forthcoming, he said the FCA will weigh how best to flex its statutory muscle, including:

- in addition to the five conduct rules under the Senior Managers Regime, a sixth rule is proposed, asking firms, “Is your management team diverse enough to provide adequate challenge and do you create the right environment in which people of all backgrounds can speak up?”.

- whether D&I should be made a requirement under the FCA Premium Listing Rules, following recent positive steps by exchanges like Nasdaq.

Busting Cryptocurrency John Doe’s

The US Internal Revenue Services (IRS) recently served a ‘John Doe’ summons on Circle Internet Financial Inc, a Boston-based digital currency exchange, this April.

Circle is not alleged of wrongdoing but the IRS is hunting for information about an unidentified taxpayer who conducted cryptocurrency transactions of at least USD20,000 between 2016 to 2020 for possible violation of federal tax laws, including failure to report virtual currency transactions.

This is the latest in the US crackdown on cryptocurrency tax cheats. Under the country’s federal law, convertible virtual currencies are classified as property for tax purposes. The tax agency has previously issued John Doe summonses to Coinbase, another US cryptocurrency exchange platform used to buy and sell bitcoin, ethereum, and other digital coins.

A ‘John Doe’ summons is an IRS-mandated summons to unmask the identities of a class of taxpayers under investigation and is used to pursue account holders at a financial institution. Most notably, a John Doe summons is what lifted the veil surrounding the hushed world of Swiss banking in 2008, leading to the IRS’ USD50 billion offshore sweep of American taxpayers using Swiss accounts.

Long-Termism Pays Off in Short Term

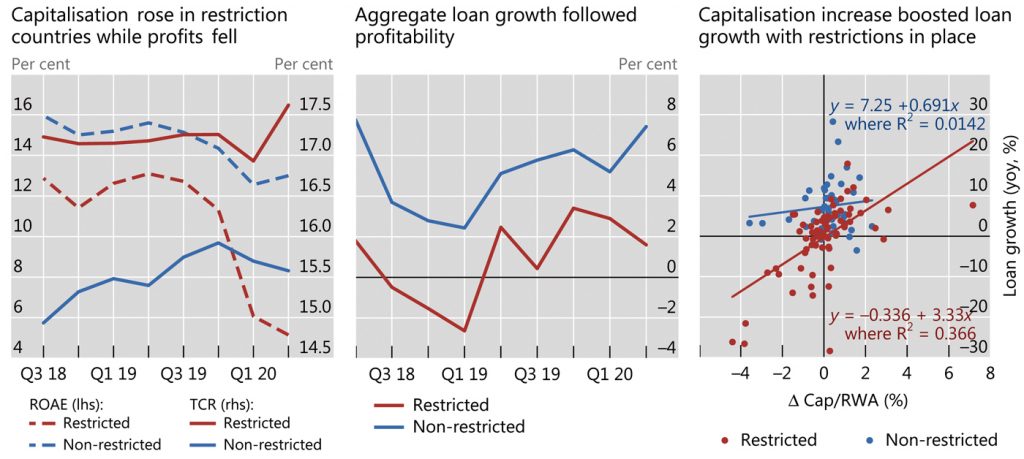

Dividend payout restrictions imposed by supervisors in some jurisdictions at the height of Covid-19 tended to increase lending and capital reserves. Based on recent research released by the Bank of International Settlements (BIS), it reports that capitalisation rose with restrictions, which helped banks better leverage additional capital into more lending.

When the payout freeze was first announced, share prices for impacted banks fell and the dividend restrictions did not receive unqualified support from all stakeholders. The BIS writes that its analysis indicates a sector-wide ban on payouts can remove stigma for individual banks that restrict dividends, but punishes prudent banks with sizeable capital buffers that could safely pay out their profits.

However, the prudential measure achieved goals of supporting policymakers by reassuring that credit was sufficient in ensuring continued economic activity.

“In contrast to its impact on the share price,” it elaborates, “the decline in anticipated dividends boosted the perceived safety of the banks. A larger decline relative to capital correlated with a smaller increase in CDS spreads. In other words, retaining more profits seemed to reassure debt investors, underlining the divergent interests of creditors and equity holders.”

“Payout restrictions appear to be effective at both increasing the capital available to the bank and channelling the additional resources towards lending. An increase in capital of 2% of risk-weighted assets resulted in loan growth that was 6.7 percentage points higher…Thus, these restrictions in the initial phase of the Covid-19 crisis supported policymakers’ objectives.”

Bank Capitalisation and lending

Source: FitchConnect, BIS calculations.