The Work Ahead in Banking & Financial Services: The Digital Road to Financial Wellness

Banking and financial services organisations are moving beyond the basics of digital banking and one-size-fits-all services, according to our recent study.

Banking and financial services organisations are moving beyond the basics of digital banking and one-size-fits-all services, according to our recent study.

By Cognizant

While digital banking has been on the rise for a decade, the pandemic pushed it to new levels and new customers. OCBC Bank in Singapore named senior customers as its fastest-growing segment for digital adoption, with uptake among 60- to 80-year-olds increasing by 20%. In the wake of intensified hygiene and safety, contactless transactions also skyrocketed; as 78% of global consumers adjusted the way they pay for items, the pandemic renewed the push toward a cashless society.

While necessity was the key driver for the accelerated adoption of digital banking and services, the convenience factor will ensure these practices live on. Research from Mastercard found that 42% of customers now handle their finances digitally more frequently than before the Covid-19 pandemic, while 62% are thinking of switching from physical banking to digital platforms altogether. The pandemic galvanised a shift in the entire banking ecosystem, shaking how customers, employees and businesses interact with financial organisations to the core.

In response, 51% of industry respondents in our study took swift and significant action in some parts or across the business, and a similar percentage (56%) expect these digital changes to accelerate. Early adopters of digital technology were better prepared. For example, Singapore’s DBS Bank saw a 30% increase in the use of its digital banking services in the first half of 2020 and now serves nearly one-third of its 3.4 million digital users entirely online.

Our research makes clear the speed of change that respondents anticipate. Currently, just over one-third (33%) of banking respondents feel they are ahead of their competitors in applying digital technologies to transform business strategies, processes and services. Fast-forward to 2023, however, and that percentage almost doubles (63%). Since no more than half of banking and financial services organisations can actually be above average, mathematically, time will tell which ones emerge as leaders, but the direction of travel is clearly uppermost in executives’ minds.

The pandemic is likely to spur a widespread implementation of high-impact digital journeys, from customer onboarding to loan origination, widening the gap between digital leaders and laggards. Banking and financial services executives must reimagine how their institutions will operate, serve customers and create value in the post-Covid-19 world.

This is as true in the consumer banking world as for corporate banking. In July 2020, Goldman Sachs launched self-serve account opening and client onboarding for corporate clients, in addition to other digital services. Interestingly, the company hired its 10,000th computer engineer as it completed its switch to digital-first. (See Figure 1)

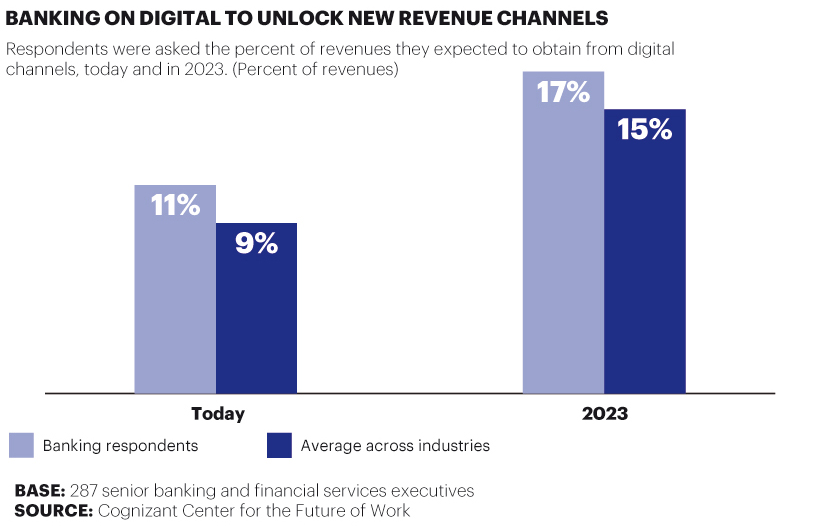

While banking respondents currently generate 11% of their revenue from digital channels on average, they expect that to reach 17% by 2023, which is higher than the global cross-industry average of 15%. This change-fuelled growth will mainly be driven by the explosion of customer data (both retail and corporate) flowing into and around processes, resulting in the hyper-personalised products and services that customers demand.

To achieve their ambitious digital revenue targets, financial institutions must move beyond transactional digital apps – checking balances and making payments and transfers – to weaving their products and services into customers’ lives in a way that makes them personalised and relevant.

One way to do this is through AI-driven financial wellness tools that deepen the bank-customer relationship by providing digitally-driven insights that improve money management. Another is to add more human-like interfaces to customer touchpoints. By adding facial recognition technology to some of its ATMs, for example, Taiwan-based Taishin International Bank has enabled its financial consultants to personally greet wealth management clients (who agree to create a facial identity) when they visit a branch.

Voice interfaces will also boost customer engagement. Alexa usage shot up 65% globally in the first two months of lockdowns in 2020, and in our earlier research, we found that banking and financial services organisations were the most bullish of all industries about generating revenue through voice technology, with 55% planning to build a ‘voice skill’ in the next 12 to 24 months.

Voice will soon become the new customer experience as consumers get more comfortable with their voice assistants performing various banking and financial activities: “Hey, Alexa, which bank is offering the lowest mortgage interest?”

In July 2020, US Bank rolled out a voice-based virtual assistant in its mobile app to help with money management, provide information about account balances, upcoming bills and spending history, and handle tasks like money transfers. From selling products, providing information, completing transactions and helping customers access services, voice interfaces will soon be embedded in chatbots, applications, products and services. (See Figure 2)

With customers’ lives shifting online so significantly, data volumes are exploding. It’s not surprising, then, that when we asked respondents which technologies they have applied and leveraged most in their digital initiatives, data analytics is seeing the most significant attention, with 81% of industry respondents either widely implementing, partially implementing or piloting this technology.

Successful banks will access and analyse multiple disparate data sources to design personalised offerings and financial wellness tools, driving customer acquisition, retention and lifetime value.

For instance, by mining debit card data, banks can gain insights into spending habits that they can share with customers or incorporate into personalised offerings. All these insights will help banks fully integrate customers’ digital lives into a single, multipurpose platform and enable them to manage money, credit, insurance, income and expenditures in a simple, streamlined way.

In 2020, Capital One moved data analytics to the public cloud. The bank says this change has helped it shift resources from managing IT operations toward building more innovative, personalised customer experiences. The Boston Consulting Group has estimated that by personalising customer interactions, a bank can garner up to USD300 million in revenue growth for every USD100 billion it has in assets.

Artificial intelligence (AI) is also seeing widespread uptake, with 77% of industry respondents either already implementing AI projects or experimenting with pilots. The banking and financial services industry will shift from a system based on historical data to being driven by AI-driven predictions. These insights will be highly accurate – no more best guesses or “we think we know”. Banks can apply machine learning and AI to develop innovative products and services that help customers save time, money and effort. They can also use it internally to gain insights into customer thresholds such as risk levels, price sensitivities or propensity for prepayments.

AI will also be crucial for improving cybersecurity, especially as digital banking increases. Research suggests that banks and financial services firms are 300 times more vulnerable to cyberattacks than other industries. As a result, financial organisations lose approximately 5% of their annual revenue to fraud. As technology continues to evolve, cybercriminals will use more sophisticated techniques to exploit technology. Our respondents echoed this challenge, as 69% of respondents agreed that people will be more exposed to fraud and theft in the future. Banks’ digital customers are a soft target for fraudsters, making digital banking platforms susceptible to a myriad of security risks. With more employees working remotely, this is another threat vector.

Fighting back requires an intelligent machine that can detect threats proactively, identify malware, reconfigure network traffic to avoid attacks, inform automated software to close vulnerabilities before they are exploited, and mitigate large-scale cyberattacks with great precision. Any cybersecurity strategy without AI will be more prone to cyberattacks.

Banks no longer see automation as optional. We found that 57% of respondents are either implementing or piloting process automation systems. Organisations are using the new machine to rewire core internal processes, including customer onboarding, loan origination, loan servicing, compliance, marketing/customer retention and cybersecurity/fraud detection. Automation is a reality, but the key is to make it intelligent. Bank of America’s AI-driven chatbot Erica handled 400,000 client interactions a day in 2020 – twice as many as in 2019. In all, digital accounted for 60% of the bank’s mortgage business in 2020.

In our study, 39% of banking organisations are piloting blockchain technology (compared with the cross-industry average of 30%), while 24% have implemented some projects or are already seeing a widespread implementation (compared with 13% across industries). With blockchain, institutions are no longer the mediators of control, transactions and trust, as these mechanisms are embedded within the technology itself. The role of intermediaries will be reinvented and even become obsolete as trusted transactions can take place among anyone, including parties with no prior relationship. As the chief investment officer of a large bank in our study said, “Our treasury and trade solutions business is currently exploring blockchain applications to automate cash management, fraud protection and foreign exchange to consolidate our position to develop a robust banking platform.” (See Figure 3)

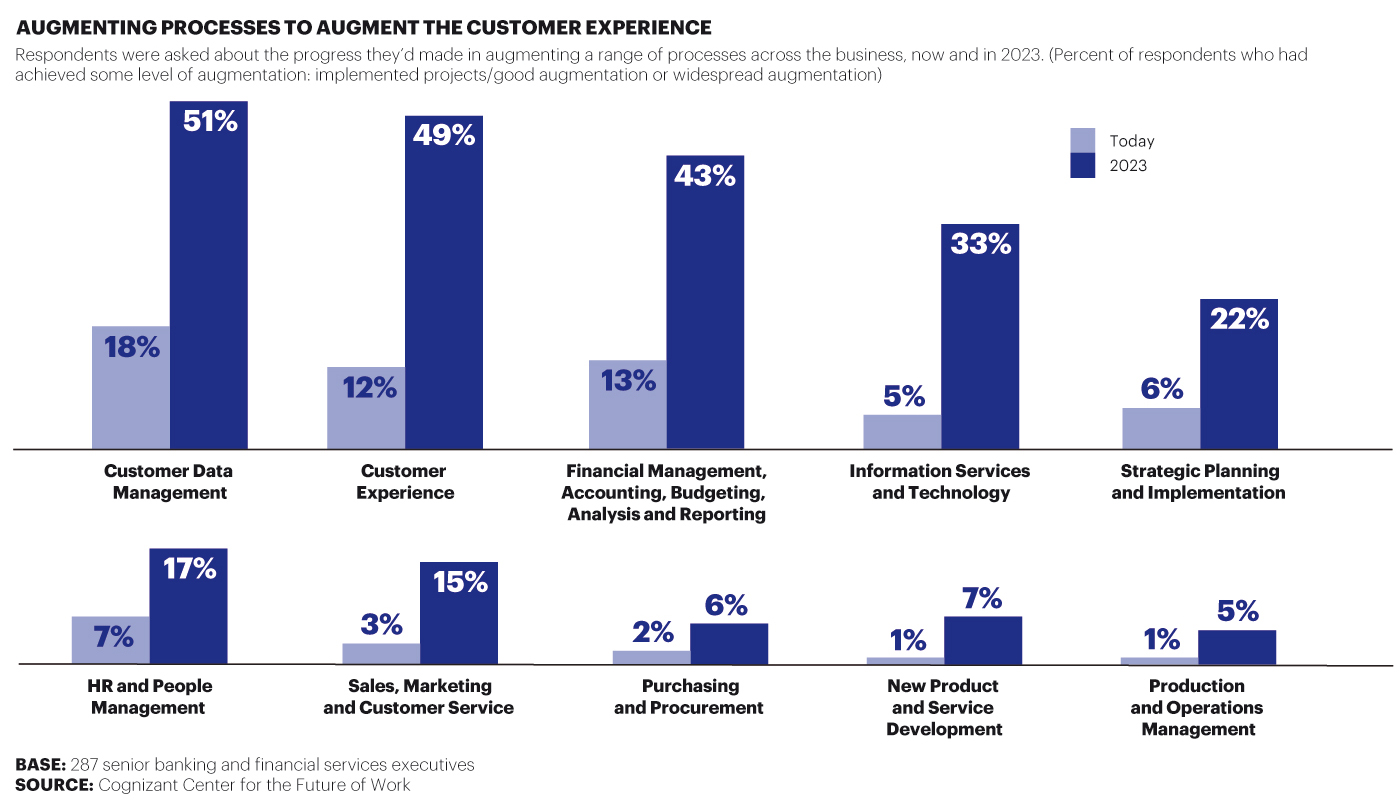

In terms of the outcomes of digitally augmented processes, the top areas in which banking and financial services respondents expect to reap benefits by 2023 are customer data management (51%), customer experience (49%) and financial management and accounting (43%). A recent study found that financial institutions lose up to USD10 billion in revenue a year due to insufficient data management practices. An example is the customer onboarding process, which can be lengthy and cumbersome for banking organisations when client documentation is spread across multiple systems and data is siloed by department or branch. This is all the more reason for banks to augment their customer data management processes.

Data management is also essential to building the hyper-personalised experiences that will deepen the customer experience. Hyper-personalisation approaches, though acknowledged conceptually for a long time within the industry, have seen limited uptake due to process limitations. In our earlier research, Algorithms Over Brands: How to Reach Today’s and Tomorrow’s AI-Augmented Customer, we found that only 45% of consumers are satisfied with the customised personal experience they get from their banks and financial services companies. With technology augmentation, banks can overcome these limitations by gaining significant insights into customer preferences and needs.

For instance, a bank could predict what kind of loan a customer will need next, whether for a wedding, college tuition or debt refinancing, before the customer approaches the bank directly. The banking user experience, in fact, will increasingly mirror the experiences seen in other tech-driven businesses. As Aris Bogdaneris, head of challengers and growth markets at ING, says, “User experiences for technology platforms like Uber are the same, regardless of where a customer is located. We started measuring ourselves more against these platforms than against traditional banks.” (See Figure 4)

When it comes to the benefits realised by augmenting processes with technology, the top focus area has been on achieving operational efficiencies. Currently, efficiency is the top outcome realised by respondents, who have so far seen a 15% improvement and expect that to grow to 25% by 2023.

Augmented processes can deliver the required level of operational efficiency the industry needs to compete in the fast-changing banking landscape.

For example, AI-infused analytics can help banks more quickly identify non-performing loans, liquidity impact and fraud so they can respond more quickly. As a senior executive from a large bank in our study said, “AI has certainly helped reduce operational costs, increase productivity and reduce turnaround time. We’ve reported 12% operational expenses savings in the last 12 months.”

Improving back-office capabilities and making them more efficient is the foundation for banks to offer a better customer experience. As processes become more streamlined on the back end, they can be seamlessly integrated with the front end, resulting in a faster and more tailored experience for customers. Between now and 2023, in fact, the focus will shift dramatically as customer experience takes centre stage. Respondents expect to see a 29% improvement in the customer experience by 2023, up from just 9% today.

Elevating the customer experience starts with finding and addressing the specific pain points that can be relieved and liberated with digital technologies. For many banks, this starts with a focus on the call centre. AI-based call centres can not only help reduce wait times, but also provide more accurate and faster resolution and also provide next-best actions that lead to revenues. A large wealth management company, for example, deployed a chatbot-based virtual assistant that handles hundreds of common call centre enquiries and transactions related to account balances, withdrawals, loans and transfers.

According to the company, the system reduced the volume of calls handled by live agents by 5%, improved the centre’s customer service index score by 5% and reduced operating costs by USD6.7 million.

Another top benefit area by 2023 will be decision-making, which will grow from 10% improvement today to 23% in 2023. For instance, banks can use AI to forecast customer behaviour and make instant decisions on loan applications and credit limits. The fundamental difference between banks and fintechs is the speed of decision-making. Fintechs can process loans, which might take banks weeks, in minutes. Common roadblocks for traditional organisations are a corporate culture that hinges on a strict hierarchy, impeding innovation, and an inability to effectively manage burgeoning data volumes, slowing decision-making.

Banks must speed data to speed intelligence. They should set a target for the next 12 months to match their decision-making speed to that of anticipated growth in data volumes. For instance, if you expect a 30% annual growth in data over the next 12 months, then the organisation’s speed of making insights and applying data intelligence needs to accelerate by 30% during the same period. Anything less will impact the speed of doing business in this fast-changing world. (See Figure 5)

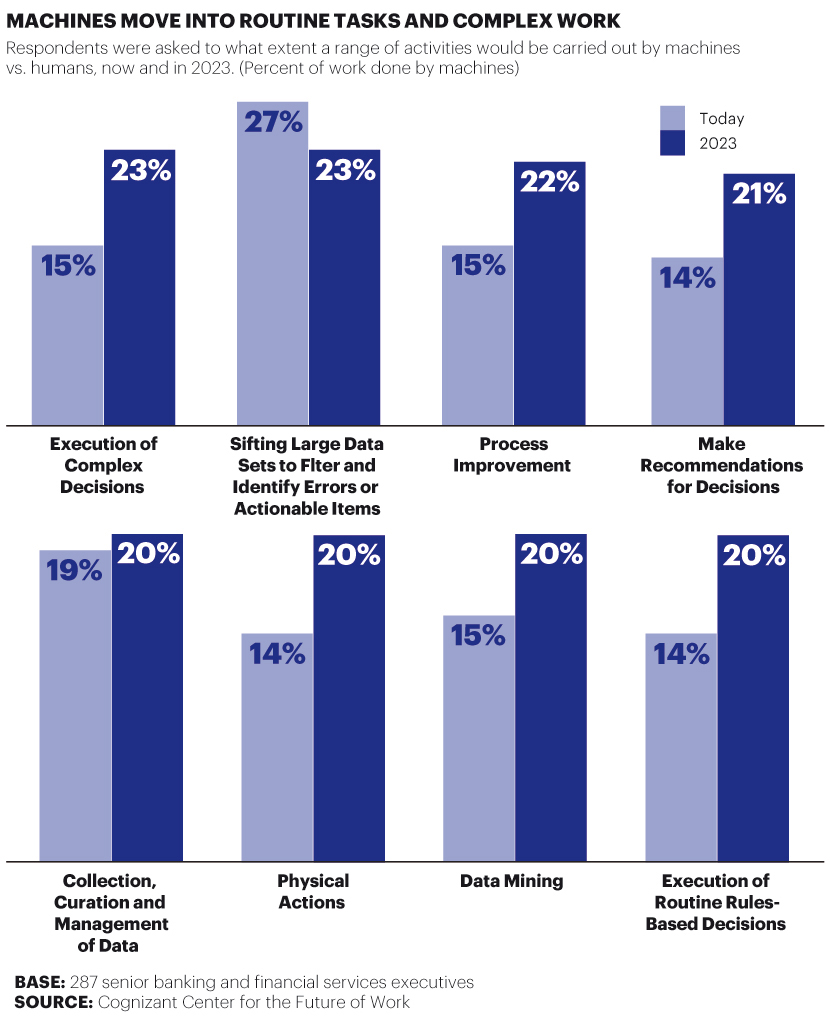

With augmented processes, organisations in our study espouse the idea of modern work supported by machines and driven by human workers. Respondents firmly believe intelligent machines will take on a greater portion of the labour involved in executing various data-oriented tasks, from about 15% of this work today to 22% by 2023.

Such work includes leveraging data for complex decisions and sifting large data sets for actionable insights. The CFO of a large bank said, “Our employees still have to deal with loads of paperwork daily. Such time-consuming and repetitive tasks often lead to a rise in operational costs, reduce productivity and increase human error chances. AI eliminates all that.”

When intelligent machines take on the work of collecting, managing and analysing data, the self-learning algorithms that drive them can learn much faster and generate valuable insights, helping businesses lower costs, improve productivity and offer more targeted products and services to customers.

At the same time, respondents are starting to develop a more realistic view of humans’ role in the age of AI. The top valued workforce skills will increasingly be tilted toward very human capabilities that validate the need for human-machine collaboration: decision-making, customer care, communication and analytical work. Both decision making and communication will surge in importance by 2023 (decision-making moving from second to first place, and communication from sixth to third).

These skills are best performed when workers are supported by the insights generated by AI and data analytics, and freed by intelligent automation from performing rote and repetitive work. By augmenting people and processes through new technologies, banks can vastly improve human performance levels.

At HSBC, for example, customers can begin a conversation in the bank’s mobile app with an AI chatbot, answering simple questions immediately. Complex inquiries get passed on to front-line colleagues. The AI system provides agents with details on the issue and provides guidance on how to resolve it. The bank aims to handle 10 million chat conversations a month by 2024. When banks pair the right technology with the right human skills, they can unlock new performance thresholds. (See Figure 6 & 7)

Changes made now, big or small, can make a significant difference in the future. Here are a few ways in which banking and financial services executives can capitalise on the massive shift in customer expectations that comes with digital’s inexorable proliferation:

> Institute front-to-back digitisation

The recent advances in AI, machine learning and robotic process automation have opened up significant possibilities for business automation. It has become an urgent priority to effectively compete with fintech competitors, which have a built-in, born-digital advantage: a structure that enables real-time decisioning, offers and fulfilment in areas that include cryptocurrency and retail and institutional financial services. By coupling process automation with the digital customer experience at the front end and leveraging the power of data analytics, banks can truly become and behave like digital institutions.

> Explore new customer segments and business paradigms.

What was risky in the past is possible today due to the prevalence of data and analytics. For example, while traditional banks had previously not prioritised the small business segment due to profitability concerns, there is increased action in this space due to more available insights into the creditworthiness of small businesses. Cases in point: Amazon’s work with Goldman to provide small-business credit lines, and American Express’ acquisition of Kabbage to provide small-business financing. Banks should balance their pursuit of these newer opportunities with their current business.

> Move toward a business model primed on platform centricity and smart aggregation that goes beyond banking.

While fintechs are fuelled by open banking-fuelled democratisation, the prospect of regulation still provides banks with a distinct advantage. It is imperative for banks to adopt a platform-centric approach, driven by digital banking application programming interfaces, to provide customers with a wide range of personalised products from partners, and also to become the engine behind fintech. By correlating customers’ financial behaviour with non-bank events, banks and financial services firms can better understand their underlying motivations and build new products and services accordingly. For example, when a customer is looking into buying a new car, a bank could offer an instant view of financing options for purchase. By integrating with other service providers like insurance companies, retirement funds, healthcare providers, retail chains and more, banks could take on an increasingly important role in customers’ lives and promote or create new business lines.

> Invest in personalising the customer relationship.

Making customers’ lives as frictionless as possible with unique and personalised experiences will be the key to success. Some hyper-personalisation concepts being explored include platforms that deliver integrated banking and business services, such as accounting and payroll management for small businesses integrated with banking services; usage-based product pricing, such as cashback based on purchase type; and dynamic lines of credit, such as capital loans based on predicted cash flow needs and smart underwriting capabilities.

> Focus on rebuilding trust and resiliency.

The shift to a digital-first society will create new questions around privacy, security and the impact of algorithmic-based decisions on disadvantaged communities. For instance, a court in the Netherlands recently determined it was a breach of human rights for the government to use an algorithmic risk scoring system to predict the likelihood that social security claimants would commit benefits or tax fraud. The biggest ethical dilemma of the near financial future is who will be in control: technology or humans. Banks need to ensure the decisions made by technology are unbiased and that the inner-workings of the supporting algorithms are transparent. The goal is to create customer experiences facilitated by machines and intensified by humans. Mastercard, for example, announced the launch of its Data Responsibility Imperative to promote dialogue around how companies collect, manage and use consumer data.

> Enshrine inclusivity into your digital strategy.

Whether for the elderly, physically or cognitively challenged or any population traditionally without access to financial services, digital augmentation can enable banks to reach new customers. In South Korea, KB Kookmin Bank’s customers can use palm recognition to withdraw money, making it easier, especially for senior populations, to access services with no need to remember their ATM password or carry a bank book. Catch, a personal benefits platform, offers its retirement savings plans, time-off savings and tax withholding services directly to those in the gig economy.

> Strike a balance between machine-driven and human-centric work.

The transition to AI won’t happen without an acute focus on the relationship between humans and machines, how the two will collaborate, and how the current workforce and the business itself will adapt to AI. To enable human-machine collaboration, companies will have to deconstruct jobs and identify which tasks are best performed by humans versus machines. As a result of this shared involvement, AI systems can learn to better proceed with new and unknown scenarios, while humans can continue to adapt and focus on higher-value tasks. An excellent first step is to appoint a role such as a human-machine teaming manager to ensure successful collaboration.

Banks have a renewed opportunity to align with the needs of the customers they serve – shifting focus from ‘managing accounts’ to ‘managing financial well-being’. Increasingly, customers will want banks and financial services firms to not only manage their money, but also guide them to be in control of their financial future. Using customer data, banks and financial services companies are well positioned today to predict what customers are looking for tomorrow, and deliver value they haven’t yet realised they needed. Using immersive technologies, banks can even become a virtual concierge by bringing the in-bank experience to customers’ homes. Banks and financial institutions have an opportunity to respond to this shift by becoming more flexible, responsive and human-centric. By making the transition from financial services to financial care, banks can ensure their brand not only survives but also thrives in the post-pandemic future.

Cognizant is one of the world’s leading professional services companies, transforming clients’ business, operating and technology models for the digital era.