‘Free from Financial Fragility’

This is the World Bank’s message in its World Development Report 2022: Finance for an Equitable Recovery, a clarion call for financial institutions to look beneath the surface and address fundamental shortcomings that get in the way of our efforts to build back better.

Carmen Reinhart, Senior Vice President and Chief Economist of the World Bank Group urges: “Prior to crises, it’s often the things that you don’t see that ultimately get you. There is reason to expect that many vulnerabilities remain hidden. It’s time to prioritise early, tailored action to support a healthy financial system that can provide the credit growth needed to fuel recovery. If we don’t, it is the most vulnerable that would be hit hardest.”

Although the share of non-performing loans remains largely unimpacted despite contraction in the economy, the organisation warns that “this may be due to forbearance policies and relaxed accounting standards that are masking significant hidden risks that will become apparent only as support policies are withdrawn”.

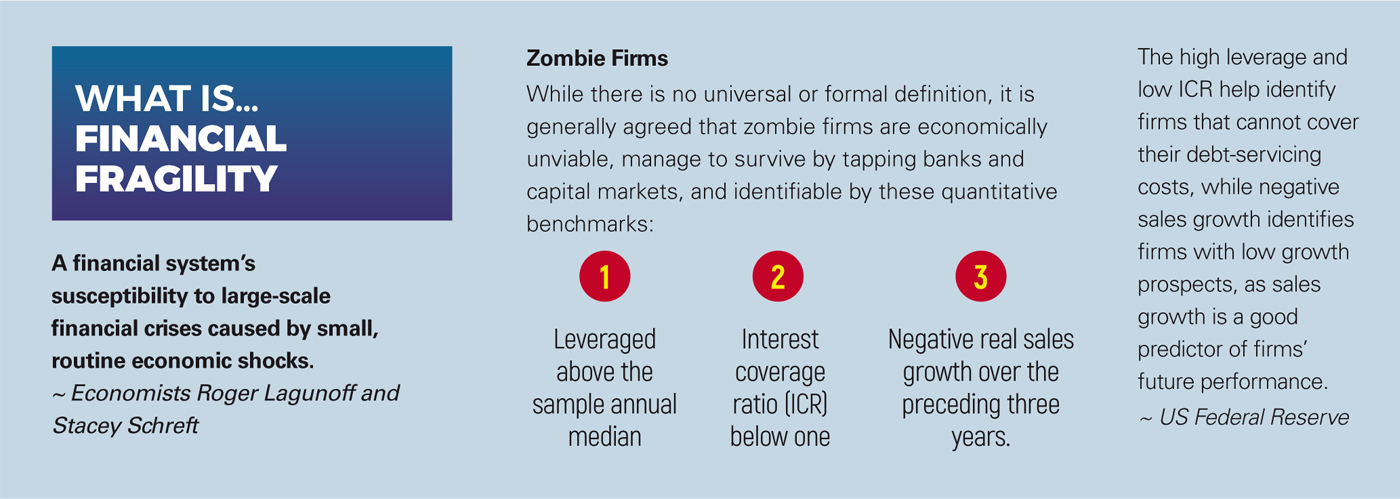

Its President, David Malpass, states: “The risk is that the economic crisis of inflation and higher interest rates will spread due to financial fragility. Tighter global financial conditions and shallow domestic debt markets in many developing countries are crowding out private investment and dampening the recovery. It is critical to work toward broad-based access to credit and growth-oriented capital allocation. This would enable smaller and more dynamic firms – and sectors with higher growth potential – to invest and create jobs.”

The report emphasises that the policy mix of a healthy financial sector must both free up resources for urgent investments and halt the spillover of financial risks, and highlights why improving institutional capacity to manage insolvency is mission critical:

- When households and businesses are saddled with unsustainable debts, consumption, job creation, and productive investment are suppressed.

- The longer the time needed to resolve a bankruptcy case, the larger the losses to creditors.

- Higher creditor losses reduce the availability of credit in the economy and raise its cost.

- The longer the bankruptcy process, the more time overindebted ‘zombie’ firms have to absorb resources that could support equitable economic recovery if they were redeployed to more productive firms.

Bounding to Net Zero

This April, the Report on the Sustainable Finance Landscape in Malaysia: An Assessment of Sustainability Practices and Product Offerings in the Financial Sector, published by the Joint Committee on Climate Change (JC3), provides insights into the state of readiness of Malaysian financial institutions in furthering the sustainability and climate agenda.

Co-chaired by the Bank Negara Malaysia and Securities Commission Malaysia, JC3 is a platform to pursue collaborative actions for building climate resilience within the domestic financial sector. The report is follow-through from a designed survey conducted in November 2021 comprising 24 financial institutions and focuses on four key aspects of sustainability practices in order to assess the readiness of the sector:

- Sustainability commitment and strategy;

- Governance and risk management;

- Green products and solutions; and

- Climate disclosures.

The alliance concludes that “a great deal remains to be done; however, we hope that this report will provide some insights on the common issues to be addressed in the industry, and the next steps forward for the Malaysian financial sector”.

BNM Sets Another Global Islamic Banking Standard

On 25 March 2022, the Bank Negara Malaysia (BNM) announced the introduction of the Malaysia Islamic Overnight Rate (MYOR-i) to “spur the development of innovative Shariah-compliant financial products which will further deepen Malaysia’s Islamic financial market”.

Developed in consultation with the Financial Markets Committee and AIBIM-FMAM Islamic Market Technical and Development Committee, the MYOR-i sets the standard as the first transaction-based Islamic benchmark rate in the world in accordance with the Principles for Financial Benchmarks developed by the International Organization of Securities Commissions.

The central bank states: “The establishment of MYOR-i as the Islamic benchmark rate will be a catalyst in driving Islamic financial product innovation and creating transparency for market players to negotiate and standardise their financial contracts, thus achieving efficient pricing across all financial instruments. This will help to deepen the onshore Islamic financial market and enhance its role in financing real economic activities in Malaysia.”

The new benchmark rate replaces the Kuala Lumpur Islamic Reference Rate and is a volume-weighted average rate of return on Shariah-compliant unsecured overnight Ringgit interbank transactions, including its Islamic overnight monetary operations.

The BNM will conduct periodic reviews of the MYOR-i “to ensure that it remains robust and representative of conditions in the underlying market”.

Refreshed Chartered Banker Framework, Enhanced User Experience

In collaboration with its global partners, the AICB is proud to announce strategic developments in 2022 set to enhance the pathways to professionalisation of Asian banking talent.

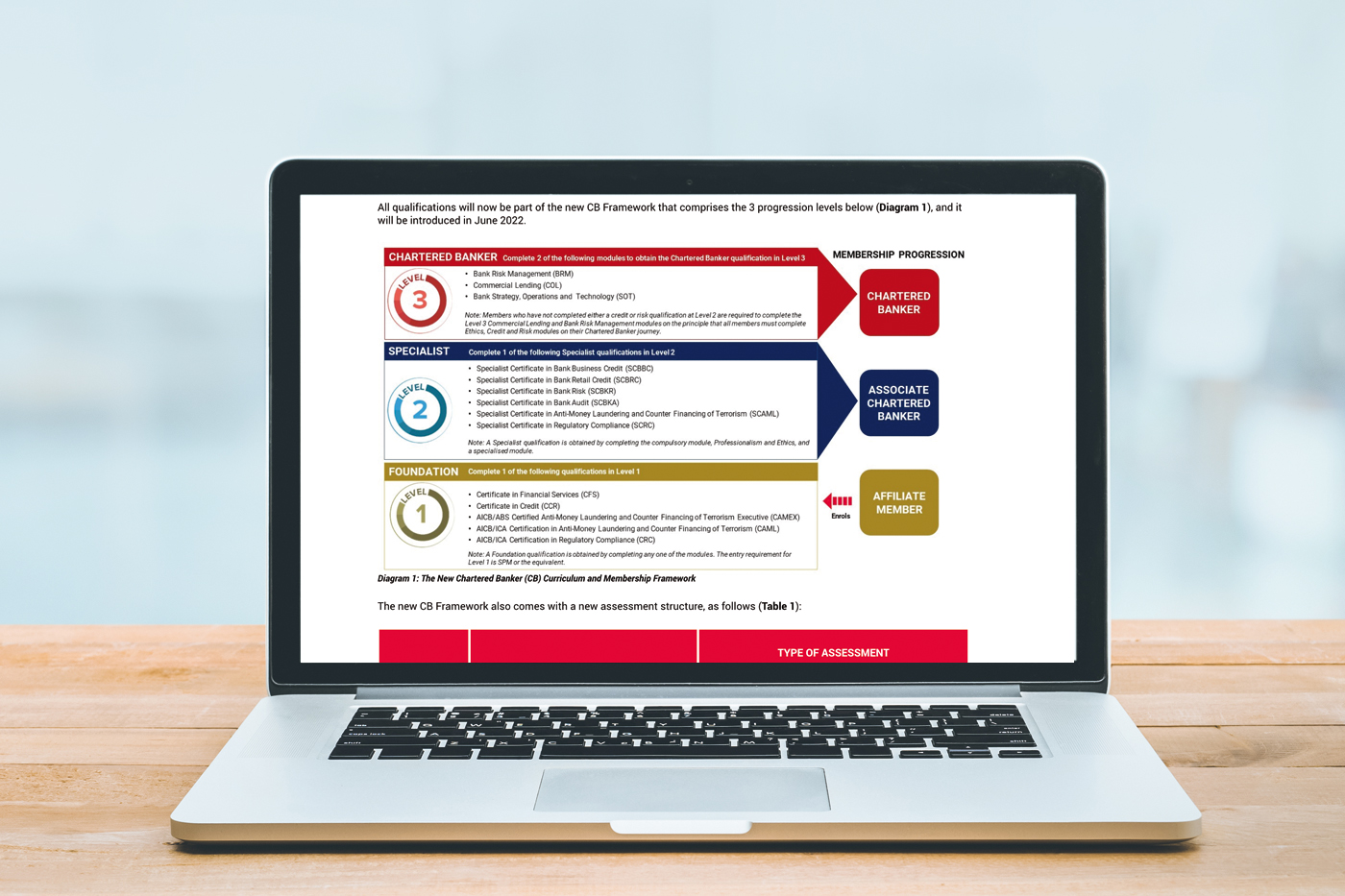

First, the AICB’s refreshed Chartered Banker Membership and Qualification Framework (CB Framework) introduces a new streamlined curriculum developed in collaboration with the Chartered Banker Institute, UK. This comes on the heels of an extensive review process to continuously align the AICB curriculum with the ever-evolving demands of global banking, ensuring our members are in step with international standards throughout their professional careers.

The refreshed CB Framework will commence in June 2022 with three progression levels, corresponding to a gradual phase-out of the current pathways and curricula.

Second, the new AICB Integrated Online Examination System with Pearson VUE (AICB-PV) is now live and provides members with an enhanced examination booking and learning experience. Members can now book and manage examinations via a single sign-on through the AICB Member Portal.

Further details on the CB Framework and AICB-PV are available at www.aicb.org.my.

Rattling the Cage of Environmental Crime

One of the five most profitable global criminal enterprises, environmental crime – the unlawful exploitation of wild fauna and flora, pollution, waste disposal, and its trade – is increasingly coming under the microscope of anti-money laundering enforcers. According to the US Financial Action Task Force, it accounts for nearly USD281 billion annually in criminal gains with associated tax revenue losses of close to USD30 billion per annum. The global watchdog’s most recent July 2021 report on the subject, Money Laundering from Environmental Crime, comprehensively reviews the treacherous landscape, loopholes, mechanisms, and developments that all financial industry stakeholders must be aware of.

As environmental, social, and governance issues continue to gain momentum, banks should expect greater push on the enforcement front. This includes initiatives such as Finance for Biodiversity, whose latest paper this January, Breaking the Environmental Crimes-Finance Connection, ups the ante by proposing a new due diligence mechanism requiring financial institutions to ensure the absence of environmental crimes in their financing value chain, a move that would put environmental crime on par with illegal activities such as conflict diamonds and slavery.