Pathway to Net Zero

The inaugural Malaysian Banking Conference, held from 12–13 September 2022 in Kuala Lumpur, was jointly hosted by the AICB and The Association of Banks in Malaysia. The highly charged event convened over 30 leading sustainability experts and 500 delegates on the theme of ‘Banking on Change: Turning the ESG Momentum into Action’.

Zeroing in on tangible climate action, the discussions traversed the ruddy but promising landscape of climate change and the critical role of the Malaysian financial sector in what the UN has called the Decade of Action. Robust discussions ensued, including defining Malaysia’s environmental, social, and governance (ESG) promises, transitioning to a low-carbon economy, climate data and disclosures, workforce transformation, and navigating the ever-evolving risks of the ESG landscape.

With a special address by the then Minister of Finance YB Senator Tengku Datuk Seri Utama Zafrul Tengku Abdul Aziz, FCB, the engaged format featured in-person panel discussions, plenary sessions, diverse breakouts, a half-day masterclass, and a Chartered Banker Roundtable facilitated by Dr Ben Caldecott, Founder and Director of the Oxford Sustainable Finance Group, University of Oxford.

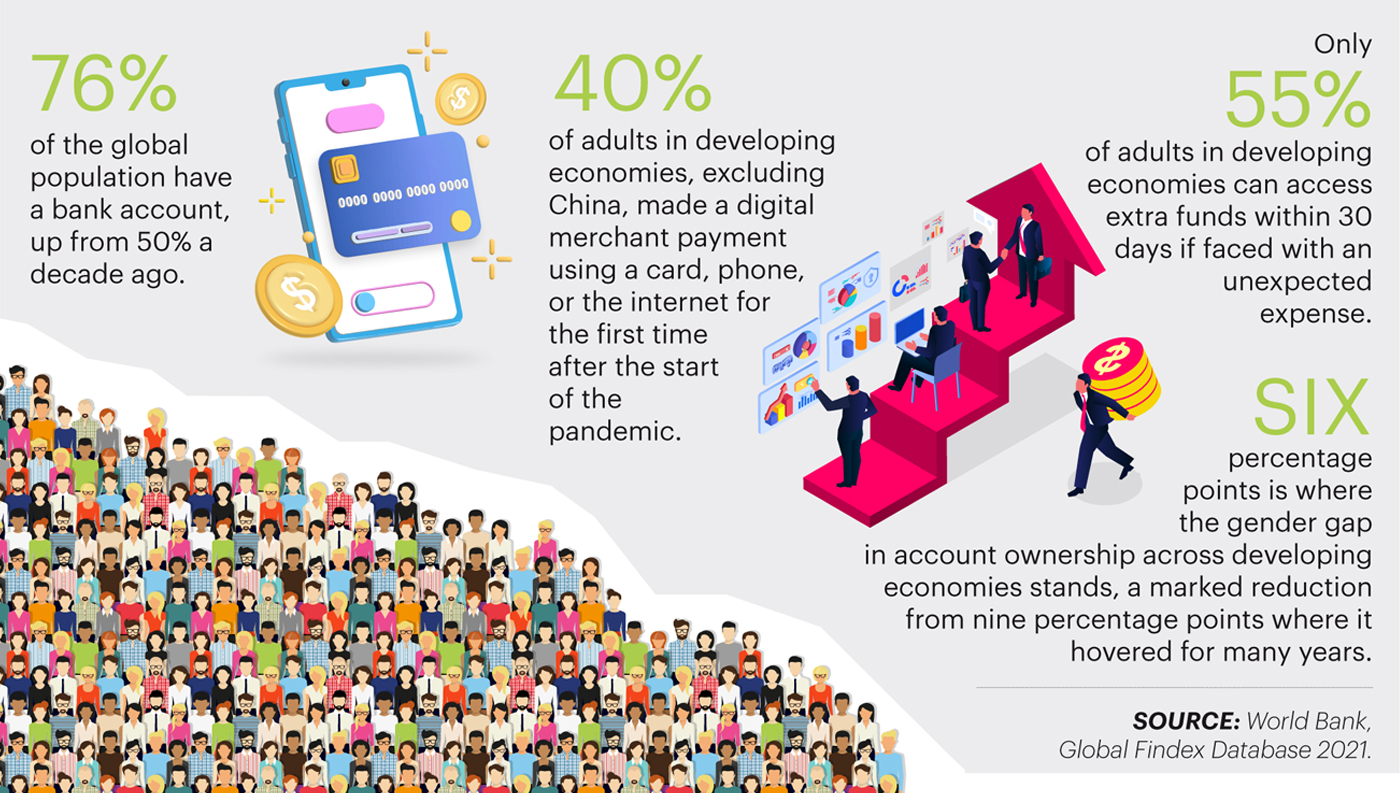

Snapshot – Global Financial Inclusion

Sharpened Focus on Financial Crime

Global financial crime experts and banking industry specialists gathered in Kuala Lumpur for the 12th International Conference on Financial Crime and Terrorism Financing (IFCTF) from 26–27 July 2022. Jointly organised by the AICB and Compliance Officers’ Networking Group, this industry feature event was supported by Bank Negara Malaysia, Securities Commission Malaysia and the Labuan Financial Services Authority and convened over 900 industry delegates with 50 global experts focused on intensifying the fight against white-collar crimes.

Themed ‘The New Frontier of Compliance: Adapt, Transform, Collaborate’, AICB Chairman, Tan Sri Azman Hashim, FCB, emphasised in his welcome address the objective of the Chartered Banker qualification in the collaborative financial network that has been built by AICB: “We continuously work closely with industry and relevant partners to build and strengthen the competence and skill sets of the financial sector workforce in compliance and AML/CFT through the various certifications that we offer. We hope these efforts will contribute strongly to building a sustainable local pipeline of finance practitioners equipped with the capacity and capabilities to combat the scourge of financial crime, and preserve the sanctity of the financial system upon which millions of people depend.”

Quantifying Metrics for Operational Resilience

The Basel Committee on Banking Supervision (BCBS) tees up on operational resilience through consultations with jurisdictions on a guiding set of principles to ensure essential services are uninterrupted in the face of pandemics, large-scale system outages, or natural disasters.

Although banking has proven to be resilient during this crisis, the concern is whether the system can withstand shocks that are large enough to trigger significant second-order financial consequences and loss of confidence. An independent 2021 study commissioned by the European Central Bank highlighted an operational failure of the TARGET2-Securities system, a centralised platform for the settlement of securities transactions within the European Union, in May 2020, which caused a halt of over 740,000 transactions for approximately 12 hours, resulting in a daily disruption value in excess of EUR1 trillion.

Although banking has proven to be resilient during this crisis, the concern is whether the system can withstand shocks that are large enough to trigger significant second-order financial consequences and loss of confidence. An independent 2021 study commissioned by the European Central Bank highlighted an operational failure of the TARGET2-Securities system, a centralised platform for the settlement of securities transactions within the European Union, in May 2020, which caused a halt of over 740,000 transactions for approximately 12 hours, resulting in a daily disruption value in excess of EUR1 trillion.

The BCBS’ broad principles on operational resilience are not prescriptive, and acknowledge that each jurisdiction will take differing approaches and set its own benchmarks for return to operational functionality following an outage.

On this score, some jurisdictions have already started the ball rolling. For instance, the US Financial Stability Board’s (FSB) white paper, An Approach to Quantifying Operational Resilience Concepts, issued on 1 July 2022, explores ‘output-based resilience’, a quantifiable measure of systemic resilience by determining what the base level of ‘critical functionality’ is for a complex system, measuring the degree to which a disruption reduces that critical functionality, and how quickly the system recovers from that reduction. The FSB paper also explores assigning a dollar value to measure the cost of disruption (defined as an interruption in the ability to deliver functionality as a result of the manifestation of some operational risk, such as a natural disaster or cyberattack) based on the size and resilience required at each level of event security.

Banks should cast a keen eye on developments in this rapidly growing topic in regulatory circles as quantifying resilience informs all aspects of critical operations, including risk mitigation and tolerance-setting thresholds.

Crypto ‘Bank Run’ Sparks Chain of Pain

In May 2022, the popular cryptocurrency TerraUSD (UST) crashed due to sell-offs from unknown sources. The uncollateralised stablecoin was designed to be pegged against the US dollar and maintained its set price by pegging itself against another sister currency, Luna tokens. When news circulated that one of Terra’s main developers and another unknown user had sold off 234 million UST, other UST depositors began withdrawing the stablecoin, which knocked UST off its USD1 peg. This spiralled into the virtual-world equivalent of a bank run for the stablecoin, with panic selling of UST and Luna token said to have cost investors USD60 billion in real cash.

The flood of UST and Luna token transactions created a domino effect for cryptocurrency-focused hedge funds that had been lured by the high payoffs touted by UST, and retail holders who had been promised as much as 20% annual returns.

One of the biggest casualties was Three Arrows Capital (3AC), a Singapore-based cryptocurrency-focused hedge fund that had invested between USD200 to USD560 million in Luna tokens that were rendered worthless in a matter of days.

Founders of the USD10 billion hedge fund went on the lam after authorities in several jurisdictions – British Virgin Islands, the US, Singapore – ordered 3AC’s liquidation in June and commenced criminal investigations. Ironically, among the laundry list of creditors is 3AC co-founder Su Zhu, who filed a USD5 million claim from his own hedge fund and was rumoured to have bought a USD50 million yacht with investors’ money before the house of cards came tumbling down.

The Monetary Authority of Singapore has stated that 3AC was found to have provided false information as it had exceeded the SGD250 million threshold that a registered fund management was permitted to oversee. Investigations are ongoing at the time of writing.

Poor risk management or criminal cyber mastermind? You decide.

Wanna Talk About It?

There is an inextricable link between human well-being and economic health. For instance, in terms of per capita gross domestic product (GDP), the world’s citizens are better off today than they were a decade ago, but do they feel safer, less anxious, more optimistic about the future?

“Just as good health — mental and physical — is fundamental to individual well-being, public health is fundamental to stable, cohesive societies. That is the lesson we must take from the Covid-19 pandemic,” writes Gita Bhatt, Editor-in-Chief of the International Monetary Fund’s monthly magazine, Finance & Development, which advocates for global adoption of a personal well-being index to measure national well-being, in addition to metrics such as GDP.

Meanwhile, McKinsey & Co proposes three key actions companies in Asia should undertake to create a flourishing, positive work culture in its August 2022 article, Employee Mental Health and Burnout in Asia: A Time to Act: