Crypto’s ‘Whoa, Nelly!’ Moment: Basel is Cracking the Whip With Its New Global Standard

Countdown begins to bridle an unregulated asset class.

Countdown begins to bridle an unregulated asset class.

By Angela SP Yap

Cryptocurrencies’ ‘Wild West’ days are numbered.

What began more than a decade ago as a project to create an independent virtual currency, cryptoassets today – like bitcoin and ethereum – have morphed into flashpoints of financial instability and a hotbed for illicit activities.

Since the stablecoin meltdown of TerraUSD in May 2022 (which we’ve tackled in previous commentaries of crypto hype in Banking Insight), the cryptocurrency ecosystem has been battling to stay afloat in this ‘crypto winter’.

Bitcoin, widely regarded as the bellwether for cryptocurrency assets, has dipped below the psychological threshold of USD28,000, whilst ethereum, another popular cryptocurrency, has lost more than 60% of its market value.

There has also been a growing number of systemic risks and bankruptcies involving cryptoassets. Think of the 2014 hack of the Japanese-based Mt Gox exchange, which saw 750,000 bitcoins ‘disappear’ into thin air. As the biggest cryptocurrency exchange at the time, the USD20 billion loss led to its bankruptcy and marked the first major collapse of the cryptoasset market.

The aforementioned collapse of high-yielding stablecoin TerraUSD and its sister-token Luna in March 2022, which wiped out nearly USD40 billion in market capitalisation, caused over USD400 billion in losses for the broader cryptocurrency market. Its developer and founder, Stanford-University-educated and ex-Google engineer Do Kwon, had been on the lam for more than a year after Interpol issued a red notice for his arrest. At the time of writing, Kwon has just been arrested in Montenegro while attempting to fly to Dubai using forged Costa Rican travel documents, and was released after paying a six-figure bail. The US is seeking his extradition to face charges of conspiracy to commit commodities fraud, securities fraud, wire fraud, conspiracy to defraud investors, and market manipulation.

“This asset class is rife with fraud, scams, and abuse in certain applications. There’s a great deal of hype and spin about how cryptoassets work. In many cases, investors aren’t able to get rigorous, balanced, and complete information. If we don’t address these issues, I worry a lot of people will be hurt.” That was Gary Gensler, Chair of the US Securities and Exchange Commission in remarks before the 2021 Aspen Security Forum.

This is about to change.

On 16 December 2022, the Group of Central Bank Governors and Heads of Supervision, the oversight body of the Basel Committee on Banking Supervision (BCBS), endorsed a finalised global prudential standard on banks’ cryptoasset exposures, for implementation by 1 January 2025.

Known as SCO60, this new (and long-awaited) prudential measure will place unbacked cryptoassets and stablecoins – private digital assets that depend on cryptography and distributed ledger technologies or similar technologies – directly under the microscope of financial regulators.

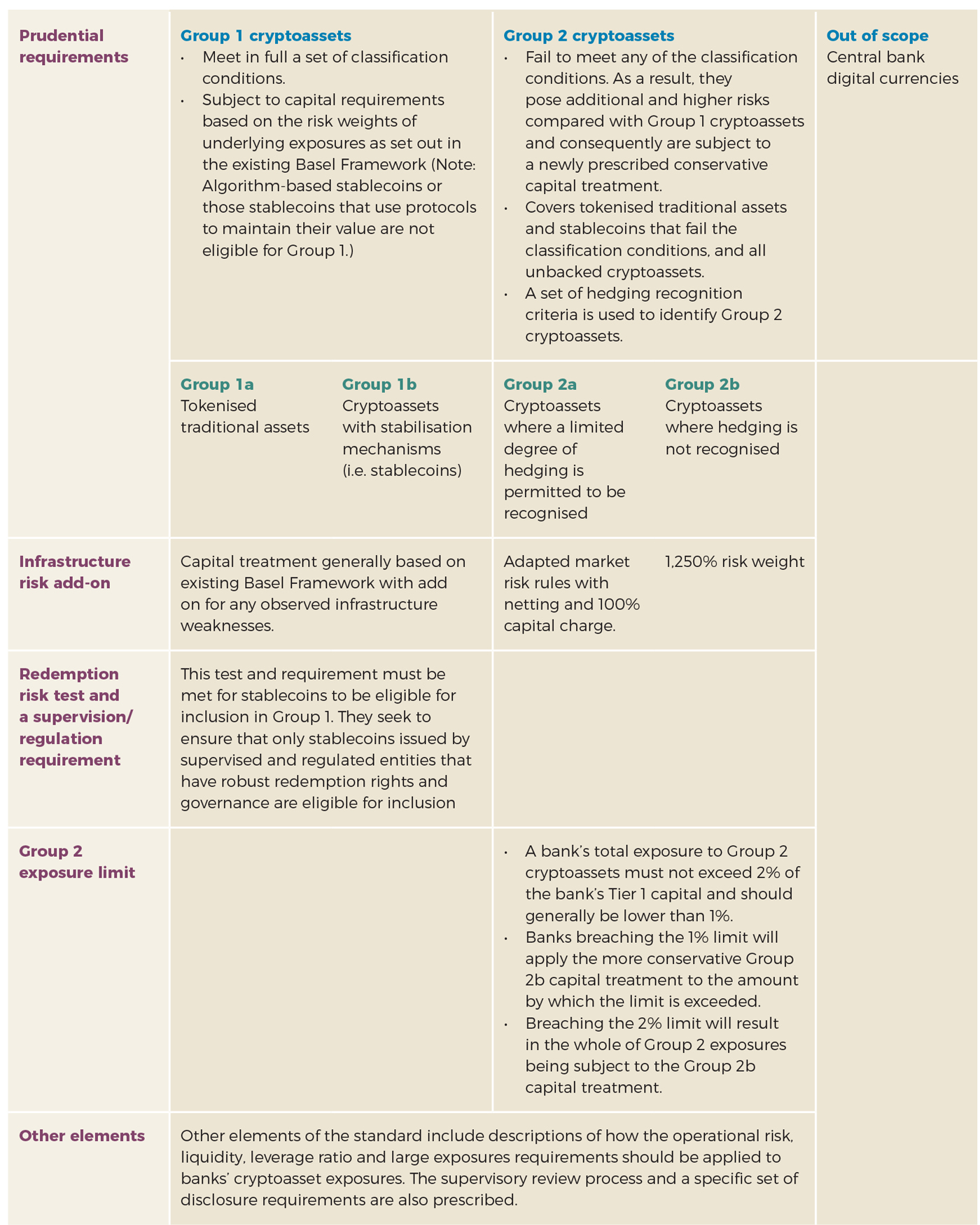

The forthcoming standard clarifies how the Basel Framework is to be applied in respect of banks’ exposures to cryptoassets. Banks can expect the consolidated new SCO60 chapter – which cross-references other chapters of the Basel Framework – to be made available soon. Table 1 indicates more granular (and in some instances, more relaxed) treatment of cryptoassets by banks. It is also important to note that SCO60 does not, at this juncture, prescribe any prudential treatment of central bank digital currencies (CBDCs), although it is on the BCBS’ radar once CBDCs are formally issued en masse in the future.

“I can already see one challenge for regulators, which is to let banks reap the economies of scale inherent to digital technologies while not recreating risks of too-big-to-fail,” said Benoît Cœuré, member of the Executive Board of the ECB, back in 2017 when speaking about the “known unknowns of financial regulation” at a conference on rethinking macroeconomic policy.

With the SCO60 go-live slated for 2025, the clock is now ticking for every jurisdiction to enhance the blueprint for the treatment of cryptoassets by banks. In addition to translating the standard into each national framework, there is the added challenge of cross-border harmonisation for the treatment of this asset class.

Although the spillover effects of past crises like Mt Gox and TerraUSD have been contained within the crypto market with little impact on systematically important banks, the lightning collapse of Silicon Valley Bank (SVB) is proof that there are enough linkages between conventional finance and crypto markets to make contagion a real worry for core financial services.

Part of the problem was the lack of portfolio diversification. SVB’s core depositors of technology start-ups and cryptocurrency firms took big hits to their balance sheets in the ongoing ‘crypto winter’, burning through cash reserves at unprecedented rates. As word of the deposit drain – coupled with the bank’s own funding mismatches and interest-rate bets that went awry – got out, a run on the bank was inevitable.

In the interconnected world of finance, there can be no safe harbour without a harmonised global standard. For investors who’ve had their fingers singed in the fire, the toughened regulatory stance on crypto can’t come soon enough.

In addition to the overall monitoring of the standard, the BCBS Committee has agreed on a set of issues that will be subject to specific monitoring and review:

Angela SP Yap is a multi-award-winning social entrepreneur, author, and financial columnist. She is Director and Founder of Akasaa, a boutique content development and consulting firm. An ex-strategist with Deloitte and former corporate banker, she has also worked in international development with the UNDP and as an elected governor for Amnesty International Malaysia. Angela holds a BSc (Hons) Economics.