Will Carbon Capture Find a Captive Audience?

Solutions at the forefront of green finance in the region.

Solutions at the forefront of green finance in the region.

By Kannan Agarwal

As economies in the Asia-Pacific region seek to decarbonise and transition to net zero by 2050, many predict that the demand for cross-border export of CO2 is set to increase and the region is naturally positioned to reap the benefits of the decarbonisation economy. Recent deals indicate that the region is already positioning itself to reap the benefits of this nascent economy.

In November 2022, the national petroleum company Petronas green-lighted Malaysia’s first carbon capture, utilisation and storage (CCUS) project in the Kasawari gas field, 200km off the coast of Bintulu. Once completed by 2025, it will be the world’s largest offshore CCUS project, capturing over 3.3 million tonnes of compressed carbon dioxide (CO2) via a 135km pipeline where it will be injected into a depleted reservoir.

In March 2023, another Malaysian state energy company, Petroleum Sarawak, was granted its first CCUS licence to unlock and commercialise the state’s stranded sour gas reserves, which covers CO2 as well as sulphur.

The International Energy Agency defines CCUS as “a suite of technologies that can play a diverse role in meeting global energy and climate goals. It involves the capture of CO2 from large point sources, such as power generation or industrial facilities that use either fossil fuels or biomass as fuel. The CO2 can also be captured directly from the atmosphere. If not being used on-site, the captured CO2 is compressed and transported by pipeline, ship, rail or truck to be used in a range of applications, or injected into deep geological formations (including depleted oil and gas reservoirs or saline aquifers), which can trap the CO2 for permanent storage.”

Whilst commercial projects are on the move, the regulatory landscape in Asia Pacific is travelling at a more languid pace. With the exception of Australia, other CCUS storage countries in the region have yet to establish a specific policy or regulation of CCUS technology.

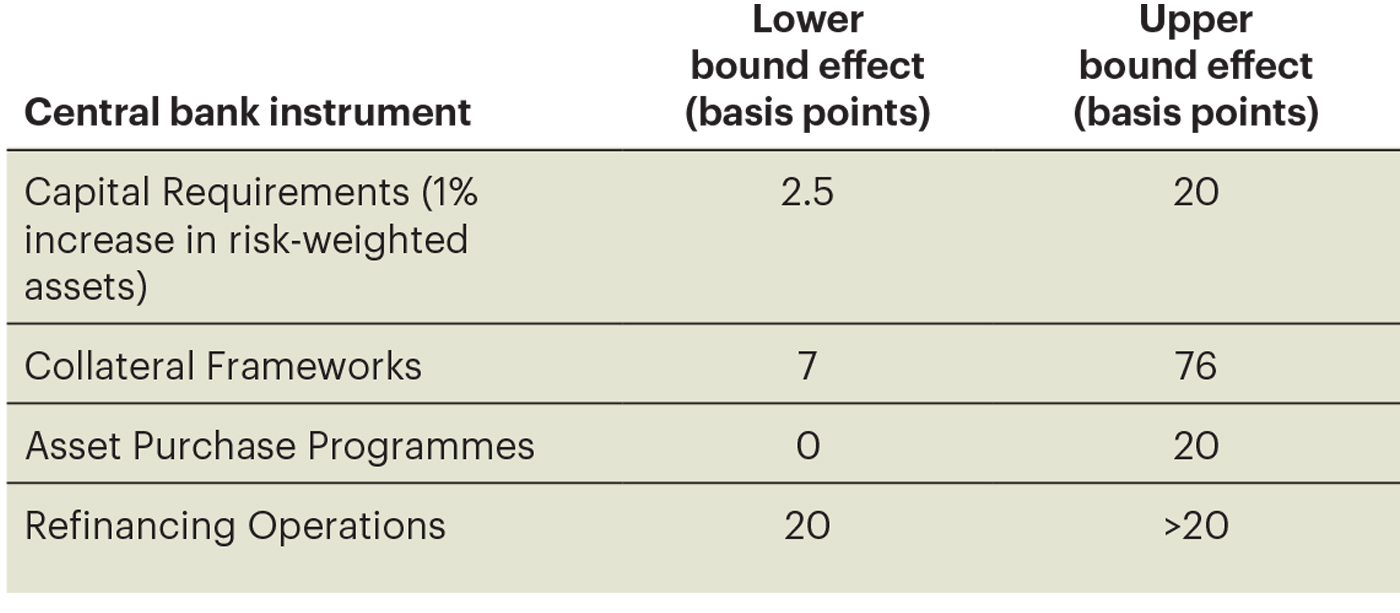

The crucial role of regulatory guidance should not be underestimated, as shown in a study by the Sustainable Finance Lab, a Netherlands-based transdisciplinary research centre established to transform financial markets and enhance sustainable development. Its recent report, How Much of a Help is a Green Central Banker?: Quantifying the Impact of Green Monetary and Supervisory Policies on the Energy Transition, sheds light on the critical role of central banks in achieving net-zero goals. In this novel research project aimed at quantifying the impact of green monetary policy and supervisory efforts, the centre found that green central bank intervention could amount to as much as 5%–12% of the needed climate action, primarily through reductions in the cost of capital for green and/or renewable subsectors. Table 1 quantifies the possible reductions in the cost of capital induced by different supervisory and monetary instruments that are currently at the disposal of central bankers.

The perspectives are aligned on many fronts towards which we see many global supervisory bodies steer and prioritise climate-friendly policies and investments. The organisation’s main conclusions from the report, all of which, it notes, should be in concert with government’s regulatory and fiscal efforts state:

+ Green central bank intervention reduces emissions and speeds up the transition as it channels investments towards targeted sectors.

+ Central bank green intervention can substantially accelerate the transition with a climate contribution that amount to 5%–12% of the needed emission reductions under an ambitious climate action scenario.

+ The quantitative impacts of green central bank intervention depend on the sectoral coverage of such intervention. Our analysis shows that the maximum impact of the intervention is achieved when it targets both green final sub-sectors and renewable power sectors at the same time.

+ Across sectors, the quantitative impacts differ according to their dependencies on different production factors.

+ An intervention that targets renewable sectors only induces spillover effects that could hinder the transition for most final sectors. Thus, the coordination between central bank green intervention and other fiscal climate policies is essential for a timely and cost-effective transition.

In Malaysia, Bursa Malaysia’s newly launched Bursa Carbon Exchange (BCX) carried out its first carbon credit auction on 16 March 2023. The electronic auction saw 15 buyers from various industries participate in purchasing a total of 150,000 Verra-registered carbon credits.

According to Bursa Malaysia, the auction facilitated the price-discovery of carbon credits from two new products offered by the BCX:

The bourse states: “To ensure proper governance during price discovery, Bursa Malaysia did not participate in the bidding process but purchased carbon credits only at the auction clearing price. The carbon credits from both projects were supplied by Vitol Asia Pte Ltd.

“By establishing a market-based price for carbon credits, the auction provides a clear signal to potential project proponents and developers on the economic viability of carbon credits. This will incentivise local project owners to develop carbon credit projects that can make a real impact in the fight against climate change.”

It should be noted that Verra, which issues, certifies, and operates the registrar of Verra-registered carbon credits and is also the world’s biggest certifier of carbon credits for the voluntary offset market, has been battling global criticism.

In a January 2023 joint exposé by The Guardian, Die Zeit and SourceMaterial, a nine-month investigation into Verra’s rainforest schemes together with recent scientific studies into the USD2 billion voluntary offset market unveiled that more than 90% of its carbon offsets “are likely to be ‘phantom credits’ and do not represent genuine carbon reductions”.

The exposé, titled Revealed: More Than 90% of Rainforest Carbon Offsets by Biggest Certifier are Worthless, Analysis Shows, cites corporates such as British low-cost airline EasyJet and fast-food chain Leon as some of the big brands who have moved away from their carbon offsetting programmes in favour of more direct net-zero impact such as “funding for the development of new zero-carbon emission aircraft technology”.

The article quotes veteran carbon-credit researcher Barbara Hayes, the director of the Berkeley Carbon Trading Project: “The implications of this analysis are huge. Companies are using credits to make claims of reducing emissions when most of these credits don’t represent emissions reductions at all…but these problems are not just limited to this credit type. These problems exist with nearly every kind of credit. One strategy to improve the market is to show what the problems are and really force the registries to tighten up their rules so that the market could be trusted.

“I started studying carbon offsets 20 years ago, studying problems with protocols and programmes. Here I am, 20 years later having the same conversation.”

Financial stability is the No.1 priority today and reining in the impact of physical and transition risks arising from climate change is increasingly on the agenda of policymakers.

A 2021 study by Banque de France economists Camille Macaire and Alain Naef found that 62.1% of the European Central Bank’s Corporate Sector Purchase Programme (CSPP) of corporate bond purchases were biased in favour of the manufacturing and electricity and gas production firms. Others like Erasmus University’s Dirk Schoenmaker advocate that the European Central Bank (ECB) should drop the market-neutrality approach in favour of targeted green lending for its asset purchasing programmes such as the CSPP.

Such evidence-based studies have spurred the ECB to look within and reposition its policy in favour of active green policies.

In a 10 January 2023 speech at the International Symposium on Central Bank Independence in Stockholm, Isabel Schnabel, Member of the Executive Board of the ECB said: “We are now tilting our corporate bond portfolio towards issuers with better climate scores, with a view to removing the existing bias towards emission-intensive firms.

“Although our current actions in relation to climate change are ambitious, they are still falling short of the Paris objectives as they are not sufficient to ensure a decarbonisation trajectory that is consistent with carbon neutrality of our operations by 2050.”

The three priority areas for greening the ECB, she said, are its stock of corporate bond holdings, public sector bond holdings, and lending operations.

In the US, although many financial service firms have committed to net-zero pledges by taking to account the environmental, social, and governance impact on their operations and investments, many more are not in favour of more granular regulation.

For instance, the Big Six financial firms – JP Morgan Chase, Citigroup, Wells Fargo, Bank of America, Morgan Stanley and Goldman Sachs – have not only signed on to net-zero pledges with overhauls to their portfolios and operations to factor in climate risk. Nonetheless, there is resistance by the industry, as represented by the American Bankers Association (ABA), to more prescriptive regulation such as climate stress testing and increased capital adequacy requirements as proposed by the Basel Committee on Banking Supervision (BCBS).

Although the ABA “conceptually agrees” with the BCBS’ recommendations to include climate-related risks (see The Heat is On on page 30), it has stated that some of the proposals – such as mandating the inclusion of climate risk in financial risk calculations – are “premature and counterproductive” as it skews the overall risk assessment of a bank.

It is one of the many obstacles in store as the world transitions to a low-carbon economy.

Kannan Agarwal is a content analyst and writer at Akasaa, a boutique content development and consulting firm.