Banking’s Nine Lives

In the unrivalled push for global financial stability, how many more chances will we have to get it right?

By Angela SP Yap

By Angela SP Yap

Price tag: USD14 trillion.

That’s what financial crises have collectively cost the world over the past two decades, according to the International Monetary Fund (IMF).

In its latest Global Financial Stability report in April 2024, the international financial institution warns that although near-term global financial stability risks have receded, its internal growth-at-risk framework points to expectations that global disinflation is entering its ‘last mile’.

“Stalling disinflation,” it reports, “could surprise investors, leading to a repricing of assets and a resurgence of financial market volatility.” For context, readers may wish to revisit the background to this discussion in Inflation: Why We Should All Take ‘Small Steps in a Dark Room’ from Banking Insight’s June 2022 edition.

The question is whether we’ve moved past too-big-to-fail. Judging by last year’s Credit Suisse creditor run and the failures at three US banks – Silicon Valley Bank, Signature Bank, and First Republic Bank, which represented a combined USD440 billion of assets to become the second, third, and fourth biggest bank resolutions since the Great Depression – the answer is a clear ‘no’.

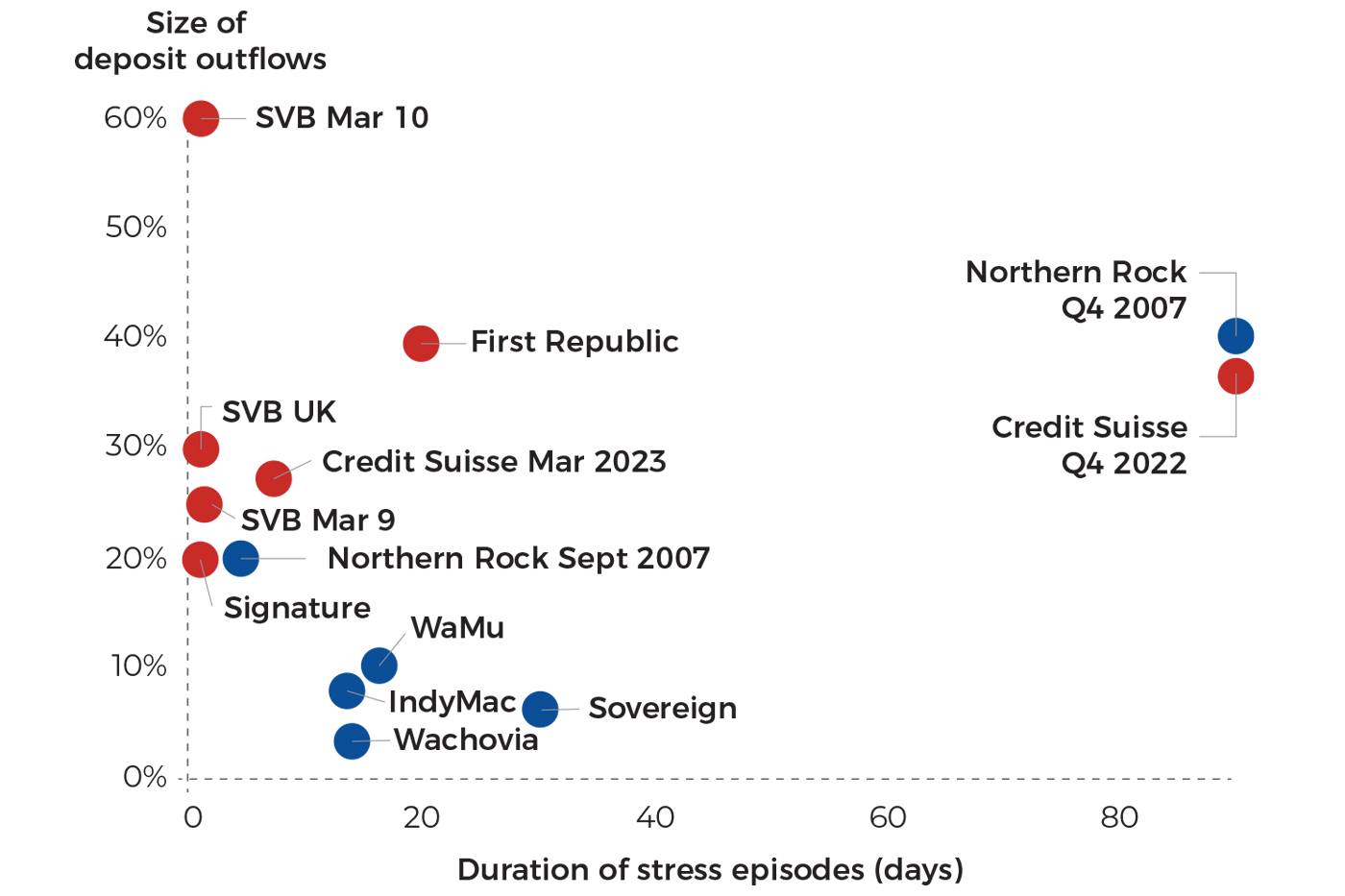

It is clear that the prescriptive panaceas of a post-2008 Basel regime, one that is centred on capital adequacy and other mostly quantitative standards, are no longer adequate to contain the risks arising from, first, the profile of newer banks; and second, banking’s rapidly changing landscape from embedded finance to the challenges of cryptocurrency. Figure 1 illustrates this, highlighting how institutions in 2023 experienced larger and faster bank runs compared to their counterparts during the global financial crisis.

Whilst the system has been fortified by supervisory oversight and enhanced liquidity requirements, the latest runs disprove some deep-rooted and widely accepted beliefs that have driven much of banking supervision and design in recent decades. These require a rethink.

In the case of SVB, the Federal Deposit Insurance Corporation (FDIC) and Federal Reserve both made exceptions. Citing concerns of systemic failure, the FDIC announced that it would guarantee all deposits at SVB, going beyond the standard USD250,000 insurance limit, whilst the Fed issued an emergency USD25 billion ‘backstop’ loan facility and eased its collateral requirements on loans to banks to ensure liquidity.

Far from being too big to fail, at the time of its collapse, SVB’s systematic risk profile was assigned as Category IV based on its total assets which totalled just USD211.8 billion in its last financial report in 2022. In comparison, global systematically important banks in the US are all designated as Category I. This is proof that, under specific environments and circumstances, even a relatively small bank could be a source of systemic instability. It is also likely that the basis of the US categorisation, based on the Fed’s Tailoring Rule which is devised on a narrow set of systemic risk indicators, requires re-evaluation under the present banking landscape.

Exceptions to the rule bring real consequences. In order to retain depositors’ confidence in the banking system, the FDIC exception to insure 100% of deposits will likely raise longer-term costs for the broader industry in the form of a premium or ‘tax’ for this overextended deposit insurance coverage.

In its latest 2023 Resolution Report: Applying Lessons Learnt, which tracks the progress of banks undertaking resolution-related work, the Financial Stability Board (FSB) outlined key priorities ahead of the next crisis to avoid the ripple effect that comes from a bank failure, including the need to reinforce its Key Attributes in order to increase financial resilience and crisis preparedness:

Bank resolvability is the next curve that banks must navigate as part of greater financial resilience. In his article, A Resolvable Bank, Dr Thomas F Huertas, Senior Fellow at the Center for Financial Studies in Frankfurt, gets to the crux of why it is crucial we get this right before the next crisis hits:

“Making banks resolvable is a key component of the regulatory reform programme enacted in response to the crisis. A resolvable bank is one that is ‘safe to fail’: it can fail and be resolved without cost to the taxpayer and without significant disruption to the financial markets or the economy at large.”

Resolvability preparations are well underway in various jurisdictions. The UK’s resolution authority, the Bank of England (BoE), published the first resolvability assessment of the eight major UK banks in 2022 and describes the exercise as “a spectrum, not a binary judgement, and therefore the Bank has not made a pass-or-fail assessment.”

Its Resolvability Assessment Framework (RAF) is less prescriptive. It was designed to set expectations in the event of a crisis or failure and includes the BoE’s own actions to maintain market stability, i.e. the BoE will issue a public statement for resolvability of firms with more than GBP50 billion in retail deposits.

The RAF also outlines three outcomes in order to support a resolution if they fail: having adequate financial resources in the context of resolution; being able to continue to do business through resolution and restructuring; coordinating and communicating effectively internally and with the authorities and markets so that resolution and subsequent restructuring are orderly.

The RAF for the eight major UK banks is conducted every two years, however, its timing is also important as it has the potential to sway markets. With general elections taking place on 4 July this year, publication of the results from the second RAF, which was due by 14 June, has been pushed back to August instead.

Monitoring systemic risk and addressing vulnerabilities in the banking sector is significantly different in the People’s Republic of China. The government holds controlling stakes in five of China’s largest commercial banks, which in total account for more than 50% of the nation’s banking system assets.

The new and still-in-the-works Financial Stability Law, which was first drafted in December 2022 and has since undergone several major changes, is directed towards mitigating systemic shocks and expected to be finalised this year. This comes amidst a real estate downturn and rising credit risk within smaller banks.

Its design includes a financial stability guarantee fund which is reported to be worth hundreds of billions of yuan, a funding backstop that will see uninterrupted emergency funding to smaller banks in order to preserve systemic stability.

According to the 2023 draft, the State Council can instruct the People’s Bank of China to provide direct liquidity support to the financial stability guarantee fund, minimising the use of public funds in its replenishment. Financial institutions must also pledge eligible collateral to draw down from the fund.

The law is also expected to introduce a resolution regime for systematically important financial institutions.

In recent times, much of the banking sector has managed to steer its way out of difficult or dangerous situations, akin to a cat’s nine lives. Yet, an ancient proverb explains: “A cat has nine lives. For three he plays, for three he strays, and the last three he stays.” It reminds us that it is possible to use up a life by staying as well as straying.

The history of banking is fraught with strategies that have gone belly up because firms strayed from the narrow path…or stayed on the well-trodden for too long. Just as the UK and China models to financial resilience differ, there can be no one-size-fits-all approach to stability.

Mapped against the current risks arising from cybersecurity threat actors, the rise of cryptocurrency versus digital currency, and the push towards embedded finance, what’s crucial is that robust resilience measures be put in place now, while there is still time and space to ring-fence. Its design should be, as all great things are, free from ideological bias and in the best interest of citizens.

The European Bank for Reconstruction and Development’s independent evaluation report published in January 2024 sheds light on the tapestry of efforts aimed towards fostering resilience in the macroeconomic fabric. The overview Connecting the Dots: Evidence that Drives Change outlines seven key evaluation insights which emerged from its extensive review of over 100 independent evaluation reports published by international financial institutions since 2007, during both crises and stable periods in financial history. It hopes that these strategic and operational imperatives would be of assistance to private-sector financial institutions that are seeking to unlock the full potential of financial stability reforms currently undertaken by prudential authorities.

The seven key evaluation insights are summarised below:

Applying a holistic approach in integrating financial sector development. This is most likely to set a solid foundation for a robust financial sector as evaluation evidence suggests that financial sector development is not a singular regulatory challenge but a dynamic interplay of policies. It cautions against a myopic focus on privatisation as an end in itself, urging a balanced perspective that emphasises well-managed banks with aligned incentives. Additionally, strengthening financial inclusion as a channel for fostering inclusive growth and mitigating volatility in the financial sector is important. It urges a proactive stance where the financial sector’s policy interactions are considered within a broader macroeconomic framework. The cautionary tales of underregulated access to borrowing in foreign currencies, highlighted by historical crises, emphasise the need for prudence in financial regulations.

Measuring progress and strategic responses to crises in the financial sector. To effectively respond to financial crises, evaluation evidence suggests a gradual approach that is built on early preparedness and anticipatory measures is the most viable route. This builds flexible safety nets that can most effectively respond to systemic shocks. Evaluation evidence calls for early preparedness to respond to crises by drawing from lessons of previous financial crises, for instance, the preparedness of Asia during the global financial crisis of 2007-2008 – its resilience is attributed to how the region learned and applied lessons garnered from the 1997 Asian financial crisis. It emphasises the need for proactive engagement during stable times, urging a shift from primarily reactive responses.

Managing currency risks and avoiding the pitfalls of over-reliance on foreign currency. Hedging and local currency loans are critical to managing currency risks and avoiding the pitfalls of over-reliance on foreign currency that can lead to financial sector fragility. This was particularly evident during the global financial crisis when countries such as Ukraine, Hungary, and Baltic nations, faced direct negative effects on their economies due to the excessive dependence of their banking systems on foreign currency. This cautionary tale points to the importance of diversification.

Building capacity for better risk management and non-performing loan (NPL) disposition. A programmatic response to managing rising banking risks, emphasising the need to avert a systemic crisis that could impede economic growth. For instance, in one Asian Development Bank programme, it was revealed that the targeted key reforms aimed at NPL reduction and enhanced regulatory oversight of governance and risk management practices contributed to strengthening and stabilising the banking industry. The multifaceted approach underscores the importance of a comprehensive strategy that addresses various facets of risk within the banking sector.

Enhancing country-level diagnostics are pivotal in discerning financial vulnerabilities and mitigating the risk of financial instability. These diagnostics play an essential role in fostering financial sector development and contributing to economic growth. However, it is acknowledged that even comprehensive diagnostics, including stress tests, cannot guarantee financial crises will be avoided every time. Advocates for more frequent and in-depth financial sector surveillance, particularly focusing on the largest systemic financial sectors, as a critical measure in preventing global crises.

Tailoring policy dialogue and investment tools for financial stability restoration. It is important to develop and implement cutting-edge financial instruments to address specific challenges that are related to crisis response, including international financial institutions’ cross-border support to foreign banks as well as adapting financial products to evolving circumstances and crises.

Synergising efforts among international financial institutions and collaborating on financial stability. The exploration of innovations in disaster risk financing, for instance, through catastrophe bonds and other financial instruments that underscore the potential for shared solutions in reinforcing fiscal and financial adjustability and strength amidst disasters. There is the importance of balancing short-term crisis mitigation and long-term resilience building, particularly in social protection mechanisms, which must be looked at. Transparent reporting frameworks and harmonised monitoring are encouraged to ensure adequate funding and tailored support during a crisis, thus potentially having a healing effect on financial stability. The lack of cooperation among multilaterals at the start of the pandemic, for instance, is cited as a potential risk area that could arise again during future crises.

Angela SP Yap is a multi-award-winning social entrepreneur, author, and financial columnist. She is Director and Founder of Akasaa, a boutique content development and consulting firm. An ex-strategist with Deloitte and former corporate banker, she has also worked in international development with the UNDP and as an elected governor for Amnesty International Malaysia. Angela holds a BSc (Hons) Economics.