When It Comes to Statistics, Boring is No Longer the Benchmark

Communicating statistical data is now top-of-mind for central banks.

By Julia Chong

By Julia Chong

In 2000, Deputy Governor Mervyn King shouted from the proverbial financial rooftop: “Our ambition at the Bank of England is to be boring.” Such high ambitions have since taken a U-turn.

In the past, the existence of national statistics organisations – whether housed within government agencies like central banks or under multilateral organisations like the United Nations – was lauded as a virtue unto itself; having a dedicated unit churning out voluminous data was indicative of a mature financial system, never mind if the statistical basis for their decisions remained largely ignored by the general public. This, however, is no longer the case.

In recent times, there has been a concerted effort by central banks to step up and step out of their comfort zone. Central banks, who are both users and producers of statistics, are in a unique position to steer expectations and the economy through the use of key financial figures. It strengthens credibility and minimises uncertainty when the public understands the statistical basis and reasoning put forth by regulators, leading to its course of action. It engenders trust in the system.

The Bank of International Settlements’ (BIS) recently published paper, Communication on Central Bank Statistics: Unlocking the Next Level, highlights that “the communication of statistics remains a constant challenge, reflecting in particular the difficulties posed by new information sources, the increasing need for granular insights and the competition of alternative, sometimes poor-quality data. Fortunately, central banks appear well positioned, building on well-established credibility, visibility and trusted independence… A key objective is to foster user engagement with, and understanding of, central bank statistics.”

Here is how:

+ A dedicated statistical communication function. This is typically set up to address both internal and external users. Success will often depend on defining clear priorities and objectives and on ensuring good cooperation with subject matter experts as well as with the main communication department of the central bank. Moreover, there is merit in following a structured approach to designing a comprehensive framework comprising all the various building blocks that constitute the “communication ecosystem” – e.g. the related information sources, audiences, channels and required multidisciplinary skills.

+ No ‘one-size-fits-all’ approach. To be effective, communication should reach out to and engage with different groups, consider their distinct needs and be tailored to their various levels of sophistication and knowledge. Central bank statisticians are indeed already following different approaches when communicating statistical information, depending on the specific user groups considered (such as the general public, researchers, students, journalists). Moreover, central banks are also developing new communication channels in order to reach out to the broadest possible audience. This calls for making the most of the wealth of data they have available, including granular data, and for using all media opportunities, especially social media.

+ Leveraging innovation. This is to enhance their statistical dissemination methods and address the most pressing challenges. For instance, they are developing single “open source” data portals to strengthen their communication, by making data more accessible and enhancing users’ experience. They are exploring new ways to share very granular information without compromising confidentiality. They are also mobilising techniques based on artificial intelligence (AI) to support a wide range of tasks, from identifying user types to offering customised solutions that are tailored to specific user needs and degrees of literacy. In particular, the recent progress observed in the field of natural language processing and large language models is providing important and promising new opportunities to strengthen central banks’ statistical communication.

There are numerous initiatives to communicate and reach out to a broader audience, signalling that they, together with the times, are changing.

Fostering engagement with data users – both within and outside the walls of the organisation – is now an explicit objective of an increasing number of regulators. Some house a dedicated communications unit within the statistical department, whilst others opt to coordinate the statistical communication function between the statistics and corporate communication departments. What is important is the acknowledgement that there is no one-size-fits-all solution.

For instance, the authors of the BIS paper – Luis de Carvalho Campos, Ligia Maria Nunes, Mafalda Sousa Trincao, and Bruno Tissot – detail the experience of Danmarks Nationalbank in developing the statistical communication function and expand on the Danish central bank’s key considerations. It is worth noting that the trajectory of the Danmarks’ experience, which is summarised below, closely mirrors that of other central banks’ statistics departments that have established communication-focused teams:

There is an increasingly deeper appreciation of the need to ‘help users think with data’. This entails reaching out to a whole new demographic consisting of semi- and non-professional users. It is a marked shift away from the days when statistics were jargon-filled, visually blah, and seemingly irrelevant to the general public.

A subset of regulators have also adopted a customer-experience-centric approach to communications by streamlining consumers of statistical data into four types of user personas – unskilled users, skilled users, students, and economists.

The European Central Bank’s (ECB) statistical data warehouse was built in 2006. Catering to over one million users globally, it was primarily used by professionals and in need of major overhauls to meet the expectations of modern users. With over 44 in-depth interviews with professional, semi- and non-professional users, the ECB was able to identify user pain points and the new requirements they envisioned. Coupled with a benchmarking exercise of 20 other data portals, these insights assisted the supra-national regulator’s revamp of a new ECB data portal which went live to the public at the end of 2022. No longer presenting just populated data in columns and rows, the new portal included interactive features such as dashboards, time series and comparisons, explainers and insights presented with downloadable visuals, including embedded features for other webpages.

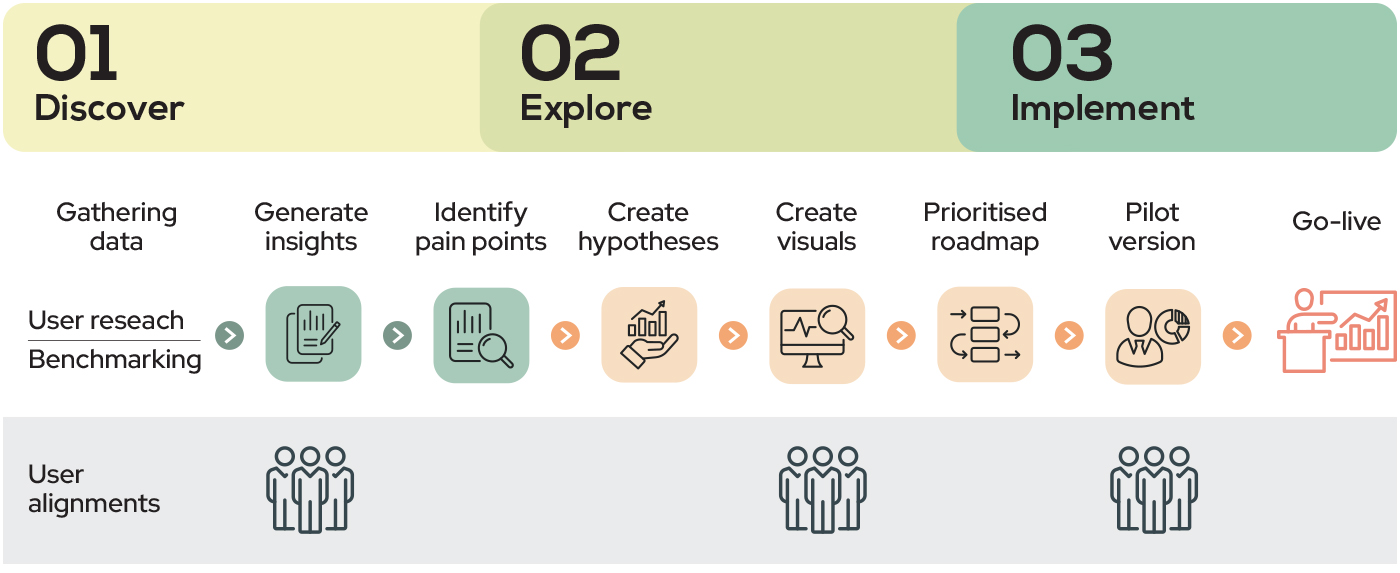

Figure 1 outlines the framework adopted by the ECB which was presented by Klára Bakk Simon in 2022 at the Irving Fisher Committee on Central Bank Statistics-Banco de Portugal Conference on Statistical Communication.

The hope is to see greater trickle-down effect in the use of economic and financial information in society. It also feeds into the financial inclusion goals of many regulators such as Bank Negara Malaysia, whose strategic push to improve economic literacy across the board, caters to a more diverse audience than in the past.

In recent years, the shift towards artificial intelligence (AI) in finance has chased to the surface some questions on its reliability, one of which is data quality.

Here’s how Jim Tebrake, Deputy Director of the Statistics Department at the International Monetary Fund (IMF), simplified one of the main challenges faced by ‘numbers people’ and their experience with generative AI:

“When ChatGPT came out about a year and a half ago, I think I, like many of you, decided, “I’m going to check this thing out”. So, I put a bunch of prompts in there and I saw what it gave back. I was quite impressed; I mean, these were quite insightful responses I was getting.

“Then I thought, “Okay, I’m going to see if ChatGPT can give me data”. So I said, “Can I have the US GDP estimates from 1990 to 2022 in a table format worthy of a table I could give to my boss. I watched the screen and magically this beautiful table appeared before my eyes, well-formatted, something I could just print off, give my boss, go home and say “Hey, job well done”. I was elated.

“But that elation turned to disappointment when I looked at the numbers. I said, “Ah, that’s not quite the US GDP, in fact, I think that’s Canada’s GDP and France’s GDP.” Something was amiss but I couldn’t quite give up on this idea that this tool could be so useful in helping people access data.

“We engaged EPAM, a world-renowned IT provider, to build our platform. So I put the question to them: “Can we use AI to allow users to talk to the IMF data in their language, but you have to guarantee me that every number that they get back is 100% accurate; no hallucination.”

“What they developed is something that we call StatGPT…At the base level, it allows you to talk to your data, it allows you to discover your data, to gather your data, to transform your data, to learn about your data. I think this has a huge potential to open up the access to official statistics across the world.”

Although the IMF has recently quieted down somewhat on this project, it is a testament to how statistics of themselves are no longer enough. It is imperative that statistics owners broaden their footprint and support information users by showing them how to use them, the infinite stories that numbers tell, and why some decisions lead to better outcomes than others.

Julia Chong is a content analyst and writer at Akasaa, a boutique content development and consulting firm.