Amplify Access to Transition Finance

Mixed signals on the global climate financing front. We need to intensify the right perspectives.

By Kannan Agarwal

By Kannan Agarwal

As the term ‘transition finance’ takes centre stage as one of the pillars towards achieving net zero, it is important that there be alignment in our understanding of this term.

One of the main critiques in the past was the absence of a unified definition from standard setters about transition finance – what it is, what it is not, what it should be. Some saw this as another greenwashing endeavour, cobbled together to continue funding to brown industries like fossil fuels. Others lacked clarity on how it could be practically implemented to bridge the financing gap and bring economies in line with the timeline of the 2015 Paris Agreement.

A transition finance plan is a time-bound implementation strategy provided by companies detailing operational, governance, financial, and non-financial shifts in their business that will meet sustainability goals, especially low-emission targets.

As critical as it is, the world is still some way from a common approach on corporate transition plans and how financial institutions should be assessing them for funding. Here is a quick recap to illustrate the global divergence based on major economic blocs:

The Trump administration has swiftly moved to take two steps back in the US’ climate pledges, sparking concerns of ‘greenhushing’ – the deliberate downplaying or hiding of a company’s environmental efforts and initiatives for fear of backlash – amongst businesses, state governments, and financial institutions.

In the weeks before President Trump’s inauguration, six of the largest US banks – led by Goldman Sachs and followed by Citigroup, Bank of America, Wells Fargo, JP Morgan, and Morgan Stanley – pulled out of the United Nations-convened Net-Zero Banking Alliance (NZBA), a global member-led initiative supporting banks to lead on climate mitigation. The NZBA was launched in the leadup to the 2021 United Nations Climate Change Conference, or COP26, and was envisioned to be a platform for banks who were “aligning their lending, investment, and capital markets activities with net-zero greenhouse gas emissions by 2050.”

The departure is not a surprise. As at March 2025, the US has pulled out of several critical global agreements, including the Paris Agreement and alliances such as the Just Energy Transition Partnership which provides USD3 billion in green financing to developing economies.

Since 2023, the European Commission has mandated that in-scope companies adopt transition plans for climate change mitigation. This comes under two directives – the Corporate Sustainability Due Diligence Directive and the Corporate Sustainability Reporting Directive – whereby corporates that are in scope must show evidence of how they plan to turn high-level climate and environmental targets into actionable, robust, and consistent plans that are assessable by financial institutions.

In January 2025, the EU Platform on Sustainable Finance, an independent advisory body comprising the world’s leading sustainability experts to advise the European Committee, issued its report titled Building Trust in Transition: Core Elements for Assessing Corporate Transition Plans, the most comprehensive technical guide to date on effective transition financing for European companies and how financial institutions should be assessing these corporate transition plans.

Although its recommendations are non-binding, the report holds sway as it works within the existing EU legal framework which enables companies to credibly operationalise their transition plans and facilitate financial institutions’ assessment of the same.

Transition finance is in top gear since Malaysia assumed the ASEAN chairmanship in January 2025 and announced two priorities: (i) financing for energy transition projects in ASEAN; and (ii) supporting small- and medium-enterprises in their low-carbon transitions. The 3rd National Climate Governance Summit from 7 to 11 April 2025 held at Sasana Kijang in Kuala Lumpur reaffirmed its commitment.

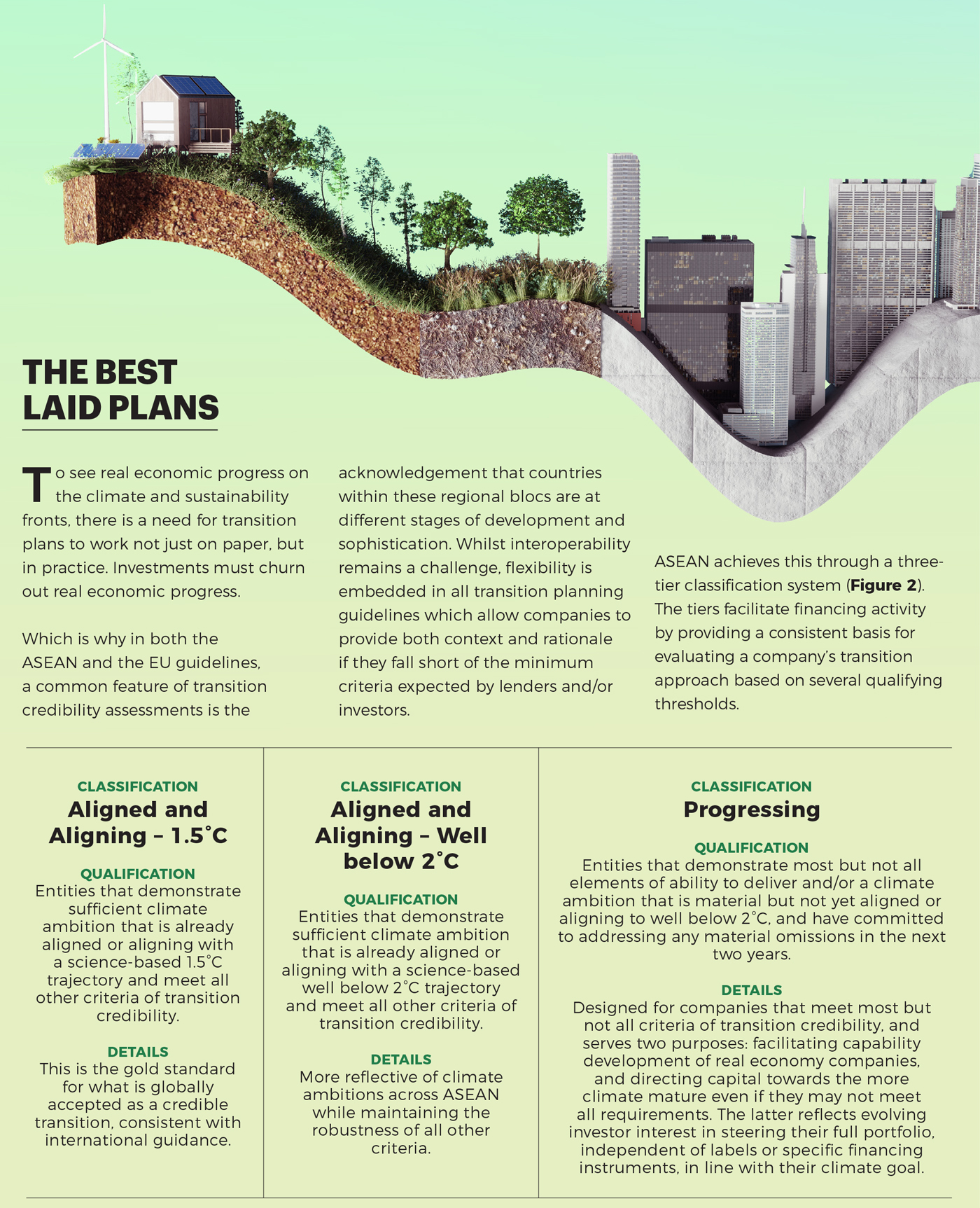

Development is governed by the ASEAN Transition Finance Guidance (ATFG), the first version of which was issued by the ASEAN Capital Markets Forum in October 2023, providing businesses with a framework to assess and demonstrate a credible transition to facilitate access to capital market financing. Version 2 of the ATFG was published on 24 October 2024 after consultation with key stakeholders, leading to:

Bank Negara Malaysia is leading the charge by facilitating funding mechanisms and solutions towards an ASEAN Power Grid project, initially announced in 2018, to construct an integrated regional power grid system, which would enhance electricity trade across borders, including renewable energy.

The central bank will also expand its Greening Value Chain programme to the region and provide small- and medium-enterprises with tools and financing to measure and report their greenhouse gas emissions.

Additionally, Capital Markets Malaysia, established by the Securities Commission Malaysia together with the Malaysian government, has released a Transition Strategy Toolkit for Corporations in ASEAN in collaboration with the Climate Bonds Initiative. The toolkit outlines five transition principles and assists organisations in developing a credible and science-based green-transition plan.

Lenders must have sufficient comfort with and an understanding about how borrowers intend to operationalise, which encompasses risk management, leveraging opportunities, achieving climate and sustainability targets, and staying competitive.

For financial institutions in ASEAN, it is important that they be well-versed in assessing transition plans at the entity level for each borrower. The basis for financing – whether to support climate targets, biodiversity goals, or other sustainability targets – should adhere to what is set as benchmark practice through guidelines such as the ATFG and ASEAN Taxonomy.

Additionally, financial institutions should be mindful that discretion is required when assessing transition plans, often on a country-to-country basis, given that ASEAN member states are at vastly different stages on the climate maturity curve with large differences in data availability.

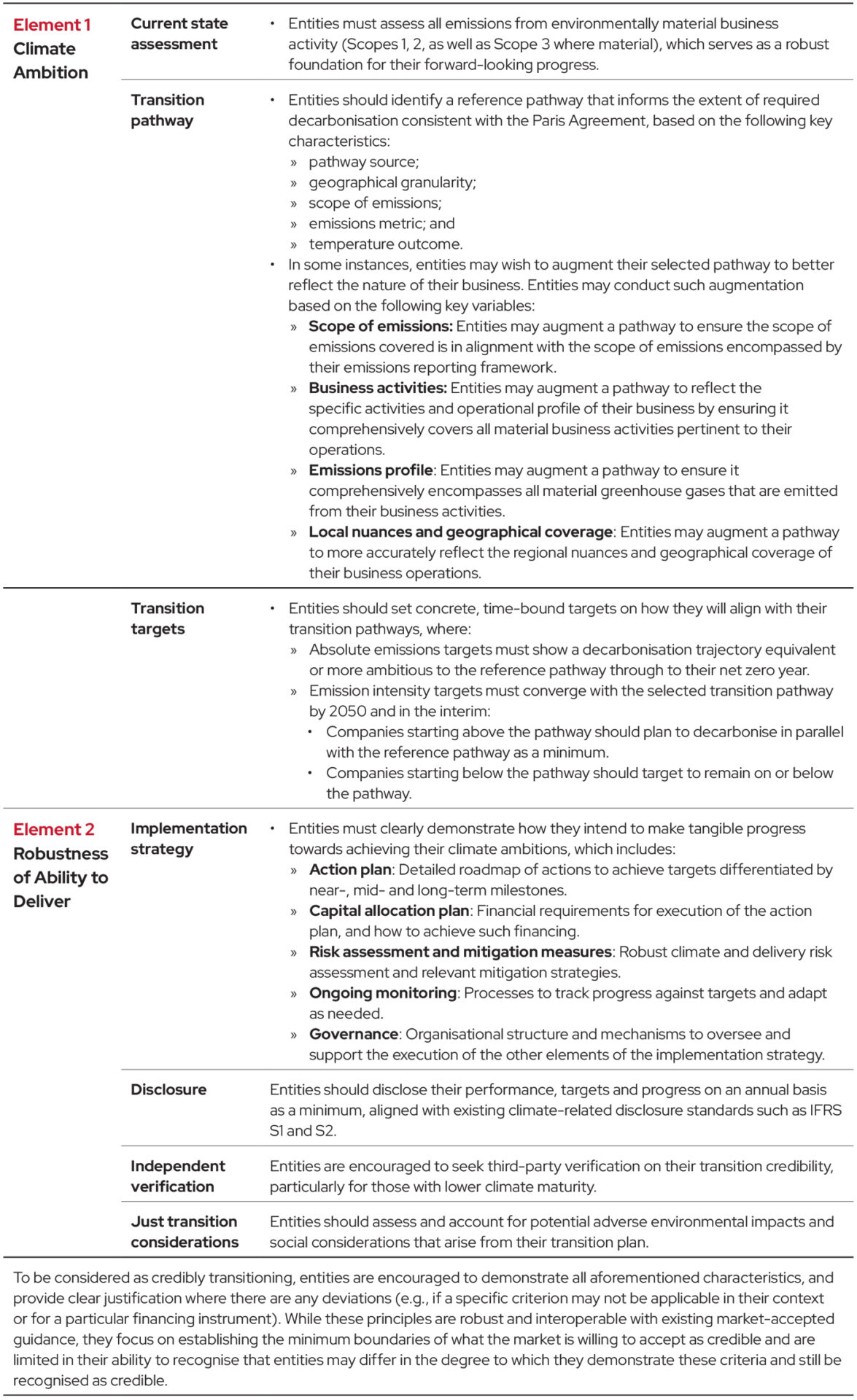

With this in mind, based on international guidance and ASEAN stakeholder input after Version 1 was issued, the latest ATFG outlines a series of principles as the cornerstone for assessing transition credibility, the core elements of which are summarised in Figure 1.

To hold “the increase in the global average temperature to well below 2°C above pre-industrial levels” is a simple yet ambitious goal. For this to occur, it is critical that access to finance is made available to entities that are committed to making this happen and withheld from those who are more inclined to greenwash.

Banks that are not for the sustainability agenda will drop out of the race eventually, until such a time when the field is more tightly regulated and opting out is no longer an option. Meanwhile, it is important that we augment the ideas, brands, and voices that elevate public discourse and offer bold, credible solutions to one of the biggest challenges we face today – the survival of our planet.

Kannan Agarwal writes for Akasaa, a strategic consulting and publishing house with offices in the UK, UAE, and Malaysia.