Islamic Finance Leadership: Lessons from the Past and Strategies for the Future

An interview with Tan Sri Abdul Wahid Omar on structuring viable and sustainable projects.

An interview with Tan Sri Abdul Wahid Omar on structuring viable and sustainable projects.

By IslamicMarkets.com

By IslamicMarkets.com

As Tan Sri Abdul Wahid Omar had successfully directed Maybank through the 2008 global financial crisis, Daud Vicary, Chairman of the Advisory Board of IslamicMarkets.com, invited him to share his experiences and whether the lessons learned could be applied to navigate through the current global pandemic. Omar admitted that whilst the previous global financial crisis was challenging, it was manageable due to immediate action taken by the Malaysian authorities.

First, the Malaysian banking system was insulated from the knock-on impacts of events that were taking place in financial systems across the United States of America and Europe by way of rigorous risk management strategies put in place. Second, through the learnings from the 1998 Asian financial crisis, Bank Negara Malaysia (BNM) had ensured that the Malaysian banking sector was well capitalised with better asset quality, such that sufficient capital buffers were maintained to absorb any sudden shocks. Third, the government of Malaysia did not solely focus on keeping the financial and banking sector afloat, but also concentrated heavily on the economy by ensuring that all businesses were able to survive the crisis, such that manufacturing capacities were maintained, and jobs were protected.

First, the Malaysian banking system was insulated from the knock-on impacts of events that were taking place in financial systems across the United States of America and Europe by way of rigorous risk management strategies put in place. Second, through the learnings from the 1998 Asian financial crisis, Bank Negara Malaysia (BNM) had ensured that the Malaysian banking sector was well capitalised with better asset quality, such that sufficient capital buffers were maintained to absorb any sudden shocks. Third, the government of Malaysia did not solely focus on keeping the financial and banking sector afloat, but also concentrated heavily on the economy by ensuring that all businesses were able to survive the crisis, such that manufacturing capacities were maintained, and jobs were protected.

In contrast, the current global pandemic is unprecedented and very different to previous crises, in that there is an impact on the global economy, with not just corporations, but also economies, societies and families being negatively affected. Omar added that with lockdowns being imposed in many countries, the global gross domestic product (GDP) is expected to contract 6.1% year-on-year (y-o-y), with most economies looking at an average 5.0% y-o-y decline in their respective GDP levels for 2020. Given this, the challenges posed by Covid-19 are far greater and require an all-encompassing remedy.

Commenting on the relief measures in place, Omar stated that the primary focus is to protect lives and improve the availability of human and financial capital resources. Second, Omar added that governments needed to provide adequate support to keep businesses afloat, to ensure that employment levels are maintained, and income support is provided to those affected. The banking sector needs to embrace the true spirit of Islamic finance and work closely with customers to provide solutions that allow flexible restructuring of facilities, without compromising on banks’ liquidity and risk management initiatives. According to Omar, it is crucial for the banking sector to ensure that sufficient capital is maintained to deal with future shocks, given the uncertainty surrounding the duration and extent of the ongoing pandemic.

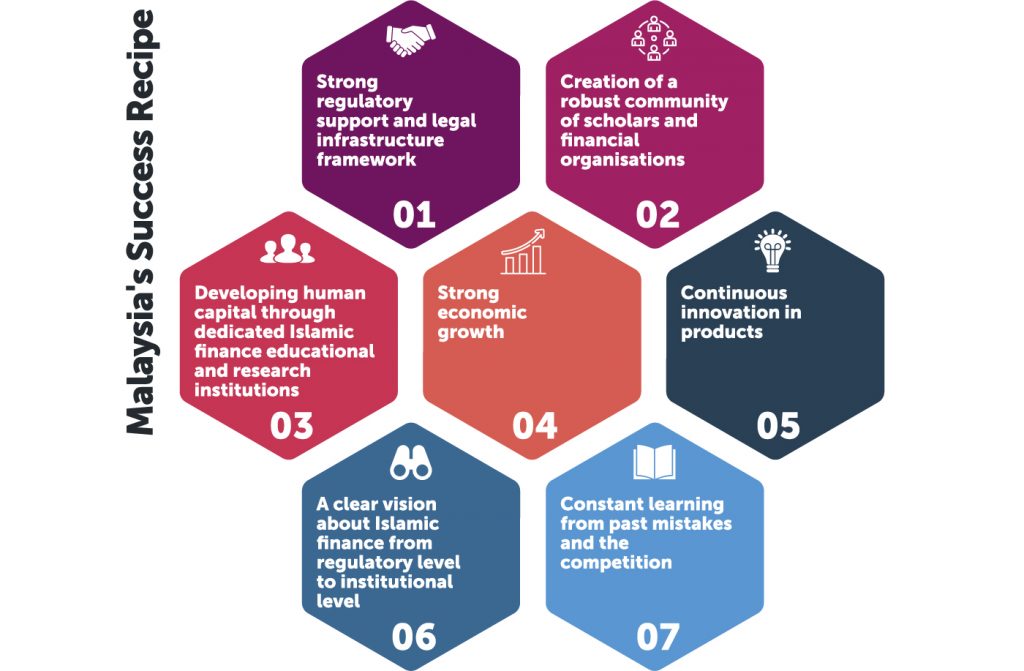

Vicary then asked Omar to discuss how Islamic finance industry has developed over the years, from having a sole focus on Shariah compliance, to one that now encompasses environmental, social and governance (ESG) practices, with a strong focus on sustainability. Omar noted that the development of Islamic finance is a ‘journey’ that has taken a pragmatic approach through the years. Back in 1983, Bank Islam was established as a stand-alone Islamic bank in Malaysia. In 1998, conventional financial institutions were permitted to other Islamic banking products using a window concept and an interest-free banking scheme, termed as the Islamic banking scheme. The year 2005 saw window operations being moved under wholly owned subsidiaries, with Islamic banking operations needing to establish their own network of branches, separate from their conventional parents’ branch networks. Later, the ‘leverage model’ was seen as more efficient, whereby conventional banks started offering Islamic banking products through Islamic banking windows.

Omar explained that all these gradual changes were supported by developments in the Islamic finance industry ecosystem, which included the establishment of the Islamic interbank money market, the International Centre for Education in Islamic Finance (INCEIF), which provides a talent pool for the Islamic finance sector, as well as research institutions such as the International Shariah Research Academy (ISRA). Simultaneously, Omar explained that the continuous revision and upgrade of laws also provided immense industry support and led to the enactment of a comprehensive Islamic Financial Services Act 2013 by BNM.

Omar opined that this approach of ‘proper planning and progressive learning’ enabled the concept of mere Shariah compliance to phase into ESG and sustainability. According to Omar, this was validated through BNM’s introduction of Value-Based Intermediation (VBI) principles in 2017, with VBI now focused on developing Islamic finance products that contribute significantly more towards the well-being of people and the environment, without a sole focus on profits.

Responding to an audience query, Omar noted that Bursa Malaysia implemented VBI initiatives through the use of two platforms, one to facilitate commodities trading for Islamic finance contracts, and the other, an end-to-end Shariah-compliant equities trading platform which has enabled the listed Shariah-compliant stocks to embrace and adopt the VBI approach. Omar noted that 75% of the listed equities were already Shariah-compliant.

Riba-free Future: Omar explained that although Malaysia’s capital markets has made notable progress over the past 37 years (asset size of RM3.1 trillion in 2019), similar to the global Islamic capital markets (asset size of USD2.5 trillion in 2018), Islamic assets are still largely based on a financial system that computed percentage returns per annum, mirroring the conventional system. Therefore, Omar opined that it is time for Islamic financial markets to develop their own identity through a completely new financial platform, which is truly riba-free.

Although still in its early days of conceptualisation, Omar spoke of a platform based on digital gold (like the gold dinar, for example), backed by deposits made in an authorised physical gold depository, and then using this platform to facilitate zero-profit borrowing and lending. Omar added that the introduction of the Central Depository System 20 years ago, coupled with developments in technology such as blockchain or distributed ledger technology facilitated the creation of a better and improved Islamic capital markets platform.

Responding to an audience question on the feasibility of the gold dinar as an asset class, Omar noted that given the current lack of standards and structure pertaining to gold investing, creating a digitised platform for people to invest and trade in gold could potentially see that asset class growing. With regard to a policy framework on securitised token offerings in relation to gold trading, Omar added that policy discussions are currently ongoing and expected to be clarified soon, following which the concept of securitised tokens could be looked further into.

Concluding the discussion, in response to another audience query, Omar explained that whilst Malaysia is clearly the leader in Islamic finance’s market development, it is imperative for other hubs to develop across key markets like Dubai, Bahrain, London, and Hong Kong, for example. According to Omar, more Islamic finance centres are required for the global Islamic finance market to be better connected and to create a vibrant ecosystem at an international level.

IslamicMarkets.com is a leading financial intelligence, learning and collaboration platform for the global Islamic economy. With the IslamicMarkets platform, professionals and institutions can access industry-led learning and a wide range of actionable content and tools from sukuk markets to daily market news and the largest network of professionals from across the global Islamic economy.