Influencing Financial Behaviour

Tipping the scales for values-based banking takes more than just a plan.

By Julia Chong

Even in the seemingly rational world of finance, you can’t win hearts and minds with facts alone. Events like stock market swings, bubbles, crashes, unethical deal-making are proof positive that mankind is driven as much by emotion as it is by rationality.

It’s obvious then why tipping the scales in favour of values-based banking is no walk in the park. After all, inciting change to habitual patterns of behaviour is part incentive, part emotion, and although banking is quite adept at economic incentives, historically it comes up short in the ‘inspiring change’ department.

In order to align the financial system with sustainable development goals, the United Nations Environment Programme established the Inquiry into the Design of a Sustainable Financial System, a leading international platform, whose members include DBS Bank and People’s Bank of China, to shift the trillions required for delivering an inclusive, green economy through the transformation of the global financial system.

The Financial System We Need, the Inquiry’s landmark report released in 2015, writes about the ‘quiet revolution’ already taking place, much of which we see today with the renewed push for sustainability in banking through green bonds, value-based banking, fiduciary responsibilities, human rights, and electronic trading.

One of its leading voices is the Global Alliance for Banking on Values (GABV), whose established 6 Principles define the values which financial institutions – whether public limited companies, mutual, or private – should embrace.

Founded in 2009, GABV explains that for the majority of banking institutions, the primary or exclusive driver of business decisions is based on the profitability of the services provided, even if the by-products of those decisions do not deliver sustainable economic, environmental or social development. As a member of the Alliance, each bank would live by the following six principles:

+ Principle 1. Triple bottom line approach at the heart of the business model.

Generating reasonable profit is recognised as an essential requirement of values-based banking but is not a stand-alone objective. Values-based banks don’t just avoid doing harm, they actively use finance to do good.

+ Principle 2. Grounded in communities, serving the real economy, and enabling new business models to meet the needs of both. Values-based banks serve the communities in which they work by financing enterprises and individuals in productive and sustainable economies.

+ Principle 3. Long-term relationships with clients and a direct understanding of their economic activities and the risks involved. Risk analysis is used at product origination so that indirect risk management tools are neither adopted as a substitute for fundamental analysis nor traded for their own sake.

+ Principle 4. Long-term, self-sustaining, and resilient to outside disruptions. At the same time, values-based banks recognise that no bank, or its clients, is entirely immune to such disruptions.

+ Principle 5. Transparent and inclusive governance and reporting. Inclusiveness means an active relationship with a bank’s extended stakeholder community beyond its shareholders or management.

+ Principle 6. All of these principles embedded in the culture of the bank. These banks develop human resources policies that reflect their values-based approach (including innovative incentive and evaluation systems for staff) and develop stakeholder-oriented practices to encourage values-based business models. These banks also have specific reporting frameworks to demonstrate their financial and non-financial impact.

Adopting these values calls for a concerted behaviour change campaign (BCC), that’s adopted by multilateral agencies such as the World Health Organisation and non-profit oriented, but rarely explored outside these circles.

A BCC consists of carefully designed strategies to shift social norms and behavioural traits in target demographics toward desired outcomes without direct intervention. An effective BCC will move the target audience from awareness to action.

In the context of values-based banking, BCCs can be deployed to shift consumption patterns towards sustainable behaviour.

If banking is truly looking to take sustainability to heart, it’s necessary they invest in BCCs in addition to incentivised economic campaigns such as cashbacks and rewards.

The most successful BCCs simultaneously tackle three fronts – social influence, social norms, and vivid examples – which we explore below.

> Social Influence

In his 2000 bestseller Irrational Exuberance, Nobel Prize-winning economist Robert J Shiller expounds: “A fundamental observation about human society is that people who communicate regularly with one another think similarly. There is at any place and in any time a Zeitgeist, a spirit of the times [in which]….word-of-mouth transmission of ideas appears to be an important contributor to day-to-day or hour-to-hour stock market fluctuations…”

Shiller’s fundamental observation has been reinforced in many financial settings, including the impact of social influence on consumer savings. The Effects of Social Influence and Financial Literacy on Savings Behavior, a 2015 research paper by Amer Azlan Abdul Jamal and co-authors at Universiti Malaysia Sabah, indicate that social influence – family involvement, financial literacy, and peer influence, in this descending order of importance – play a major role in nurturing students’ savings behaviour in Kota Kinabalu, Sabah.

This is the process of financial socialisation, i.e. acquiring knowledge about money management and developing financial skill sets to influence behavioural intentions. What’s crucial here is that a BCC directed at social influence can speed up efforts to shift consumer preferences and choices in favour of green banking products.

> Social Norms

In 2009, to reduce the purchase of plastic bottled water on campus, Princeton University kicked-off its ‘Drink Local’ programme. Groups of incoming students were given Princeton-branded reusable bottles and briefed about getting involved in sustainability initiatives. Paired with a campus-wide effort to replace over 200 sinks and water fountains with filtered water stations, results showed that students who received the reusable bottles reported reduced bottled water consumption and were more likely to support a campus-wide ban on disposable bottled water on campus.

What clue does this hold for us? Princeton’s signalling of pro-environment norms worked by communicating the default value system to students in order to achieve the desired behaviour. Banks can adopt such innovative institutional signalling to gently compel staff and clients and reorient capital/support in favour of values-based banking. This reframes the push for sustainability – making it less mandatory action (e.g. ban on brown sector lending or compliance to green rules) and more voluntary adoption – to reduce resistance and secure greater buy-in. Possibilities are also greater that those on board today will support future green initiatives.

> Vivid Examples

There are many techniques to illustrate desired norms. Gamification – the application of game-design elements and principles in non-game contexts – is the latest. It is a behavioural tool that is increasingly used in business to engage customers and enhance return on investment. Whether a mobile app, website, or in-house customer experience, ‘gamifying’ as a process has been deployed in finance and investor education to great success.

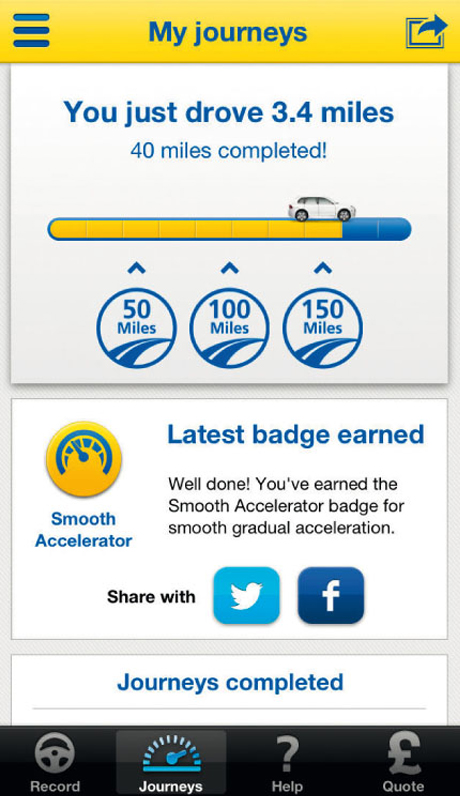

Numerous studies indicate a positive correlation between motivation and gamification features embedded in digital platforms. Take insurer Aviva Italy’s mobile app. For every 300 kilometres driven, it provides a rating of one to 10 as feedback on the users driving skills – cornering, fuel efficiency, acceleration and braking – subtly nudging users toward more environmentally conscious driving patterns. The tech also rewards users in the form of badges which can be shared on social media and, if you wish, used to renew your insurance in-app.

The nifty way of changing consumer behaviour ties in nicely to subtly rebrand the insurer as a sustainability-first advocate and retain customers for the long term.

Armed with this knowledge, banks should consider embarking on their own BCCs in favour of values-based banking, if they haven’t already.

Although a seemingly small step in the climate-change agenda, the tipping point comes with the power of numbers, when a sufficiently large pool of users collectively change their behaviour.

Julia Chong is a Singapore-based writer with Akasaa. She specialises in compliance and risk management issues in finance.