Trust In Our Newly Minted Chartered Bankers

Our 4th Chartered Banker Conferment was held on the morning of 2 October 2021 with 276 individuals conferred the Chartered Banker status, a prestigious designation jointly awarded with the Chartered Banker Institute (CBI), UK. The ceremony, broadcast from Bangunan AICB and joined virtually by close to 300 individuals, recognised the diligence and determination of conferees in attaining the gold standard in banking.

The ceremony commenced with a welcome address by the AICB Chairman Tan Sri Azman Hashim, FCB, with the Council in attendance. In his speech, Tan Sri Azman echoed the sentiments that underpin the expectations of all Chartered Bankers:

“When ethics becomes a shared responsibility, we will see real change that may even become our strongest defence against a future financial crisis. And with good ethics and trust at the centre of any relationship, the possibilities for the future are boundless. This is where AICB’s role as a professional body for bankers helps to promote good core values and develop this mindset and capacity in the banking workforce as we nurture our banking talent into leaders who will shape and contribute significantly to the industry.”

Since its inception, the AICB has inducted 511 Chartered Bankers – a 49.6% increase compared to 2019 – with more than 900 bankers at various stages of progression and a growing base of over 32,500 members.

He also shared the historic partnership between the Asian Banking School and the renowned Bangor Business School, listed by Financial Times as one of the world’s most influential business schools, in offering the Chartered Banker MBA — the only degree in the world with dual qualification that allows candidates to gain both a top MBA and the Chartered Banker status.

Simon Thompson, Chief Executive Officer of CBI, UK, delivered his address virtually and the proceedings continued with conferees sharing highlights of their professional journey towards attaining the Chartered Banker status. This was followed by the presentation of Excellence Awards to the winners of 2019 and 2020. The Chartered Banker conferees then took the oath of commitment to the Code of Professional Conduct.

New Chief Executive

On 20 September 2021, we welcomed Edward Ling Hsiao Wee as the Asian Institute of Chartered Bankers’ Chief Executive. He takes over from Prasad Padmanaban, who served the Institute for close to five years.

A veteran in the financial sector, Edward has held various leadership positions in his 11 years of service at ACCA, including his most recent role as Regional Portfolio Head — Maritime Southeast Asia following four years as Country Head of ACCA Malaysia.

Edward holds an MBA in Operations Management Science and a BBA in Finance. He is passionate about aviation and photography and an avid fan of the Civilization strategy game series.

Show, Not Tell, On Operational Resilience

Defined by the Basel Committee for Banking Supervision as “the ability of a bank to deliver critical operations through disruption”, financial institutions must design processes that are sound, balanced, and practicable in order to weather the next crisis.

UK-based Risk.net recently reported that a senior bank examiner for the US Federal Reserve (Fed) warned banks of the “disconnect” between theory and practice when it comes to drawing up a playbook for coping with a repeat similar to the coronavirus pandemic.

It reported that financial institutions were urged to show, not tell, on operational resilience, ensuring that first-liners understand and can implement measures at the drop of a hat. The Fed examiner said: “I’ll be disappointed if I go into a firm, and resiliency people show me graphs and PowerPoints, and then I go to senior management or people on the frontline and they can’t explain it.”

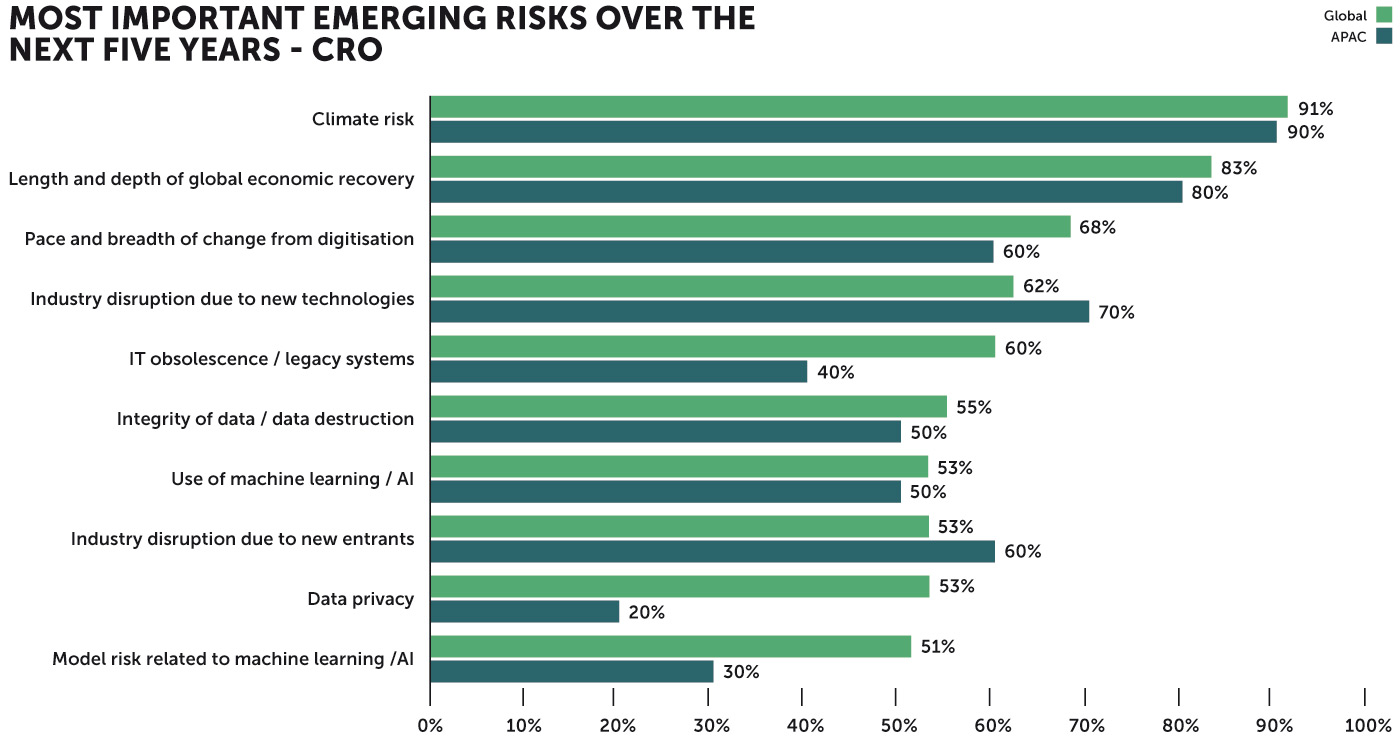

According to this year’s Annual EY/IIF Global Bank Risk Management Survey, banks’ chief risk officers (CROs) in Asia-Pacific – already early movers in operational or enterprise resilience pre-Covid-19 – say that the pandemic has opened their eyes to the broader dimensions of resilience:

- 70% of CROs state that operational resilience has become a higher priority since the pandemic.

- Three in five believe operational resilience skills will be one of the most important skill sets required in their risk functions over the next three years.

- 93% of Asia-Pacific banks expect regulators to impose additional or new operational resilience requirements over the next few years. Expected areas of change include capital and liquidity, and stress testing scenario selection and key assumptions.

- Only a third of Asia-Pacific CROs put digital transformation at the top of their risk issues. However, extended to a five-year view, around 60% of CROs nominate the pace and breadth of change from digitisation as a top emerging risk – perhaps indicating that many Asia-Pacific banks still have a way to go on their digital transformation journey.

- As well as being concerned about the data security implications of remote work, CROs worry that productivity, culture and engagement have been permanently degraded by the virtual work environment. In their efforts to monitor culture, banks are also considering more employee surveys and focus groups. Q

Source: EY