What’s The Right ESG Framework For You?

Deciding on the best sustainability reporting standard for your organisation.

Deciding on the best sustainability reporting standard for your organisation.

By Julia Chong

As environmental, social, and governance (ESG) standards take centre stage, there is healthy competition when it comes to sustainability reporting initiatives. Corporations that are eager to redefine their value by incorporating ESG metrics have a range of competing systems to choose from.

Navigating the landscape of sustainability reporting can seem daunting and is not for the fainthearted. At last count, in April this year, the Grantham Research Institute on Climate Change and the Environment listed 3,144 policies and laws related to climate change alone, excluding other sustainability-related regulations.

The Task Force on Climate-related Financial Disclosures’ (TCFD) notes encouraging progress in its 2022 Status Report as all regions significantly increased their levels of disclosure over the previous three years. The average level across the 11 recommended disclosures was 60% for European companies (+23 percentage points since fiscal year 2019); 36% for Asia Pacific (+11 percentage points); and 29% for North America (+12 percentage points).

Although on the uptrend, there is still a long way to go for organisations to achieve their respective sustainability commitments.

In line with the global transition to a low-carbon economy, on 26 September 2022, Bursa Malaysia announced enhanced sustainability reporting requirements for Main Market- and ACE Market-listed issuers, in accordance with international best practices. Julian Hashim, Chief Regulatory Officer of Bursa Malaysia, stated: “Come 2025, all Main Market-listed issuers will be reporting TCFD-aligned disclosures where they will be internalising climate change considerations in their business strategies as well as in responding to the needs of their key stakeholders.

“Separately, Bursa Malaysia’s overall enhanced Sustainability Reporting Framework puts listed issuers in a good position to adopt international reporting frameworks and standards, such as those issued by the Global Reporting Initiative and the International Sustainability Standards Boards. Overall, these enhancements put our requirements on par with benchmarked international markets.”

The timeline requires disclosure of common sustainability matters on or after the financial year ending (FYE) 31 December 2023 and culminates with TCFD-aligned disclosures for FYE 31 December 2025.

The following is a short guide to help you understand the most widely adopted sustainability reporting standards and to decide which one would be the best option for your organisation.

Green Reporting Initiative (GRI)

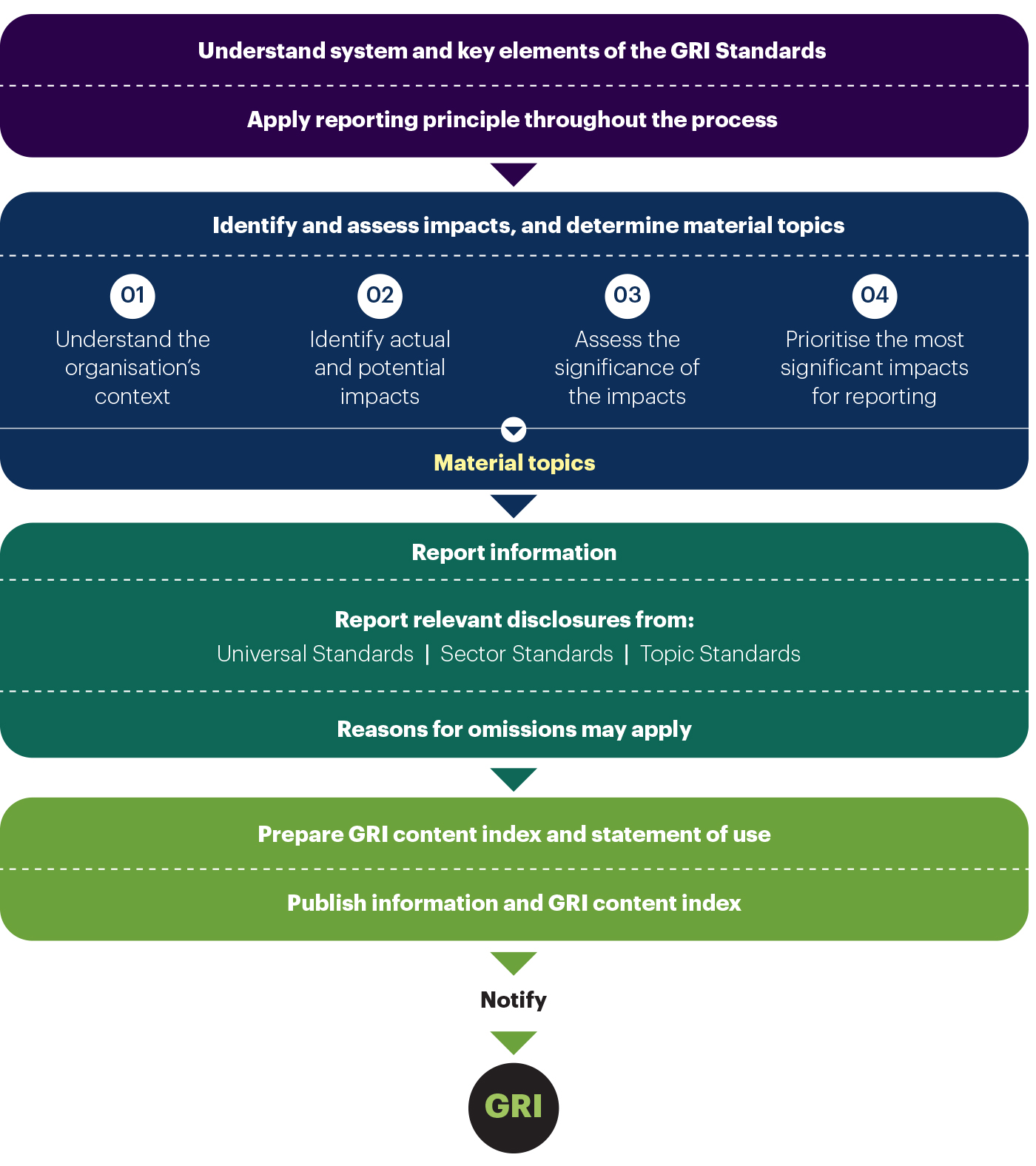

The first and most commonly used standard, the GRI was developed in 1997 by a non-governmental organisation. The standard is broader than many other frameworks and is often adopted by large multinational companies for their ESG report and utilised by third parties in deriving sustainability indices and ESG awards. The methodology includes an independent, multi-stakeholder process which advocates transparency in assessing all aspects of E, S, and G in a corporation.

The GRI consists of three series of standards:

Due to its comprehensive assessment across major industries, most companies adopt the GRI and report according to its standards on all material topics and related impacts. However, the standard can also be used by smaller organisations that cannot fulfil some requirements but still wish to adopt a benchmark to begin their sustainability assessment journeys. In such cases, a company can use selected topics and report with reference to the GRI Standards.

Sustainability Accounting Standards Board (SASB)

Devised by the Value Reporting Foundation, it has since consolidated with the International Financial Reporting Standards (IFRS) Foundation in order to simplify the global baseline of sustainability disclosure for investors. The SASB Standards were first made public in 2018 through a set of 77 Industry Standards, identifying financially material sustainability topics and the relevant metrics for a company in a specific industry. Their focus is on the financial performance of a company and the potential impact arising from critical ESG issues. The SASB Standards are far-reaching in assessing sustainability dimensions such as diversity, general issue categories like whistleblower policies, disclosure topics such as reporting and risk profile, and linking these to accounting metrics. The Industry Standards must be read and applied together with the SASB Standards Application Guidance.

The SASB Standards are also a feed-in component to the International Sustainability Standards Board’s (ISSB) upcoming standards in June 2023, namely IFRS S1 and S2 (outlined below), which cover sustainability related risks and opportunities and tie-in with the SASB Standards. These comprise of:

TCFD

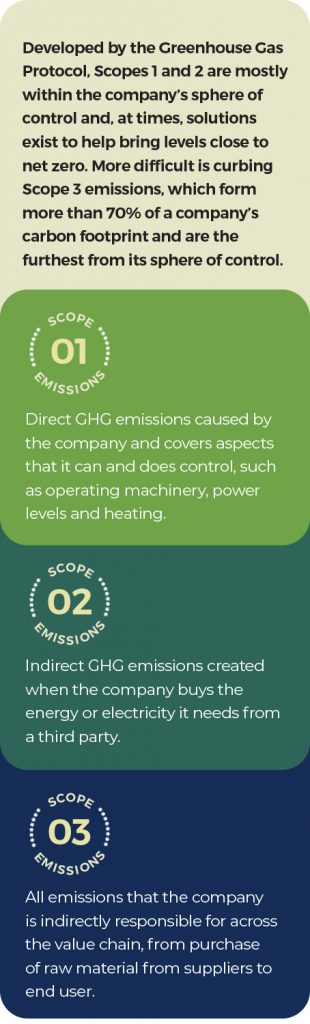

Set up in 2015 by the Basel-based Financial Stability Board, the TCFD issued a set of recommendations in June 2017 for organisations in order to develop more effective climate-related financial disclosures. These are intended to assist financial markets in making more accurate assessments and pricing of climate-related risks and opportunities. Although adoption is voluntary, many jurisdictions are increasingly making its 11 disclosure recommendations mandatory as part of the regulatory framework for climate risk disclosures from 2023 onwards.

The TCFD recommendations zooms in on four pillars of a company:

> Governance: Disclose the company’s governance around climate-related risks and opportunities.

> Strategy: Disclose the actual and potential impacts of climate-related risks and opportunities on the company’s businesses, strategy, and financial planning where such information is material.

> Risk management: Disclose how the company identifies, assesses, and manages climate-related risks.

> Metrics and targets: Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

A recent initiative that builds on the TCFD model is the United Nations-backed Taskforce on Nature-related Financial Disclosures (TNFD) that was launched in June 2021. The TNFD provides a framework for corporate disclosures on risks from biodiversity loss and ecosystem degradation and is aligned to the TCFD as it is organised across the same four pillars of governance, strategy, risk management, and metrics and targets. The TNFD framework is scheduled to be published and ready for market adoption by September 2023.

Carbon Disclosure Project (CDP)

Started in 2000, its core platform is the CDP Online Response System (ORS) which is used by organisations and cities to report sustainability information. A city or company’s sustainability information is requested by stakeholders but submission is voluntary. Data submitted on the ORS platform is benchmarked on four key areas: climate change, forests, water security, supply chain.

Based on the organisation’s submission, a CDP score from (D- to A) is assigned, giving stakeholders a snapshot of its environmental disclosure standards and performance. The report card incentivises companies to take action. It is important to note that an ‘A’ grade merely means that the company is among the most transparent of its peers when it comes to climate disclosure. CDP’s scoring methodology is aligned with the TCFD and other major environmental standards, allowing for comparability across the market, however it is not as comprehensive as other methods in measuring the level of sustainability of a city or organisation.

Different Strokes for Different Folks

With so many different frameworks and metrics to consider, the task of deciding which framework or metric to use when reporting corporate sustainability performance can seem daunting.

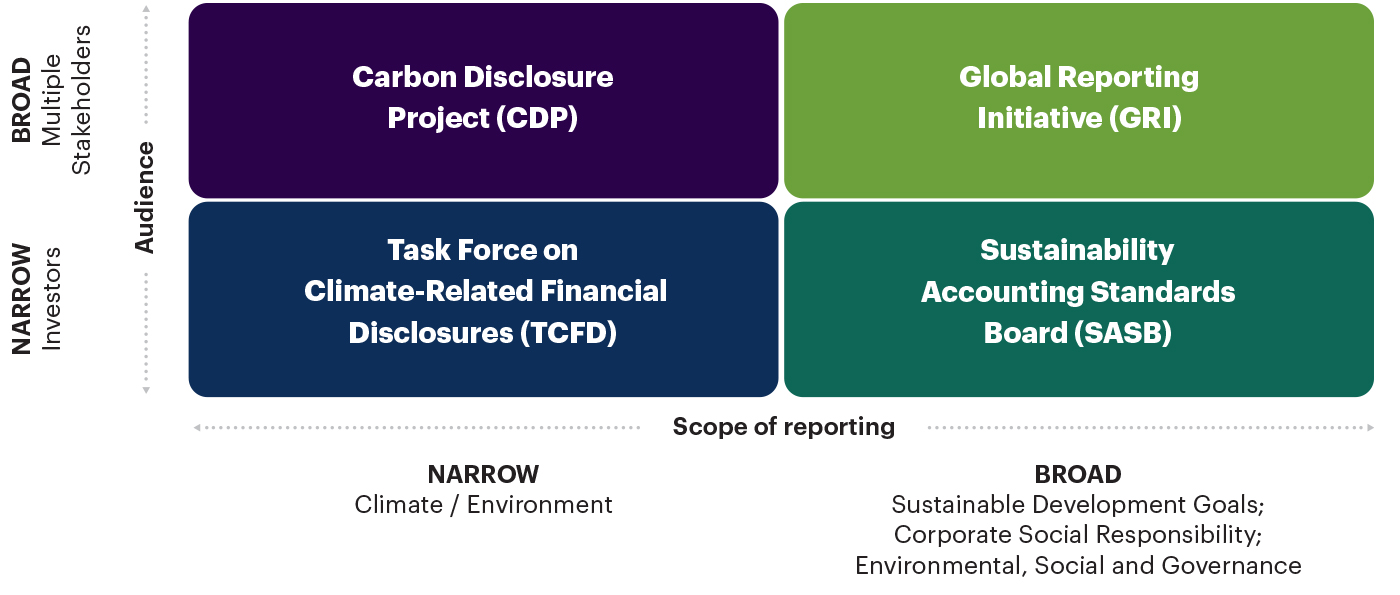

In Harvard Business Review’s January 2022 article, Designing Your Company’s Sustainability Report, authors Tim Rogmans and Karim El-Jisr elaborate on a matrix (Figure 2) developed by Dubai’s Sustainable City which “sorted through these differences by placing topic on one axis and audience on the other…then analysed all the major global sustainability reporting standards and placed each one in the relevant quadrant on the matrix.”

“Using this matrix, executives can see that if they want to report on the specific risks that climate change present to its financial results, they can choose to use…TCFD (a broad framework). Companies looking to report on a wide range of issues can use SASB.

“On the top half of the chart, the CDP focuses on the impact of a company on the greenhouse gas emissions. CDP allows companies to report their impact on climate, water and forests, with reporting on climate typically based on the Greenhouse Gas Protocol. Finally, companies looking to report on a broad set of environmental and social topics can use GRI, the world’s most widely used sustainability reporting standard.

“Managers who use this matrix need to decide whether to focus reporting only on environmental aspects or to include a broader set of non-financial topics in the report. A second consideration is whether companies are reporting their impact on the environment or the impact of the environment (in particular, climate change) on the company. The former question is of interest to a broad set of stakeholders, whereas the latter is of relevance primarily to the company’s management and investors. Although both are based on a solid understanding of climate change and its causes, they are essentially separate questions and use different reporting standards. The sustainability reporting standards matrix provides guidance on which standards are appropriate in each of the four scenarios that arise.”

It’s important to emphasise that no standard is superior to another. Instead, companies should assess their needs and ensure that whichever sustainability reporting standard it adopts, it must be fit-for-purpose and lead to regulatory compliance.

Julia Chong is a content analyst and writer at Akasaa, a boutique content development and consulting firm.