What Resolution Planning Means and Why It Matters

Trust as the cornerstone in finance.

By Perbadanan Insurans Deposit Malaysia (PIDM)

In the intricate world of finance, trust stands as the cornerstone upon which the entire system rests. However, this trust can be remarkably fragile at times. Even a misstep is capable of eroding the confidence of depositors and investors, potentially impacting not only a single financial institution, but may send rippling effects to the rest of the financial system. One notable example that underscores the fragility of trust is the case of Silicon Valley Bank (SVB) in the US where depositors’ widespread panic and loss of trust resulted in the bank’s rapid collapse and impacted other regional banks.

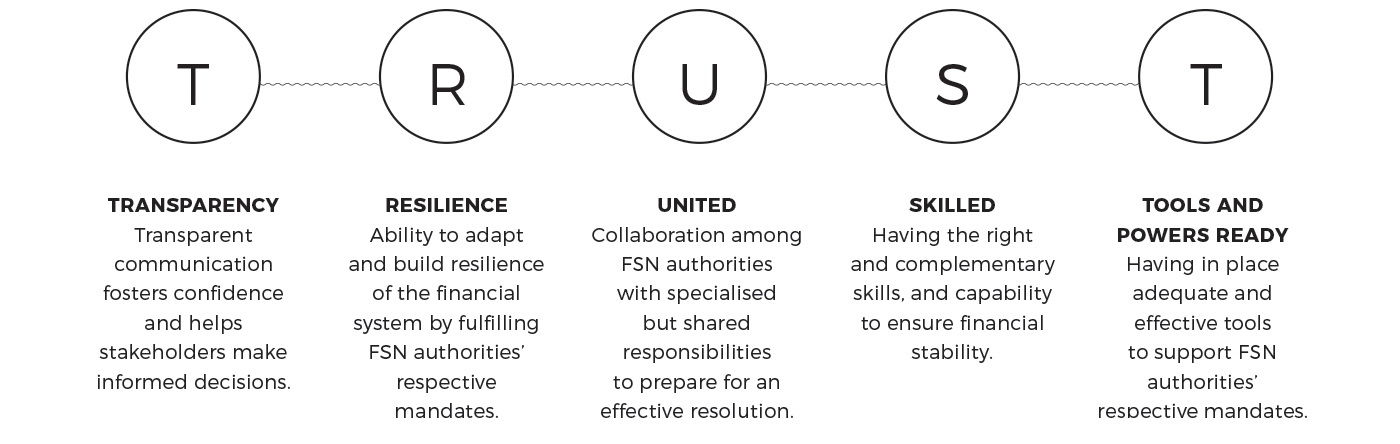

An important component of depositors’ trust is also the ability of the financial safety net (FSN) authorities to ensure the functioning of the financial system, both during good and bad times. During the failure of SVB, the Federal Reserve, Federal Deposit Insurance Corporation (FDIC) and US Treasury worked together to enhance confidence in the banking system and prevent disruptive failures.

As one of the FSN authorities, PIDM is mandated not only to protect depositors but also to resolve a failed member institution with minimal cost and impact to the financial system. PIDM works hand-in-hand with Bank Negara Malaysia (BNM) and the Ministry of Finance (MoF) in ensuring trust and confidence of Malaysians in our financial system.

An important element in ensuring trust is for each FSN player to be prepared to fulfil its role in maintaining financial stability. One of the ways for PIDM to ensure that it can undertake an effective resolution is to go through a process called resolution planning.

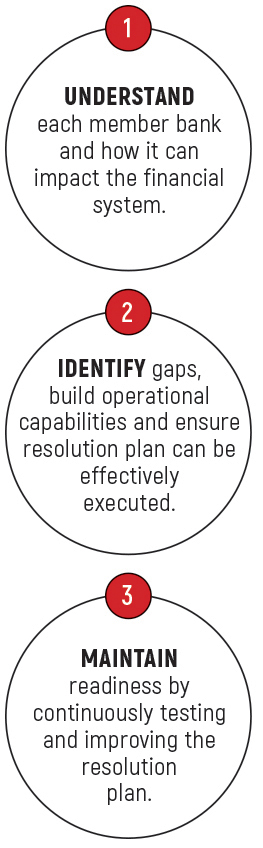

Working closely with member banks during good times, resolution planning serves as a pre-planning exercise to help PIDM understand member banks better and to develop a customised plan for each member bank to support a resolution. By nature, banks are complex entities due to their roles as financial intermediaries and their interconnectedness within the payment and financial system. Resolution planning will enable PIDM to obtain not only in-depth knowledge about each specific member bank, but also to have an industry-wide overview of the financial landscape. This will facilitate informed decision-making to ensure prompt and timely intervention and orderly resolution.

On 8 September 2023, PIDM issued the Guidelines on Resolution Planning for Deposit-Taking Members. Under the Guidelines, PIDM’s preferred resolution strategy is for failed member banks to be resolved through a transfer strategy. The transfer strategy is the presumptive path for planning purposes in the Malaysian context.

The key steps to the resolution planning process are summarised in the following figure:

PIDM aims to work with member banks to develop transfer capability, so that they are ‘transfer-ready’. Being transfer-ready means that a bank possesses the required operational capabilities to ensure continuity of operations and ability to support PIDM in implementing an effective transfer in resolution.

Being transfer-ready is preferred as it: (i) aligns with the funding structure of Malaysian banks, which is heavily reliant on deposits with limited loss-absorbing capacity in debt; (ii) ensures the continuity of critical functions and minimises disruptions while protecting depositors in a resolution; and (iii) is widely understood and universally applicable, making it not only useful during resolution, but also flexible during recovery, as well as during normal business operations when opportunities arise for mergers and acquisitions.

They say that “time and tide wait for no man… especially in a crisis”. Have you ever wondered why window shades must be opened during flight takeoff and landing?

In the aviation industry, the above practice serves as a safety precaution as open shades enhances situational awareness during a flight’s takeoff and landing. This is because the most dangerous part of the flight is during takeoff and landing as the aircrew and passengers need to take quick action during these times. By lifting the shades, it helps human eyes to adjust better to the surrounding environment and this facilitates a prompt response to external circumstances.

In a crisis, every second counts.

Relating this back to the banking industry, resolution planning enhances a bank’s readiness to support an effective resolution by identifying and addressing key gaps and shortcomings early on. It also offers an opportunity to enhance the industry’s collective readiness and contribute to a more resilient financial system, securing trust and confidence for tomorrow, today.

The term ‘credit’ is derived from credo, which is Latin for ‘belief’, hence the expression “to bank on things we know to be true”. This is also why some financial institutions are called ‘trusts’, and traditional banks were often built with sturdy granite facades and pillars to convey a sense of stability and permanence. Banking is – and has always been – built on the confidence of its customers. However, the evanescence of confidence means it is easily lost, and once gone, it is difficult to regain.

The term ‘credit’ is derived from credo, which is Latin for ‘belief’, hence the expression “to bank on things we know to be true”. This is also why some financial institutions are called ‘trusts’, and traditional banks were often built with sturdy granite facades and pillars to convey a sense of stability and permanence. Banking is – and has always been – built on the confidence of its customers. However, the evanescence of confidence means it is easily lost, and once gone, it is difficult to regain.

Source: Firefighting: The Financial Crisis and Its Lessons; Bernanke, B; Geithner, T F; Paulson, H M.

The inaugural National Resolution Symposium 2023 (NRS), with its theme Empowering Resilience Through Resolution Planning, was hosted by PIDM from 18 to 19 October 2023. Drawing upon lessons from global bank failures in the US and Europe in 2023, the symposium provided a unique perspective on resolution planning for the Malaysian financial system.

The NRS marked a milestone, fostering innovative thinking and cooperation among stakeholders, and building institutional resilience amid the complexities and challenges in the financial sector. The key points from the symposium are:

> Industry collaboration: There is a need for close collaboration between PIDM and financial institutions. The goal is to achieve prompt and orderly resolutions by engaging with institutions to build resolution capabilities over time.

> Operational resilience: When correctly executed, resolution planning offers significant benefits. It enhances operational resilience by clarifying roles, improves governance, enhances risk monitoring, and provides better management information systems for informed decision-making.

Participants engaged in balanced discussions and gained insights from regulatory and industry perspectives. Technical resolution masterclasses delved into specific issues, offering a comprehensive understanding.

Silicon Valley Bank (SVB) – The first resolution plan was filed with the Federal Deposit Insurance Corporation (FDIC) in December 2022 without allowing sufficient time for an FDIC review and SVB to build its resolution capabilities. Does this suggest that resolution planning has little value?

> Who is SVB?

Based in Santa Clara, California, SVB focused on providing private and commercial banking services to venture capital and technology start-ups in the US.

> Why did SVB fail?

> How was SVB resolved?

> Could resolution planning have improved the outcome?

If the FDIC had more time to review SVB’s resolution plan, this would have aided in identifying issues and ensured the credibility and reliability of the plan, especially concerning the following areas:

In addition, the FDIC would have had more time to work with SVB to develop resolution-related capabilities (e.g. the ability to quickly produce information needed to sell SVB in the event of a resolution).

Credit Suisse (CS) – Planned for a bail-in during resolution planning, but why was it subjected to an arranged merger with a global systemically important bank (G-SIB)?

> Who is CS?

CS is a G-SIB in Switzerland. It has operations in over 40 countries.

> Why did CS fail?

CS was weakened by a series of events over the last two decades (e.g. allegations of money laundering, corruption, and tax evasion). It eventually experienced serious liquidity outflow in March 2023 due to the delayed publication of its financial statements and a widely publicised statement by a large shareholder which created concerns about CS’ franchise and triggered a confidence crisis.

> How was CS dealt with?

> How did resolution planning process improve the outcome?

The following key lessons learnt of the case studies are based on the Financial Stability Board’s report, 2023 Bank Failures: Preliminary Lessons Learnt for Resolution, dated 10 October 2023.

Key Lessons Learnt:

In both cases, resolution planning helped/would have helped:

SVB

The SVB case highlighted the importance for banks to develop resolution-related capabilities during good times (e.g. ability to generate information quickly to market an institution and the ability to operationalise the retention plan involving key staff). It was noted that when such capabilities lack maturity, this can be a hindrance to an efficient resolution process.

CS

It was observed that resolution planning and other resolution-related work carried out had positioned authorities to conduct a Single Point of Entry resolution (SPE) via a bail-in strategy at the parent company level. Under the SPE approach, the group resolution authority will ensure that the parent bank and all significant subsidiaries remain well-capitalised as ‘going concern’ entities and stay ’out of resolution’ through bail-in, ensuring that the entire banking group to remain intact and continue to operate. However, it was determined by the authorities that the SPE resolution via bail-in should not be the chosen path, despite it being an executable strategy at the time of planning. Nevertheless, the resolution planning process and preparedness aided authorities to swiftly execute the immediate transfer of CS to UBS without entering into a resolution.

Established in 2005, PIDM administers two protection systems – the Deposit Insurance System and Takaful and Insurance Benefits Protection System. In addition to its financial consumer protection mandate, PIDM is also the resolution authority for its member institutions, and is responsible for undertaking prompt resolution actions at minimum cost to the financial system. PIDM’s mandates and initiatives contribute toward financial system stability.