Decarbonising the Banking Sector: How Green Finance is Paving the Pathway for Institutions to Achieve their Net-zero Targets

Navigating the complexities of green financing in order to achieve decarbonisation and environmental sustainability.

Navigating the complexities of green financing in order to achieve decarbonisation and environmental sustainability.

By Dr Chee Wei Yen

By Dr Chee Wei Yen

As the world confronts the escalating climate crisis, the imperative for all sectors to reduce their carbon footprints has never been more pressing. The banking sector, with its vast influence and resources is no different. Being uniquely positioned to drive the transition to a low-carbon economy, banks play a pivotal role in achieving global net-zero targets such as limiting global temperature rise to 1.5°C as set out during the 2015 Paris Agreement and the climate financing commitments detailed in the 2021 Glasgow Climate Pact. Central to this transformation is green finance – a set of financial practices and instruments specifically designed to support environmental sustainability. Through the incorporation of green finance into their individual portfolios, the banking sector can in turn tackle its most carbon intensive component – financed emissions – which account for 95% of its total carbon footprint. This article will explore how green finance could pave the way for financial institutions to achieve net zero, highlighting its mechanisms, benefits, and the challenges that need to be addressed to make this critical transition a reality.

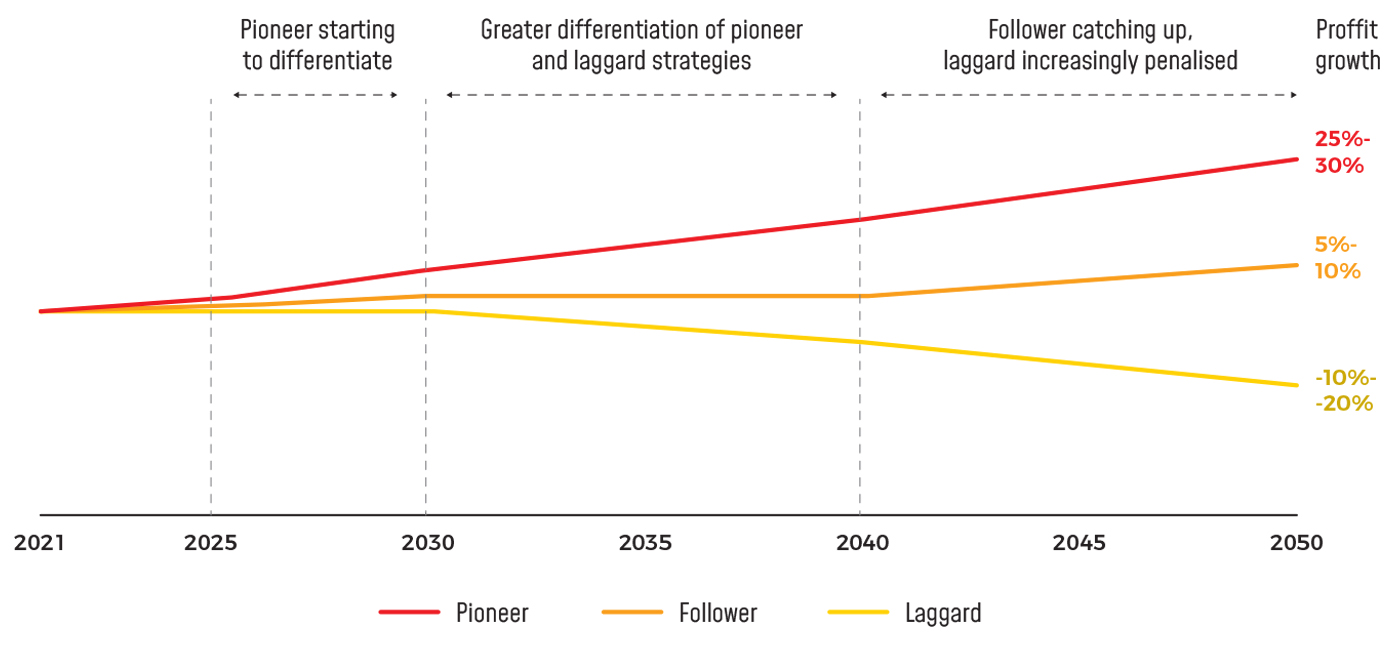

As the crucial role of banks in financing the global transition away from carbon-emitting activities gains greater recognition, stakeholders are increasingly pressuring banks to address their environmental impact. This demand is not only about responsibility but also profitability; banks that demonstrate due diligence and a commitment to environmental accountability often enhance their reputation and financial performance. This notion of profitability from environmental commitments and aligning a bank’s portfolio with net-zero targets is further supported in the 2022 study by Bain & Company, Bank’s Great Carbon Challenge, which highlighted that early pioneers of sustainable investments and practices would see an estimated profit growth of around 25%–30% by 2050 (Figure 1).

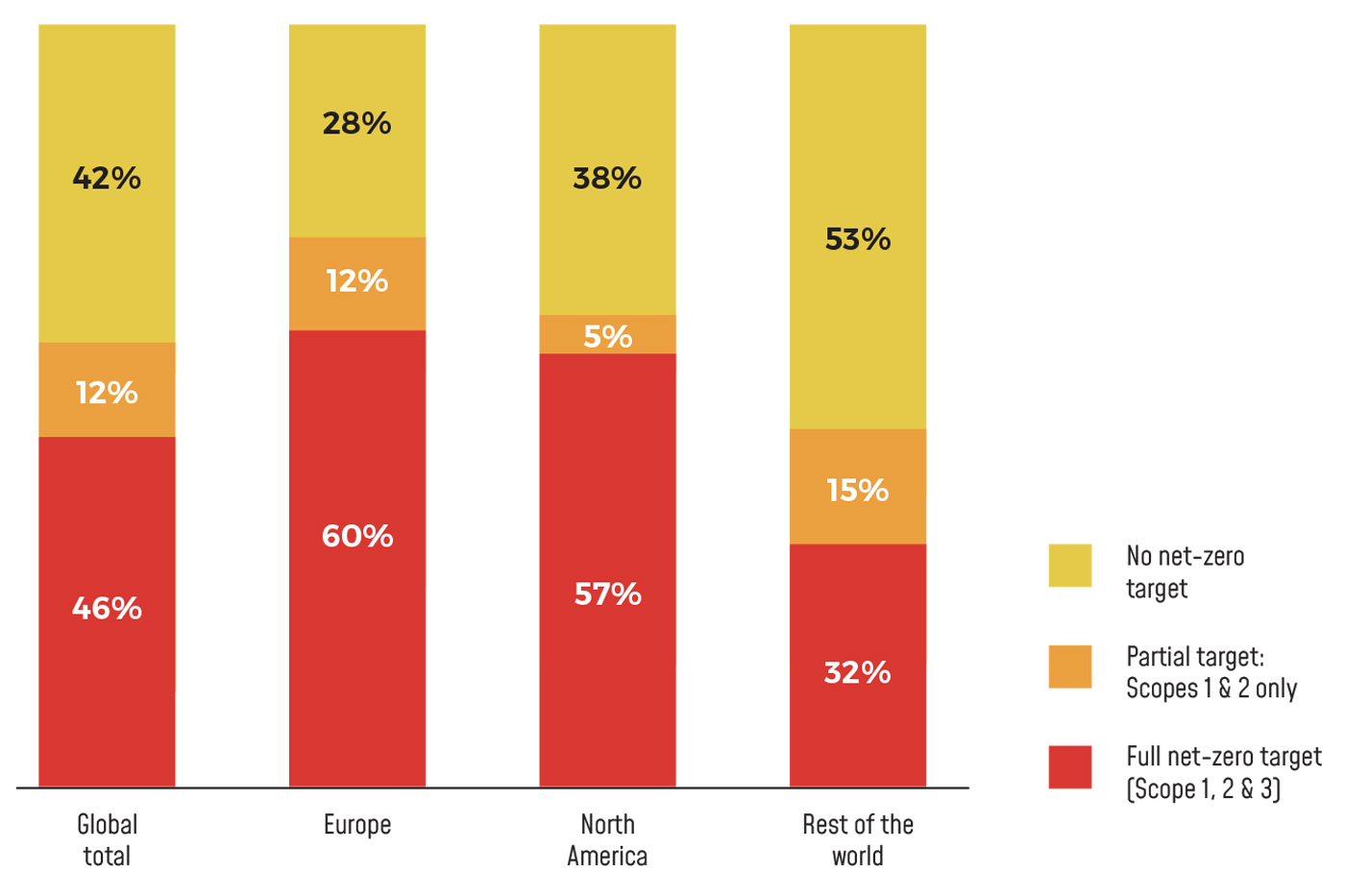

Additionally, one key initiative that has spurred the banking sector’s transition towards carbon neutrality was the formation of the Net-Zero Banking Alliance (NZBA) launched in 2021 by the United Nations Environment Programme Finance Initiative. Formed as a part of the broader Glasgow Financial Alliance for Net Zero, the NZBA includes over 144 banks from 44 countries, with its members accumulating a total asset value of USD74 trillion, representing 41% of global banking assets. The inception of the NZBA has also instilled core values of transparency and accountability among its members through committing to the alliance’s six principles of responsible banking, ensuring a consistent and credible approach to achieving these ambitious goals. This initiative has also led to significant transformations within the financial sector, galvanising a global consortium of banks to align their lending and investment portfolios with net-zero targets, with 46% of the world’s leading banks committing to become net-zero organisations.

However, decarbonising the banking sector isn’t straightforward, as it necessitates a two-pronged approach: reducing operational emissions and limiting the carbon footprint of financed activities. The complexities surrounding decarbonising the banking sector is seen in a 2022 study by Accenture, who found that despite the overwhelming pledges to carbon neutrality, an estimated 12% of banking institutions are on track to meet their Scope 1 & Scope 2 targets in 2050, with even less, at 5%, predicted to achieve Scope 3 decarbonisation. This is where green finance could play a crucial role, providing the tools and frameworks needed to drive widespread transition by offering innovative financial instruments and incentives that align with climate goals. Through green finance, banks can achieve decarbonisation targets while fostering sustainable economic growth and enhancing their market position.

Aligning the banking sector with global climate change mitigation goals involves a strategic focus on reducing the carbon footprint of lending and investment portfolios. The Partnership for Carbon Accounting Financials (PCAF) provides an essential framework that guides banks in systematically measuring and disclosing the greenhouse gas (GHG) emissions associated with their financing activities. By adopting the PCAF standard, banks gain the capability to transparently measure, report, and reduce emissions linked to their portfolios, enhancing their contribution to environmental sustainability. Notably, financial institutions are actively advancing their efforts in decarbonising financed emissions, with several leading banks making significant headway. For instance, Maybank has set ambitious targets to achieve carbon neutrality in its operations by 2030 and is actively aligning its financing activities to reduce emissions, in accordance with PCAF standards. In its latest Environmental Report 2023, the bank disclosed that the carbon emissions from its financed projects have been reduced from 25.7 million tonnes of carbon dioxide equivalent (tCO2e) to 24.6 million tCO2e since 2021. This proactive approach underlines Maybank’s dedication to sustainable banking practices and positions it as a leader in the industry’s transition towards environmental sustainability.

The PCAF framework is structured into two comprehensive parts: Part A and Part B. Part A describes the general methodology for GHG accounting applicable across all financial products. It offers a uniform approach to emission calculation and reporting, ensuring consistency in how banks approach carbon accounting. This includes guidance on defining the scope of emissions, data collection techniques, calculation methods, and the specifics of emission reporting. Part B expands on this by addressing the specific challenges associated with diverse asset classes, such as mortgages, commercial real estate, corporate loans, and bonds. This part is particularly crucial for banks as it delves into the unique aspects of various financial instruments, providing tailored strategies for effective carbon management in each category. Utilising the PCAF standards enables banks to not only meet regulatory requirements and investor expectations for sustainability but also positions them as leaders in the shift towards a low-carbon economy. This commitment to rigorous carbon accounting and reduction through PCAF’s guidelines demonstrates a bank’s proactive stance on environmental stewardship and risk management, aligning business operations with the broader global agenda for sustainable development.

Having first been introduced in 1997 following the Kyoto Protocol, green financing wasn’t adopted into mainstream banking until the early 2000s when the European Investment Bank issued the first ever green bond in 2007, historically marking the beginning of green finance. Since then, spurred on by numerous legislations and a growing investor preference for sustainable practices, the field has expanded significantly. Green finance now encompasses green bonds and loans, ESG integration, and climate risk assessments. Notably, the market valuation of green bonds and loans aimed at financing environmentally positive projects has surged to an estimated USD1.05 trillion by 2024. ESG investments have also grown, with ESG assets expected to exceed USD50 trillion by 2025. This monumental shift in investor preferences highlights the financial sector’s prioritisation of environmental considerations and underscores the vital role of green finance in addressing climate challenges. In the first half of 2023 alone, the issuance of green bonds globally reached a record USD314 billion. Banks like HSBC are also contributing, committing to provide USD100 billion in sustainable financing by 2025. Incorporating environmental, social, and governance (ESG) criteria into investment decisions ensures that banks’ financial activities align with sustainability goals. This approach not only reduces direct operational emissions – by adopting green building practices and energy-efficient tecnologies – but also curbs the carbon footprint of their financed activities. With sustainable investments now accounting for nearly one-third of all assets under management globally, green finance is proving to be a powerful tool in the banking sector’s transition to a low-carbon economy, ultimately helping to achieve net-zero emissions.

Decarbonising the banking sector through green financing faces several significant challenges. Regulatory and policy barriers present one of the foremost obstacles. Different regions have varying regulations and standards for green finance, making it difficult to create a unified approach. The lack of harmonised methodologies for measuring and reporting emissions, particularly Scope 3 emissions, complicates efforts to align with international climate targets. Financial and operational constraints further hinder progress. High upfront costs for green projects can be prohibitive, especially for banks in developing countries with limited financial resources. Additionally, the risk of stranded assets – investments that may lose value as the economy transitions to low-carbon – poses a significant financial risk, necessitating careful capital allocation. Data and transparency issues exacerbate these challenges. Accurate and comprehensive data on environmental impact is crucial for setting targets and tracking progress, yet many banks struggle with significant data limitations. According to the International Banking Federation and Deloitte report, Banking on Climate Neutrality, financed emissions represent around 75% of banks’ carbon footprints but are notoriously difficult to measure accurately. The lack of reliable data can lead to greenwashing, where banks overstate their environmental achievements. Addressing these challenges requires a collaborative effort to standardise regulations, provide financial incentives, and improve data collection and transparency to ensure effective decarbonisation of the banking sector.

Overcoming the challenges to effective decarbonisation of the banking sector through green financing requires targeted strategies addressing regulatory and policy barriers, financial and operational constraints, and data and transparency issues. Advocating for harmonised global standards and policies, such as the European Union’s Sustainable Finance Disclosure Regulation helps mitigate regulatory barriers, which mandates transparency in sustainability-related disclosures for financial market participants. For example, the European Investment Bank has led by example, becoming the world’s first ‘climate bank’ by aligning all its financing activities with the Paris Agreement. Financial and operational constraints, including high upfront costs and limited green finance expertise, can be tackled through public-private partnerships and capacity-building initiatives. The Asian Development Bank has demonstrated this by mobilising over USD6 billion in climate financing annually, supporting renewable energy projects across Asia. Additionally, innovative financial instruments like green bonds and sustainability-linked loans can provide the necessary capital for green projects. Data and transparency issues necessitate the development of robust frameworks, such as the Task Force on Climate-related Financial Disclosures, are crucial, with over 1,500 organisations adopting it, including JPMorgan Chase, which has committed to aligning its financing activities with the Paris Agreement. By implementing these strategies and learning from successful case studies, banks can navigate the complexities of green finance and drive meaningful decarbonisation.

Dr Chee Wei Yen is an Executive Director with Deloitte and she holds a PhD in Finance from Lincoln University.