A Fast & Furious Dress-down

When it comes to window dressing, Basel takes the bull by the horns.

When it comes to window dressing, Basel takes the bull by the horns.

By Angela SP Yap

By Angela SP Yap

Do you seem more attractive than you actually are?

Or rather, does your bank look better than it actually is?

That is what we call window dressing, behaviour that is increasingly coming under the radar of supervisory authorities led by the Basel Committee on Banking Supervision (BCBS).

In the decade since the adoption of chapter SCO40 of the consolidated Basel Framework in 2013, which describes the indicator-based measurement approach for assessing global systemically important banks (G-SIBs), the BCBS has stated: “Window-dressing by banks is unacceptable, as it undermines the intended policy objectives of the leverage ratio requirement and risks disrupting the operations of financial markets.”

“The mismeasurement of systemic importance in the G-SIB methodology due to window-dressing activity can result in changes in the allocation of G-SIBs to the buckets used to assign the higher loss absorbency requirements and the misidentification of G-SIBs. Also, bank scores in the G-SIB framework are calculated using a relative methodology, which means that any window-dressing behaviour by banks to artificially lower their G-SIB scores will cause the scores of banks that do not engage in window-dressing activities to increase.

“These impacts have implications for financial sector resilience and resource efficiency as well as broader unintended consequences for both financial stability and monetary policy.”

Evidence from the BCBS’ quantitative impact study, Working Paper 42: Banks’ Window-dressing of the G-SIB Framework, indicate that the existing G-SIB framework generates window-dressing incentives, with such behaviour occurring significantly more in the group of banks that lie just below the G-SIB bucket threshold since 2016.

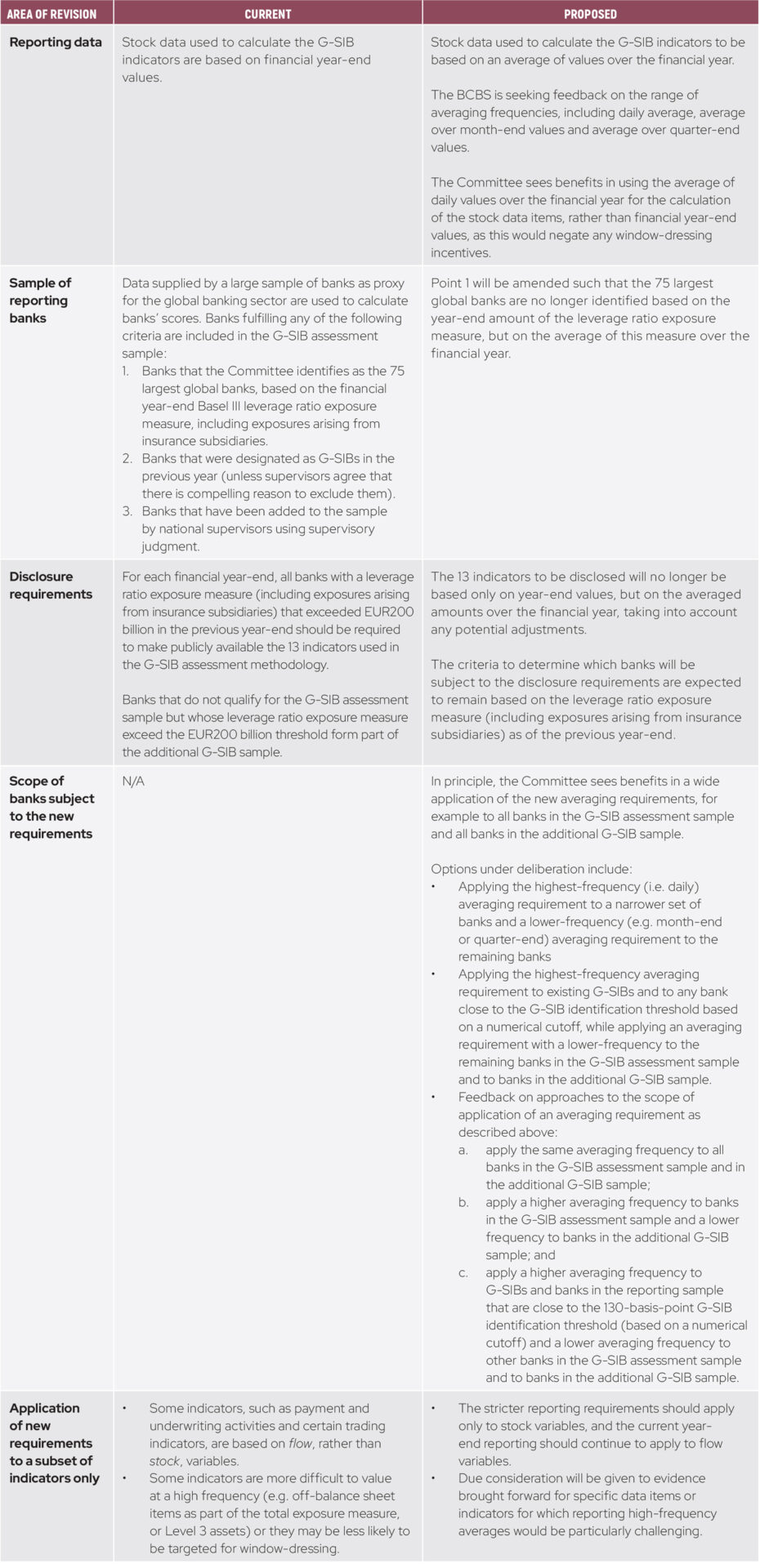

In order to rein in such behaviour, on 7 March 2024, the BCBS published its proposed revisions to the assessment framework containing potential measures to mitigate window-dressing behaviour in G-SIBs. The consultative document, Global Systematically Important Banks – Revised Assessment Framework, outlines revisions which would require banks to report and disclose the indicators used to calculate G-SIB scores based on average values over the reporting year, rather than year-end values.

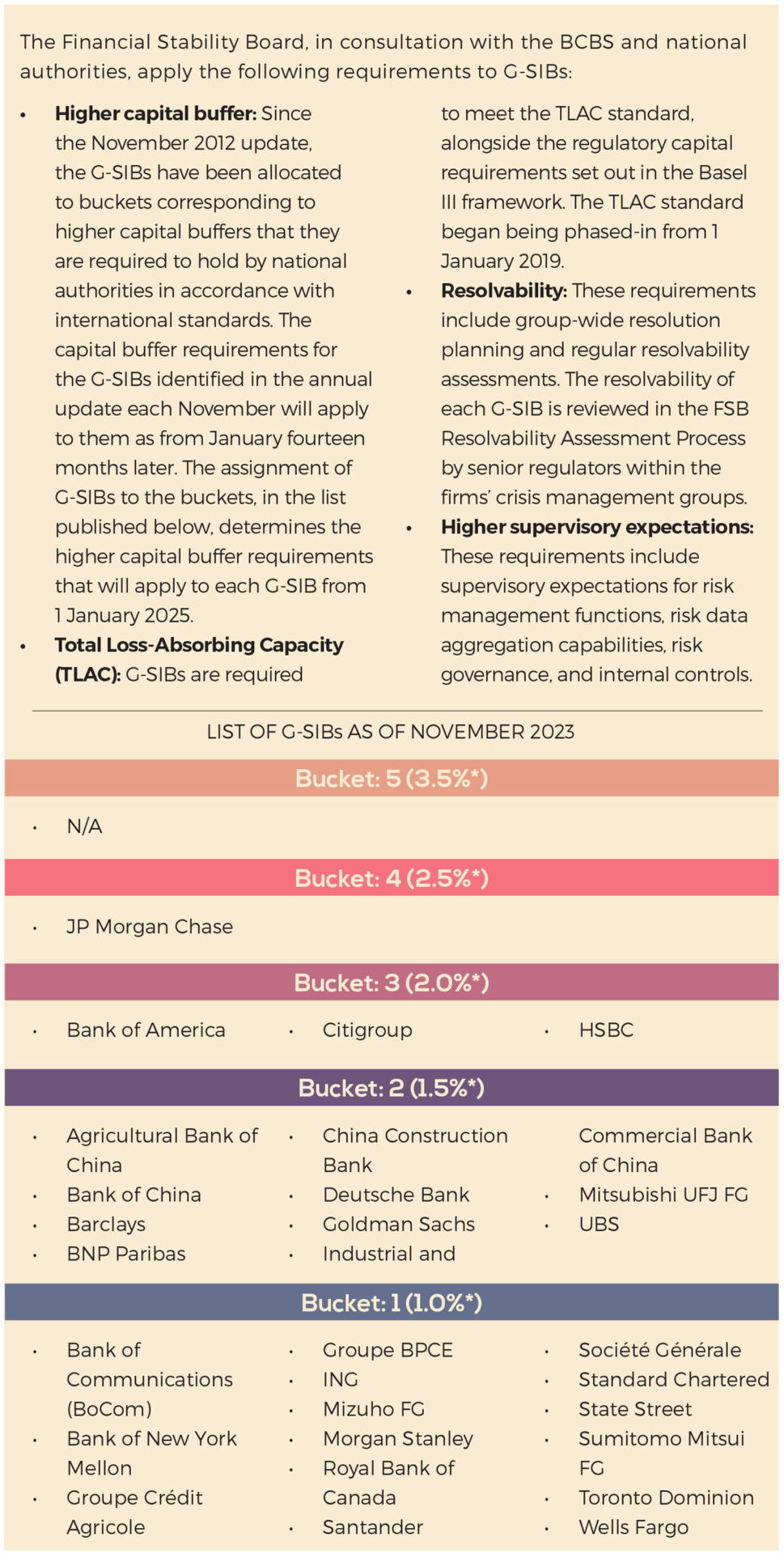

To recap, the current assessment methodology for G-SIBs is an indicator-based approach comprising five broad categories: size, interconnectedness, lack of readily available substitutes or financial institution infrastructure, global (cross-jurisdictional) activity and complexity. Banks are designated as G-SIBs based on these indicators and supervisory judgment.

G-SIBs are subject to higher capital requirements and other policy measures to reduce the probability and impact of their failure. In particular, they must maintain additional capital buffers, the size of which range from 1% to 2.5% Common Equity Tier 1 (CET1) depending on a bank’s systemic importance.

Potential revisions would require banks to report and disclose the indicators used to calculate G-SIB scores based on average values over the reporting year, rather than year-end values. Industry comments were submitted by 7 June 2024. They were not entirely supportive.

A joint response by the International Swaps and Derivatives Association, the Global Financial Markets Association and the Institute of International Finance – private trade organisations whose members, mainly banks, transact in the over-the-counter derivatives market – believe that the BCBS findings and focus on perceived window-dressing behaviour is “not founded on robust evidence”.

The coalition’s inclusion of several anonymised responses from member banks across the major banking jurisdictions highlight the variety of operational challenges that would apply across all jurisdictions and business models in banking and finance.

“The feedback is therefore intended to help achieve higher-quality data over the financial year to support the G-SIB assessment framework, rather than focusing on purported window-dressing behaviour.”

Those in industry who are supportive of the BCBS’ objectives and methodology to mitigate window dressing in banking operations have raised concerns regarding the data requirements and additional regulatory compliance burdens in a financial ecosystem that’s already bursting at the seams.

The proposals put forth by the World Savings and Retail Banking Institute are just part of the feedback that the BCBS need to take into account to ensure a more proportional G-SIB framework and less burdensome reporting requirements for banks:

“Regulators should there[fore] consider a phased approach to implementing these requirements, with gradual rollout times, which can grant banks sufficient time to upgrade and adapt their processes without compromising data integrity. Additionally, the BCBS should take into account materiality of each entity and their weight in terms of those indicators that are more likely to incentivise window-dressing behaviours during the G-SIB assessment exercise. That would contribute to setting more proportional, risk-sensitive, and meaningful requirements. Informational requirements should be proportionate to ‘window-dressing risks’. As such, by tailoring reporting to the specific operation situation of a bank, it would be more practical to limit the assessment to monthly averages and quarterly average reporting should be sufficient to achieve the BCBS objectives on this matter.”

What does this revision to G-SIB assessment mean for us?

Just as these selected international banks are subject to additional requirements over and above those of Basel III, national supervisory authorities can opt to translate the same modality to domestic systemically important banks.

In Malaysia, these powers rest with the central bank, Bank Negara Malaysia, and Perbadanan Insurans Deposit Malaysia, the resolution authority for banks and member institutions. In September 2023, the latter issued its Guidelines on Resolution Planning for Deposit-Taking Members, outlining the objectives, approach, and requirements for resolution planning.

Translating these global rules to the national level are led by those who are best placed to determine the impact of failure in the local financial ecosystem.

The proposed revisions are aimed at negating window-dressing incentives and will apply to international banks at the consolidated level with a proposed transitional period starting on 1 January 2026 and proposed implementation date of 1 January 2027. During the transitional period:

Angela SP Yap is a multi-award-winning social entrepreneur, author, and financial columnist. She is Director and Founder of Akasaa, a boutique content development and consulting firm. An ex-strategist with Deloitte and former corporate banker, she has also worked in international development with the UNDP and as an elected governor for Amnesty International Malaysia. Angela holds a BSc (Hons) Economics.