From Insight to Impact: The Strategic Imperative for AI in Malaysian Financial Services

Integrating AI and tapping into external innovation are no longer optional, but strategic imperatives.

By Sash Mukherjee

By Sash Mukherjee

Think about the sheer volume of information flowing through Malaysia’s financial system today. Every DuitNow QR payment, every e-Know Your Customer onboarding, every credit card swipe and foreign exchange transfer tells a story. With Bank Negara Malaysia (BNM) pushing the agenda on digital banking, financial inclusion, and Open Banking, the sector is sitting on a goldmine of insights. This isn’t just about collecting data. It’s about turning that data into strategic advantage in an increasingly competitive, customer-driven landscape.

With five digital bank licences issued and BNM’s Financial Sector Blueprint 2022–2026 outlining bold reforms, Malaysia is entering a new phase of financial innovation, driven by data and accelerated by artificial intelligence (AI).

Malaysian banks are ramping up their tech investments, following the lead of regional peers, but with clear priorities in sight. They aim to build loyalty, boost efficiency, and position themselves for long-term growth. The shift is already underway, with banks leveraging data intelligence to deliver hyper-personalised, intuitive digital experiences – think pre-approved financing, targeted investment nudges, and contextual app recommendations that anticipate customer needs rather than just react to them.

At the same time, technology is strengthening compliance and fraud detection frameworks. AI models are being deployed to spot anomalies in real time, aligning with rising regulatory expectations and improving overall risk management. Automation is also streamlining back-end processes, such as small- and medium-sized enterprise loan approvals, cutting time and cost while boosting service levels.

These advances are unlocking new revenue opportunities as well. Banks are tapping into emerging customer segments, offering environmental, social, and governance-linked products to environmentally conscious millennials and designing Shariah-compliant solutions that meet both ethical and financial goals.

Underpinning all of this is a push for greater resilience and agility: automating core operations, improving risk visibility, and laying the foundation for Open Banking through secure, application programming interface-first infrastructure.

AI adoption is accelerating rapidly across Malaysia’s banking sector. From chatbots like CIMB’s Eva to credit scoring models that integrate both traditional and alternative data, AI is poised to become the driving force behind the nation’s banking transformation. The potential? Beyond efficiency gains, AI is enabling entirely new value propositions, centred around predictive and proactive customer service.

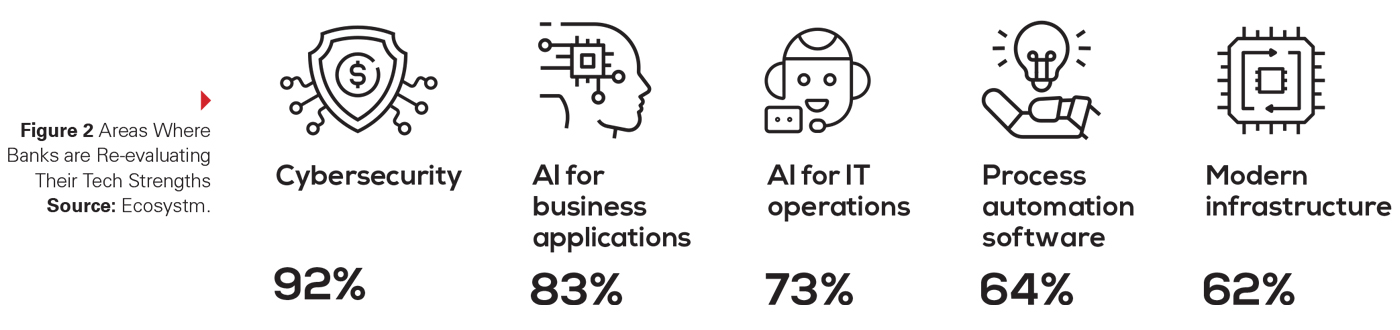

However, the impact of AI on Malaysia’s banking tech landscape goes even deeper. Driven by its transformative power, both technological investments and strategic priorities are undergoing significant change. While cybersecurity remains a top priority – given the increasing sophistication of AI-driven threats and the need to safeguard valuable digital assets – AI itself is now a central focus for technology spending. Banks and financial institutions are actively embracing AI for a range of business applications, understanding its potential to unlock unprecedented levels of efficiency, uncover new insights, and deliver hyper-personalised customer experiences.

At the same time, AI is playing a pivotal role in streamlining technology operations, helping to create more agile, resilient, and self-managing environments. The continued investment in foundational technologies, such as process automation software, reflects the ongoing drive to optimise workflows, while the urgent need for infrastructure modernisation is becoming ever more apparent. As businesses prepare their digital foundations to support the growing computational and data demands of AI solutions, they are also laying the groundwork for future scalability.

This evolving landscape shows that AI is no longer just an emerging trend; it’s becoming a core element of technology investment strategies and driving the next phase of digital transformation in the region.

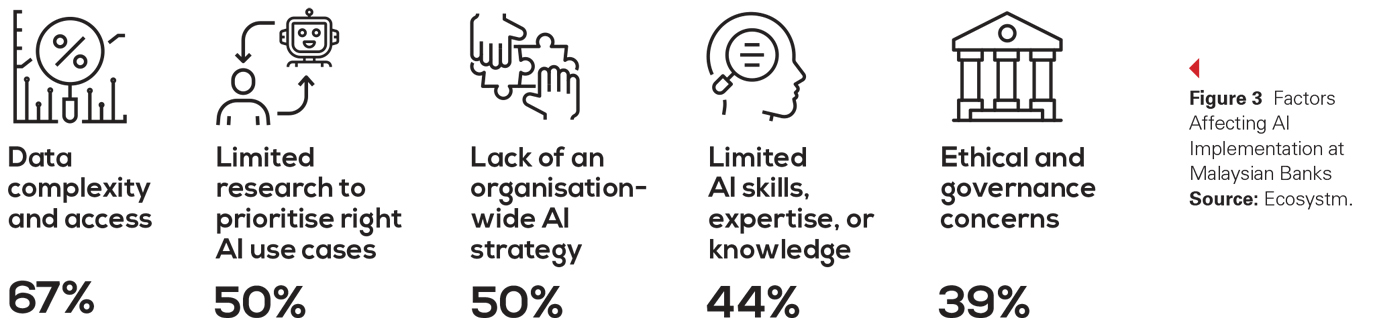

Adopting AI in Malaysia’s banking sector promises immense potential, but the journey is far from straightforward. One of the major hurdles is the complexity of data. Many banks are still grappling with fragmented systems and data silos, where critical information is locked in disparate platforms. This disconnection makes it difficult to access and integrate the data needed to train and deploy effective AI models. Without unified data access, banks are unable to create the comprehensive AI solutions required to drive meaningful change.

A key challenge for banks is defining clear and impactful use cases for AI. Without in-depth research into customer pain points and opportunities, AI initiatives often fail to target the most pressing business challenges, resulting in scattered projects that deliver little tangible value. At the core of this problem is the absence of a cohesive AI strategy. Without a unified roadmap that aligns AI efforts with business objectives, banks risk pursuing isolated projects that lack scalability or long-term vision, making it difficult to prioritise investments and ensure consistent AI adoption across the organisation.

Additionally, the shortage of in-house AI expertise is a significant hurdle. The specialised talent needed to build, deploy, and manage AI solutions is in high demand, forcing many banks to rely on expensive external consultants, adding both complexity and cost. Ethical concerns also complicate AI adoption, as many models operate in a “black box” fashion, raising issues of transparency, accountability, and fairness, especially in the highly regulated banking environment. Addressing these concerns is essential to maintaining trust and ensuring responsible AI use.

Taken together, these challenges present a clear picture of a banking sector eager to embrace AI but facing significant strategic, organisational, and ethical obstacles.

Achieving meaningful and sustainable success with AI in banking requires more than just deploying technology – it demands a comprehensive strategy that aligns with business goals.

Malaysia’s banking sector is on the cusp of a major shift. With regulatory support and a flood of rich data from digital interactions, the foundation is set for a smarter, more adaptive financial ecosystem. Early wins in personalised customer engagement and proactive risk management are more than isolated use cases; they signal a deeper transformation underway. However, as challenges like fragmented data, unclear AI strategies, and a shortage of skilled talent show, success demands a rethink of how banks operate and innovate.

It starts with a solid data strategy, sharp ROI thinking, and AI governance that’s built in from day one – not bolted on later. Bridging legacy data silos, integrating AI into everyday workflows, and tapping into external innovation through fintech and tech partnerships are no longer optional, but strategic imperatives. Banks that embed these priorities into their core – not just in information technology, but across business lines – will lead the way. With the right approach, Malaysia’s wealth of financial data can fuel a hyper-personalised, efficient, and resilient banking system, putting the nation at the forefront of intelligent finance in the region.

Sash Mukherjee, VP Industry Insights at Ecosystm, brings nearly two decades of deep industry analysis and strategic foresight, translating complex tech trends into clear, actionable insights that shape key conversations and guide critical decisions across the tech landscape.